Prepared Food & Beverage Tax Return Form

ADVERTISEMENT

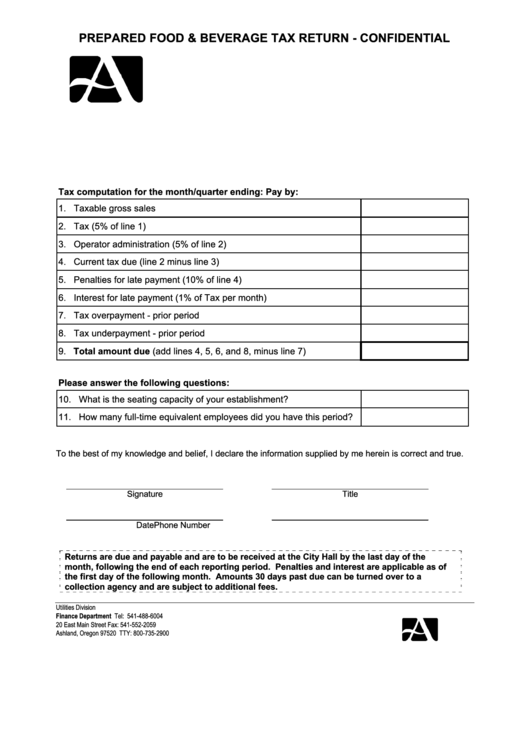

PREPARED FOOD & BEVERAGE TAX RETURN - CONFIDENTIAL

Tax computation for the month/quarter ending:

Pay by:

1. Taxable gross sales

2. Tax (5% of line 1)

3. Operator administration (5% of line 2)

4. Current tax due (line 2 minus line 3)

5. Penalties for late payment (10% of line 4)

6. Interest for late payment (1% of Tax per month)

7. Tax overpayment - prior period

8. Tax underpayment - prior period

9. Total amount due (add lines 4, 5, 6, and 8, minus line 7)

Please answer the following questions:

10. What is the seating capacity of your establishment?

11. How many full-time equivalent employees did you have this period?

To the best of my knowledge and belief, I declare the information supplied by me herein is correct and true.

Signature

Title

Date

Phone Number

Returns are due and payable and are to be received at the City Hall by the last day of the

month, following the end of each reporting period. Penalties and interest are applicable as of

the first day of the following month. Amounts 30 days past due can be turned over to a

collection agency and are subject to additional fees.

Utilities Division

Finance Department

Tel: 541-488-6004

20 East Main Street

Fax: 541-552-2059

Ashland, Oregon 97520

TTY: 800-735-2900

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1