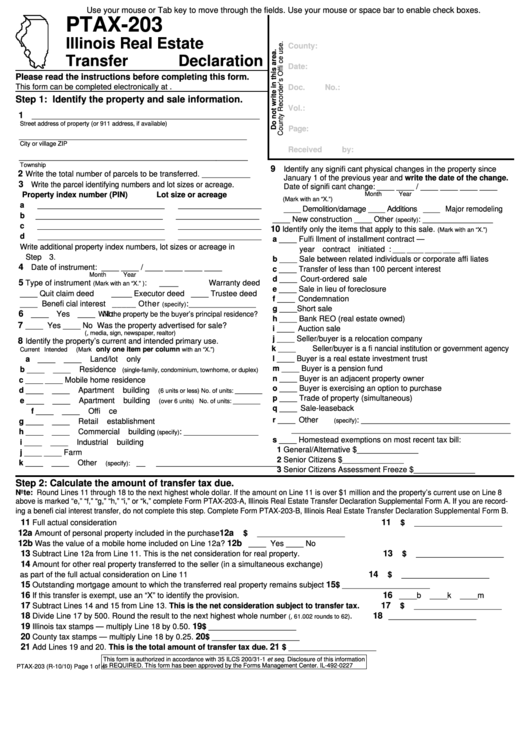

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

PTAX-203

Illinois Real Estate

County:

Transfer Declaration

Date:

Please read the instructions before completing this form.

This form can be completed electronically at tax.illinois.gov/retd.

Doc. No.:

Step 1: Identify the property and sale information.

Vol.:

1

____________________________________________________

Street address of property (or 911 address, if available)

Page:

____________________________________________________

City or village

ZIP

Received by:

____________________________________________________

Township

9

Identify any signifi cant physical changes in the property since

2

Write the total number of parcels to be transferred. ___________

January 1 of the previous year and write the date of the change.

3

Write the parcel identifying numbers and lot sizes or acreage.

Date of signifi cant change: ____ ____ / ____ ____ ____ ____

Property index number (PIN)

Lot size or acreage

Month

Year

(Mark with an “X.”)

a _____________________________

___________________

____ Demolition/damage ____ Additions ____ Major remodeling

b _____________________________

___________________

____ New construction

____ Other

: ________________

(specify)

c _____________________________

___________________

10

Identify only the items that apply to this sale.

(Mark with an “X.”)

d _____________________________

___________________

a ____ Fulfi llment of installment contract —

Write additional property index numbers, lot sizes or acreage in

year contract initiated : ___ ____ ____ ____

Step 3.

b ____ Sale between related individuals or corporate affi liates

4

Date of instrument: ____ ____ / ____ ____ ____ ____

c ____ Transfer of less than 100 percent interest

Month

Year

d ____ Court-ordered sale

5

Type of instrument

:

_____ Warranty deed

(Mark with an “X.” )

e ____ Sale in lieu of foreclosure

____ Quit claim deed _____ Executor deed ____ Trustee deed

f ____ Condemnation

____ Benefi cial interest _____ Other

:______________

(specify)

g ____ Short sale

6

____ Yes ____ No

Will the property be the buyer’s principal residence?

h ____ Bank REO (real estate owned)

7

____ Yes ____ No Was the property advertised for sale?

i ____ Auction sale

(i.e., media, sign, newspaper, realtor)

j ____ Seller/buyer is a relocation company

8

Identify the property’s current and intended primary use.

k ____ Seller/buyer is a fi nancial institution or government agency

only one item per column

Current Intended

(Mark

with an “X.”)

l ____ Buyer is a real estate investment trust

a ____

____ Land/lot only

m ____ Buyer is a pension fund

b ____

____ Residence

(single-family, condominium, townhome, or duplex)

n ____ Buyer is an adjacent property owner

c ____

____ Mobile home residence

o ____ Buyer is exercising an option to purchase

d ____

____ Apartment building

_______

(6 units or less) No. of units:

p ____ Trade of property (simultaneous)

e ____

____ Apartment building

_______

(over 6 units)

No. of units:

q ____ Sale-leaseback

f ____

____ Offi ce

r ____ Other

: __________________________________

(specify)

g ____

____ Retail establishment

__________________________________________________

h ____

____ Commercial building

: _________________

(specify)

s ____ Homestead exemptions on most recent tax bill:

i ____

____ Industrial building

1 General/Alternative

$______________

j ____

____ Farm

2 Senior Citizens

$______________

k ____

____ Other

____________________________

__

(specify):

3 Senior Citizens Assessment Freeze $______________

Step 2: Calculate the amount of transfer tax due.

Note: Round Lines 11 through 18 to the next highest whole dollar. If the amount on Line 11 is over $1 million and the property’s current use on Line 8

above is marked “e,” “f,” “g,” “h,” “i,” or “k,” complete Form PTAX-203-A, Illinois Real Estate Transfer Declaration Supplemental Form A. If you are record-

ing a benefi cial interest transfer, do not complete this step. Complete Form PTAX-203-B, Illinois Real Estate Transfer Declaration Supplemental Form B.

11

11

Full actual consideration

$ ____________________

12a

12a

Amount of personal property included in the purchase

$ ____________________

12b

12b

Was the value of a mobile home included on Line 12a?

____ Yes ____ No

13

13

Subtract Line 12a from Line 11. This is the net consideration for real property.

$ ____________________

14

Amount for other real property transferred to the seller (in a simultaneous exchange)

14

as part of the full actual consideration on Line 11

$ ____________________

15

15

Outstanding mortgage amount to which the transferred real property remains subject

$ ____________________

16

16

If this transfer is exempt, use an “X” to identify the provision.

____b

____k

____m

17

17

Subtract Lines 14 and 15 from Line 13. This is the net consideration subject to transfer tax.

$ ____________________

18

18

Divide Line 17 by 500. Round the result to the next highest whole number

.

____________________

(e.g., 61.002 rounds to 62)

19

19

Illinois tax stamps — multiply Line 18 by 0.50.

$ ____________________

20

20

County tax stamps — multiply Line 18 by 0.25.

$ ____________________

21

21

Add Lines 19 and 20. This is the total amount of transfer tax due.

$ ____________________

This form is authorized in accordance with 35 ILCS 200/31-1 et seq. Disclosure of this information

is REQUIRED. This form has been approved by the Forms Management Center.

IL-492-0227

PTAX-203 (R-10/10)

Page 1 of 4

1

1 2

2