Form Ct-945 (Drs) - Connecticut Annual Reconciliation Of Withholding For Nonpayroll Amounts - 2009

ADVERTISEMENT

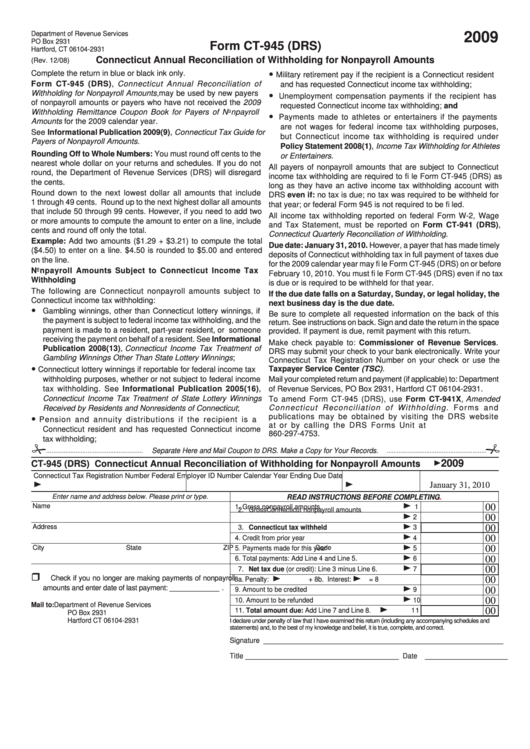

Department of Revenue Services

2009

PO Box 2931

Form CT-945 (DRS)

Hartford, CT 06104-2931

Connecticut Annual Reconciliation of Withholding for Nonpayroll Amounts

(Rev. 12/08)

Complete the return in blue or black ink only.

Military retirement pay if the recipient is a Connecticut resident

Form CT-945 (DRS), Connecticut Annual Reconciliation of

and has requested Connecticut income tax withholding;

Withholding for Nonpayroll Amounts, may be used by new payers

Unemployment compensation payments if the recipient has

of nonpayroll amounts or payers who have not received the 2009

requested Connecticut income tax withholding; and

Withholding Remittance Coupon Book for Payers of Nonpayroll

Payments made to athletes or entertainers if the payments

Amounts for the 2009 calendar year.

are not wages for federal income tax withholding purposes,

See Informational Publication 2009(9), Connecticut Tax Guide for

but Connecticut income tax withholding is required under

Payers of Nonpayroll Amounts.

Policy Statement 2008(1), Income Tax Withholding for Athletes

Rounding Off to Whole Numbers: You must round off cents to the

or Entertainers.

nearest whole dollar on your returns and schedules. If you do not

All payers of nonpayroll amounts that are subject to Connecticut

round, the Department of Revenue Services (DRS) will disregard

income tax withholding are required to fi le Form CT-945 (DRS) as

the cents.

long as they have an active income tax withholding account with

Round down to the next lowest dollar all amounts that include

DRS even if: no tax is due; no tax was required to be withheld for

1 through 49 cents. Round up to the next highest dollar all amounts

that year; or federal Form 945 is not required to be fi led.

that include 50 through 99 cents. However, if you need to add two

All income tax withholding reported on federal Form W-2, Wage

or more amounts to compute the amount to enter on a line, include

and Tax Statement, must be reported on Form CT-941 (DRS),

cents and round off only the total.

Connecticut Quarterly Reconciliation of Withholding.

Example: Add two amounts ($1.29 + $3.21) to compute the total

Due date: January 31, 2010. However, a payer that has made timely

($4.50) to enter on a line. $4.50 is rounded to $5.00 and entered

deposits of Connecticut withholding tax in full payment of taxes due

on the line.

for the 2009 calendar year may fi le Form CT-945 (DRS) on or before

Nonpayroll Amounts Subject to Connecticut Income Tax

February 10, 2010. You must fi le Form CT-945 (DRS) even if no tax

Withholding

is due or is required to be withheld for that year.

The following are Connecticut nonpayroll amounts subject to

If the due date falls on a Saturday, Sunday, or legal holiday, the

Connecticut income tax withholding:

next business day is the due date.

Gambling winnings, other than Connecticut lottery winnings, if

Be sure to complete all requested information on the back of this

the payment is subject to federal income tax withholding, and the

return. See instructions on back. Sign and date the return in the space

payment is made to a resident, part-year resident, or someone

provided. If payment is due, remit payment with this return.

receiving the payment on behalf of a resident. See Informational

Make check payable to: Commissioner of Revenue Services.

Publication 2008(13), Connecticut Income Tax Treatment of

DRS may submit your check to your bank electronically. Write your

Gambling Winnings Other Than State Lottery Winnings;

Connecticut Tax Registration Number on your check or use the

Taxpayer Service Center (TSC).

Connecticut lottery winnings if reportable for federal income tax

withholding purposes, whether or not subject to federal income

Mail your completed return and payment (if applicable) to: Department

tax withholding. See Informational Publication 2005(16),

of Revenue Services, PO Box 2931, Hartford CT 06104-2931.

Connecticut Income Tax Treatment of State Lottery Winnings

To amend Form CT-945 (DRS), use Form CT-941X, Amended

Connecticut Reconciliation of Withholding. Forms and

Received by Residents and Nonresidents of Connecticut;

publications may be obtained by visiting the DRS website

Pension and annuity distributions if the recipient is a

at or by calling the DRS Forms Unit at

Connecticut resident and has requested Connecticut income

860-297-4753.

tax withholding;

Separate Here and Mail Coupon to DRS. Make a Copy for Your Records.

2009

CT-945 (DRS) Connecticut Annual Reconciliation of Withholding for Nonpayroll Amounts

Connecticut Tax Registration Number

Federal Employer ID Number

Calendar Year Ending

Due Date

January 31, 2010

Enter name and address below. Please print or type.

READ INSTRUCTIONS BEFORE

COMPLETING.

Name

00

1. Gross nonpayroll amounts

1

2. Gross Connecticut nonpayroll amounts

2

00

Address

00

3. Connecticut tax withheld

3

00

4. Credit from prior year

4

00

City

State

ZIP Code

5. Payments made for this year

5

6. Total payments: Add Line 4 and Line 5.

6

00

00

7. Net tax due (or credit): Line 3 minus Line 6.

7

Check if you no longer are making payments of nonpayroll

00

8a. Penalty:

+ 8b. Interest:

= 8

amounts and enter date of last payment: ____________ .

00

9. Amount to be credited

9

10. Amount to be refunded

10

00

Mail to:

Department of Revenue Services

00

11. Total amount due: Add Line 7 and Line 8.

11

PO Box 2931

Hartford CT 06104-2931

I declare under penalty of law that I have examined this return (including any accompanying schedules and

statements) and, to the best of my knowledge and belief, it is true, complete, and correct.

Signature _____________________________________________________________

Title _______________________________________ Date _____________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2