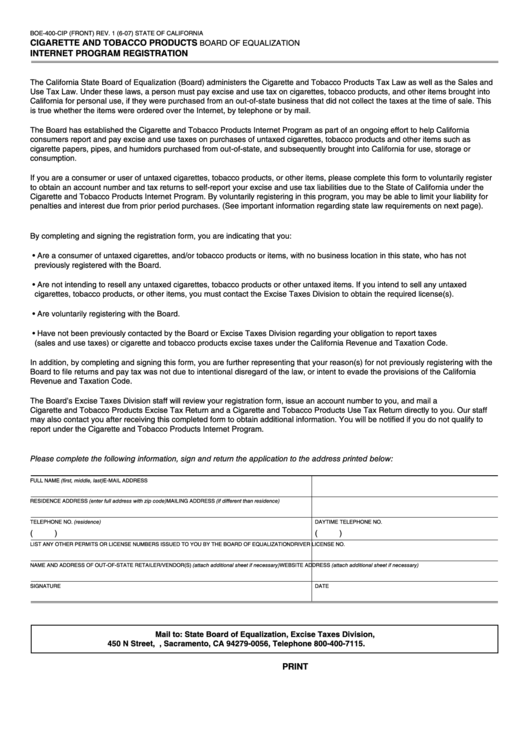

BOE-400-CIP (FRONT) REV. 1 (6-07)

STATE OF CALIFORNIA

CIGARETTE AND TOBACCO PRODUCTS

BOARD OF EQUALIZATION

INTERNET PROGRAM REGISTRATION

The California State Board of Equalization (Board) administers the Cigarette and Tobacco Products Tax Law as well as the Sales and

Use Tax Law. Under these laws, a person must pay excise and use tax on cigarettes, tobacco products, and other items brought into

California for personal use, if they were purchased from an out-of-state business that did not collect the taxes at the time of sale. This

is true whether the items were ordered over the Internet, by telephone or by mail.

The Board has established the Cigarette and Tobacco Products Internet Program as part of an ongoing effort to help California

consumers report and pay excise and use taxes on purchases of untaxed cigarettes, tobacco products and other items such as

cigarette papers, pipes, and humidors purchased from out-of-state, and subsequently brought into California for use, storage or

consumption.

If you are a consumer or user of untaxed cigarettes, tobacco products, or other items, please complete this form to voluntarily register

to obtain an account number and tax returns to self-report your excise and use tax liabilities due to the State of California under the

Cigarette and Tobacco Products Internet Program. By voluntarily registering in this program, you may be able to limit your liability for

penalties and interest due from prior period purchases. (See important information regarding state law requirements on next page).

By completing and signing the registration form, you are indicating that you:

• Are a consumer of untaxed cigarettes, and/or tobacco products or items, with no business location in this state, who has not

previously registered with the Board.

• Are not intending to resell any untaxed cigarettes, tobacco products or other untaxed items. If you intend to sell any untaxed

cigarettes, tobacco products, or other items, you must contact the Excise Taxes Division to obtain the required license(s).

• Are voluntarily registering with the Board.

• Have not been previously contacted by the Board or Excise Taxes Division regarding your obligation to report taxes

(sales and use taxes) or cigarette and tobacco products excise taxes under the California Revenue and Taxation Code.

In addition, by completing and signing this form, you are further representing that your reason(s) for not previously registering with the

Board to file returns and pay tax was not due to intentional disregard of the law, or intent to evade the provisions of the California

Revenue and Taxation Code.

The Board’s Excise Taxes Division staff will review your registration form, issue an account number to you, and mail a

Cigarette and Tobacco Products Excise Tax Return and a Cigarette and Tobacco Products Use Tax Return directly to you. Our staff

may also contact you after receiving this completed form to obtain additional information. You will be notified if you do not qualify to

report under the Cigarette and Tobacco Products Internet Program.

Please complete the following information, sign and return the application to the address printed below:

FULL NAME (first, middle, last)

E-MAIL ADDRESS

RESIDENCE ADDRESS (enter full address with zip code)

MAILING ADDRESS (if different than residence)

TELEPHONE NO. (residence)

DAYTIME TELEPHONE NO.

(

)

(

)

LIST ANY OTHER PERMITS OR LICENSE NUMBERS ISSUED TO YOU BY THE BOARD OF EQUALIZATION

DRIVER LICENSE NO.

NAME AND ADDRESS OF OUT-OF-STATE RETAILER/VENDOR(S) (attach additional sheet if necessary)

WEBSITE ADDRESS (attach additional sheet if necessary)

SIGNATURE

DATE

Mail to: State Board of Equalization, Excise Taxes Division,

450 N Street, P.O. Box 942879, Sacramento, CA 94279-0056, Telephone 800-400-7115.

CLEAR

PRINT

1

1