Instructions For Form 8839 - 2009

ADVERTISEMENT

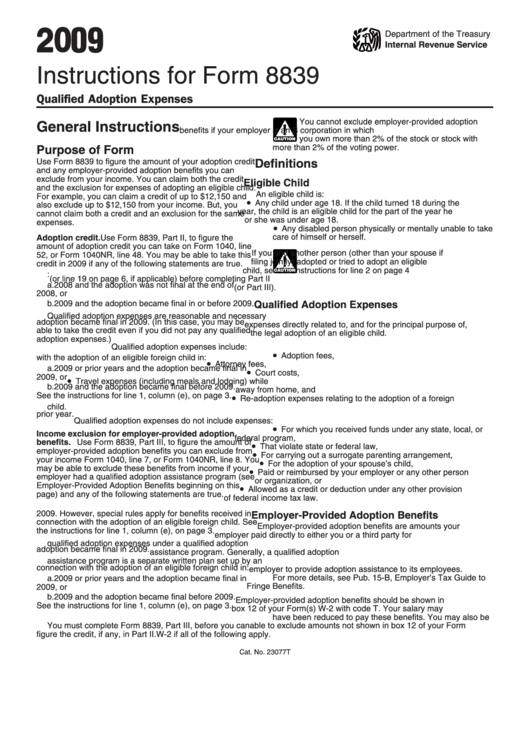

2 0 09

Department of the Treasury

Internal Revenue Service

Instructions for Form 8839

Qualified Adoption Expenses

You cannot exclude employer-provided adoption

General Instructions

!

benefits if your employer is an S corporation in which

you own more than 2% of the stock or stock with

CAUTION

more than 2% of the voting power.

Purpose of Form

Use Form 8839 to figure the amount of your adoption credit

Definitions

and any employer-provided adoption benefits you can

exclude from your income. You can claim both the credit

Eligible Child

and the exclusion for expenses of adopting an eligible child.

An eligible child is:

For example, you can claim a credit of up to $12,150 and

•

Any child under age 18. If the child turned 18 during the

also exclude up to $12,150 from your income. But, you

year, the child is an eligible child for the part of the year he

cannot claim both a credit and an exclusion for the same

or she was under age 18.

expenses.

•

Any disabled person physically or mentally unable to take

care of himself or herself.

Adoption credit. Use Form 8839, Part II, to figure the

amount of adoption credit you can take on Form 1040, line

If you and another person (other than your spouse if

52, or Form 1040NR, line 48. You may be able to take this

!

filing jointly) adopted or tried to adopt an eligible

credit in 2009 if any of the following statements are true.

child, see the instructions for line 2 on page 4

CAUTION

1. You paid qualified adoption expenses in:

(or line 19 on page 6, if applicable) before completing Part II

a. 2008 and the adoption was not final at the end of

(or Part III).

2008, or

b. 2009 and the adoption became final in or before 2009.

Qualified Adoption Expenses

2. You adopted a child with special needs and the

Qualified adoption expenses are reasonable and necessary

adoption became final in 2009. (In this case, you may be

expenses directly related to, and for the principal purpose of,

able to take the credit even if you did not pay any qualified

the legal adoption of an eligible child.

adoption expenses.)

Qualified adoption expenses include:

3. You paid qualified adoption expenses in connection

•

Adoption fees,

with the adoption of an eligible foreign child in:

•

Attorney fees,

a. 2009 or prior years and the adoption became final in

•

Court costs,

2009, or

•

Travel expenses (including meals and lodging) while

b. 2009 and the adoption became final before 2009.

away from home, and

•

See the instructions for line 1, column (e), on page 3.

Re-adoption expenses relating to the adoption of a foreign

4. You have a carryforward of an adoption credit from a

child.

prior year.

Qualified adoption expenses do not include expenses:

•

For which you received funds under any state, local, or

Income exclusion for employer-provided adoption

federal program,

benefits. Use Form 8839, Part III, to figure the amount of

•

That violate state or federal law,

employer-provided adoption benefits you can exclude from

•

For carrying out a surrogate parenting arrangement,

your income Form 1040, line 7, or Form 1040NR, line 8. You

•

For the adoption of your spouse’s child,

may be able to exclude these benefits from income if your

•

Paid or reimbursed by your employer or any other person

employer had a qualified adoption assistance program (see

or organization, or

Employer-Provided Adoption Benefits beginning on this

•

Allowed as a credit or deduction under any other provision

page) and any of the following statements are true.

of federal income tax law.

1. You received employer-provided adoption benefits in

2009. However, special rules apply for benefits received in

Employer-Provided Adoption Benefits

connection with the adoption of an eligible foreign child. See

Employer-provided adoption benefits are amounts your

the instructions for line 1, column (e), on page 3.

employer paid directly to either you or a third party for

2. You adopted a child with special needs and the

qualified adoption expenses under a qualified adoption

adoption became final in 2009.

assistance program. Generally, a qualified adoption

3. You received employer-provided adoption benefits in

assistance program is a separate written plan set up by an

connection with the adoption of an eligible foreign child in:

employer to provide adoption assistance to its employees.

For more details, see Pub. 15-B, Employer’s Tax Guide to

a. 2009 or prior years and the adoption became final in

Fringe Benefits.

2009, or

b. 2009 and the adoption became final before 2009.

Employer-provided adoption benefits should be shown in

See the instructions for line 1, column (e), on page 3.

box 12 of your Form(s) W-2 with code T. Your salary may

have been reduced to pay these benefits. You may also be

You must complete Form 8839, Part III, before you can

able to exclude amounts not shown in box 12 of your Form

figure the credit, if any, in Part II.

W-2 if all of the following apply.

Cat. No. 23077T

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6