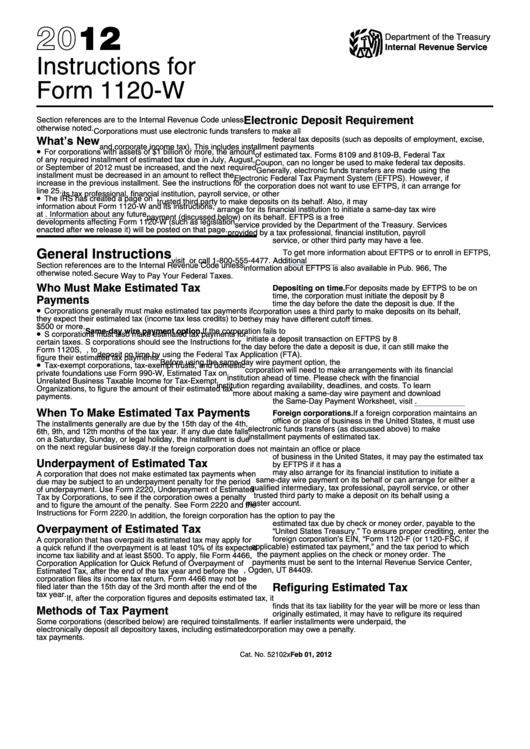

Instructions For Form 1120-W - 2012

ADVERTISEMENT

2012

Department of the Treasury

Internal Revenue Service

Instructions for

Form 1120-W

Electronic Deposit Requirement

Section references are to the Internal Revenue Code unless

otherwise noted.

Corporations must use electronic funds transfers to make all

What’s New

federal tax deposits (such as deposits of employment, excise,

and corporate income tax). This includes installment payments

•

For corporations with assets of $1 billion or more, the amount

of estimated tax. Forms 8109 and 8109-B, Federal Tax

of any required installment of estimated tax due in July, August,

Coupon, can no longer be used to make federal tax deposits.

or September of 2012 must be increased, and the next required

Generally, electronic funds transfers are made using the

installment must be decreased in an amount to reflect the

Electronic Federal Tax Payment System (EFTPS). However, if

increase in the previous installment. See the instructions for

the corporation does not want to use EFTPS, it can arrange for

line 25.

its tax professional, financial institution, payroll service, or other

•

The IRS has created a page on IRS.gov that includes

trusted third party to make deposits on its behalf. Also, it may

information about Form 1120-W and its instructions,

arrange for its financial institution to initiate a same-day tax wire

at Information about any future

payment (discussed below) on its behalf. EFTPS is a free

developments affecting Form 1120-W (such as legislation

service provided by the Department of the Treasury. Services

enacted after we release it) will be posted on that page.

provided by a tax professional, financial institution, payroll

service, or other third party may have a fee.

General Instructions

To get more information about EFTPS or to enroll in EFTPS,

visit

or call 1-800-555-4477. Additional

Section references are to the Internal Revenue Code unless

information about EFTPS is also available in Pub. 966, The

otherwise noted.

Secure Way to Pay Your Federal Taxes.

Who Must Make Estimated Tax

Depositing on time. For deposits made by EFTPS to be on

time, the corporation must initiate the deposit by 8 p.m. Eastern

Payments

time the day before the date the deposit is due. If the

•

Corporations generally must make estimated tax payments if

corporation uses a third party to make deposits on its behalf,

they expect their estimated tax (income tax less credits) to be

they may have different cutoff times.

$500 or more.

Same-day wire payment option. If the corporation fails to

•

S corporations must also make estimated tax payments for

initiate a deposit transaction on EFTPS by 8 p.m. Eastern time

certain taxes. S corporations should see the Instructions for

the day before the date a deposit is due, it can still make the

Form 1120S, U.S. Income Tax Return for an S Corporation, to

deposit on time by using the Federal Tax Application (FTA).

figure their estimated tax payments.

Before using the same-day wire payment option, the

•

Tax-exempt corporations, tax-exempt trusts, and domestic

corporation will need to make arrangements with its financial

private foundations use Form 990-W, Estimated Tax on

institution ahead of time. Please check with the financial

Unrelated Business Taxable Income for Tax-Exempt

institution regarding availability, deadlines, and costs. To learn

Organizations, to figure the amount of their estimated tax

more about making a same-day wire payment and download

payments.

the Same-Day Payment Worksheet, visit .

When To Make Estimated Tax Payments

Foreign corporations. If a foreign corporation maintains an

office or place of business in the United States, it must use

The installments generally are due by the 15th day of the 4th,

electronic funds transfers (as discussed above) to make

6th, 9th, and 12th months of the tax year. If any due date falls

installment payments of estimated tax.

on a Saturday, Sunday, or legal holiday, the installment is due

on the next regular business day.

If the foreign corporation does not maintain an office or place

of business in the United States, it may pay the estimated tax

Underpayment of Estimated Tax

by EFTPS if it has a U.S. bank account. The foreign corporation

may also arrange for its financial institution to initiate a

A corporation that does not make estimated tax payments when

same-day wire payment on its behalf or can arrange for either a

due may be subject to an underpayment penalty for the period

qualified intermediary, tax professional, payroll service, or other

of underpayment. Use Form 2220, Underpayment of Estimated

trusted third party to make a deposit on its behalf using a

Tax by Corporations, to see if the corporation owes a penalty

master account.

and to figure the amount of the penalty. See Form 2220 and the

Instructions for Form 2220.

In addition, the foreign corporation has the option to pay the

estimated tax due by check or money order, payable to the

Overpayment of Estimated Tax

“United States Treasury.” To ensure proper crediting, enter the

foreign corporation’s EIN, “Form 1120-F (or 1120-FSC, if

A corporation that has overpaid its estimated tax may apply for

applicable) estimated tax payment,” and the tax period to which

a quick refund if the overpayment is at least 10% of its expected

the payment applies on the check or money order. The

income tax liability and at least $500. To apply, file Form 4466,

payments must be sent to the Internal Revenue Service Center,

Corporation Application for Quick Refund of Overpayment of

P.O. Box 40901, Ogden, UT 84409.

Estimated Tax, after the end of the tax year and before the

corporation files its income tax return. Form 4466 may not be

Refiguring Estimated Tax

filed later than the 15th day of the 3rd month after the end of the

tax year.

If, after the corporation figures and deposits estimated tax, it

finds that its tax liability for the year will be more or less than

Methods of Tax Payment

originally estimated, it may have to refigure its required

Some corporations (described below) are required to

installments. If earlier installments were underpaid, the

electronically deposit all depository taxes, including estimated

corporation may owe a penalty.

tax payments.

Feb 01, 2012

Cat. No. 52102x

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4