Instructions For Schedule B (Form 941) - Report Of Tax Liability For Semiweekly Schedule Depositors - 2010

ADVERTISEMENT

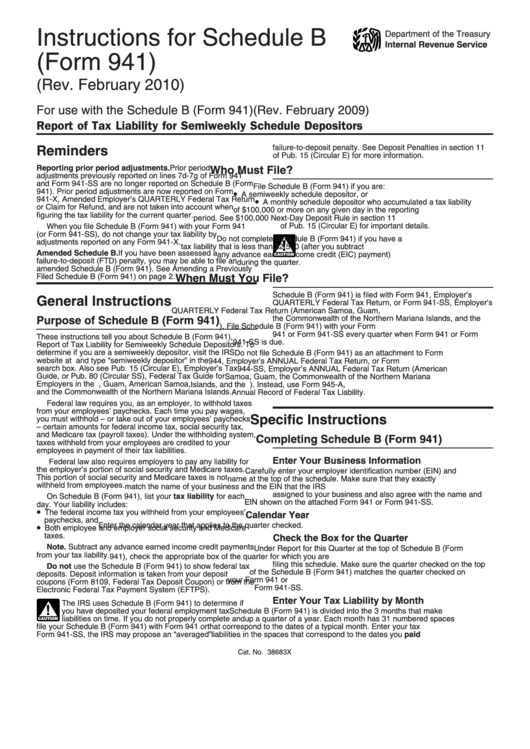

Instructions for Schedule B

Department of the Treasury

Internal Revenue Service

(Form 941)

(Rev. February 2010)

For use with the Schedule B (Form 941)(Rev. February 2009)

Report of Tax Liability for Semiweekly Schedule Depositors

failure-to-deposit penalty. See Deposit Penalties in section 11

Reminders

of Pub. 15 (Circular E) for more information.

Reporting prior period adjustments. Prior period

Who Must File?

adjustments previously reported on lines 7d-7g of Form 941

and Form 941-SS are no longer reported on Schedule B (Form

File Schedule B (Form 941) if you are:

•

941). Prior period adjustments are now reported on Form

A semiweekly schedule depositor, or

•

941-X, Amended Employer’s QUARTERLY Federal Tax Return

A monthly schedule depositor who accumulated a tax liability

or Claim for Refund, and are not taken into account when

of $100,000 or more on any given day in the reporting

figuring the tax liability for the current quarter.

period. See $100,000 Next-Day Deposit Rule in section 11

of Pub. 15 (Circular E) for important details.

When you file Schedule B (Form 941) with your Form 941

(or Form 941-SS), do not change your tax liability by

Do not complete Schedule B (Form 941) if you have a

adjustments reported on any Form 941-X.

!

tax liability that is less than $2,500 (after you subtract

Amended Schedule B. If you have been assessed a

any advance earned income credit (EIC) payment)

CAUTION

failure-to-deposit (FTD) penalty, you may be able to file an

during the quarter.

amended Schedule B (Form 941). See Amending a Previously

Filed Schedule B (Form 941) on page 2.

When Must You File?

Schedule B (Form 941) is filed with Form 941, Employer’s

General Instructions

QUARTERLY Federal Tax Return, or Form 941-SS, Employer’s

QUARTERLY Federal Tax Return (American Samoa, Guam,

the Commonwealth of the Northern Mariana Islands, and the

Purpose of Schedule B (Form 941)

U.S. Virgin Islands). File Schedule B (Form 941) with your Form

941 or Form 941-SS every quarter when Form 941 or Form

These instructions tell you about Schedule B (Form 941),

941-SS is due.

Report of Tax Liability for Semiweekly Schedule Depositors. To

determine if you are a semiweekly depositor, visit the IRS

Do not file Schedule B (Form 941) as an attachment to Form

website at and type “semiweekly depositor” in the

944, Employer’s ANNUAL Federal Tax Return, or Form

search box. Also see Pub. 15 (Circular E), Employer’s Tax

944-SS, Employer’s ANNUAL Federal Tax Return (American

Guide, or Pub. 80 (Circular SS), Federal Tax Guide for

Samoa, Guam, the Commonwealth of the Northern Mariana

Employers in the U.S. Virgin Islands, Guam, American Samoa,

Islands, and the U.S. Virgin Islands). Instead, use Form 945-A,

and the Commonwealth of the Northern Mariana Islands.

Annual Record of Federal Tax Liability.

Federal law requires you, as an employer, to withhold taxes

from your employees’ paychecks. Each time you pay wages,

Specific Instructions

you must withhold – or take out of your employees’ paychecks

– certain amounts for federal income tax, social security tax,

and Medicare tax (payroll taxes). Under the withholding system,

Completing Schedule B (Form 941)

taxes withheld from your employees are credited to your

employees in payment of their tax liabilities.

Enter Your Business Information

Federal law also requires employers to pay any liability for

the employer’s portion of social security and Medicare taxes.

Carefully enter your employer identification number (EIN) and

This portion of social security and Medicare taxes is not

name at the top of the schedule. Make sure that they exactly

withheld from employees.

match the name of your business and the EIN that the IRS

assigned to your business and also agree with the name and

On Schedule B (Form 941), list your tax liability for each

EIN shown on the attached Form 941 or Form 941-SS.

day. Your liability includes:

•

The federal income tax you withheld from your employees’

Calendar Year

paychecks, and

•

Enter the calendar year that applies to the quarter checked.

Both employee and employer social security and Medicare

taxes.

Check the Box for the Quarter

Note. Subtract any advance earned income credit payments

Under Report for this Quarter at the top of Schedule B (Form

from your tax liability.

941), check the appropriate box of the quarter for which you are

filing this schedule. Make sure the quarter checked on the top

Do not use the Schedule B (Form 941) to show federal tax

of the Schedule B (Form 941) matches the quarter checked on

deposits. Deposit information is taken from your deposit

your Form 941 or

coupons (Form 8109, Federal Tax Deposit Coupon) or from the

Form 941-SS.

Electronic Federal Tax Payment System (EFTPS).

Enter Your Tax Liability by Month

The IRS uses Schedule B (Form 941) to determine if

!

you have deposited your federal employment tax

Schedule B (Form 941) is divided into the 3 months that make

liabilities on time. If you do not properly complete and

up a quarter of a year. Each month has 31 numbered spaces

CAUTION

file your Schedule B (Form 941) with Form 941 or

that correspond to the dates of a typical month. Enter your tax

Form 941-SS, the IRS may propose an “averaged”

liabilities in the spaces that correspond to the dates you paid

Cat. No. 38683X

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2