Instructions For Form 1120-Sf - (Rev. Sept. 1996)

ADVERTISEMENT

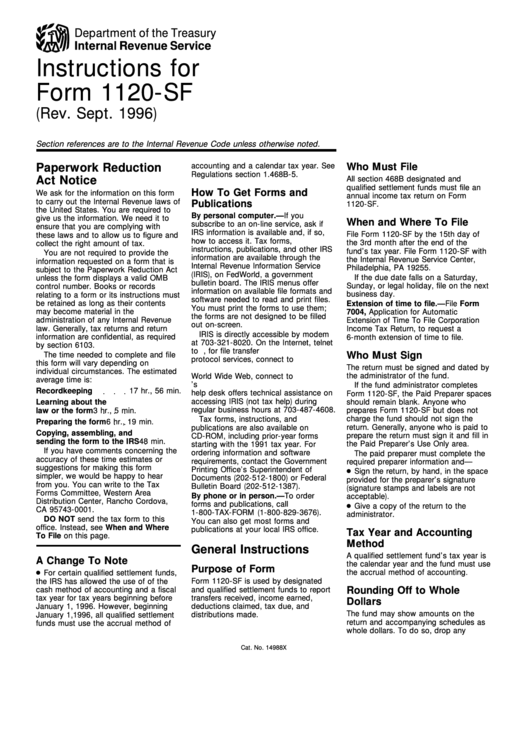

Department of the Treasury

Internal Revenue Service

Instructions for

Form 1120-SF

(Rev. Sept. 1996)

U.S. Income Tax Return for Settlement Funds

Section references are to the Inter nal Revenue Code unless otherwise noted.

Paperwork Reduction

accounting and a calendar tax year. See

Who Must File

Regulations section 1.468B-5.

Act Notice

All section 468B designated and

qualified settlement funds must file an

How To Get Forms and

We ask for the information on this form

annual income tax return on Form

to carry out the Internal Revenue laws of

Publications

1120-SF.

the United States. You are required to

By personal computer.—If you

give us the information. We need it to

When and Where To File

subscribe to an on-line service, ask if

ensure that you are complying with

IRS information is available and, if so,

File Form 1120-SF by the 15th day of

these laws and to allow us to figure and

how to access it. Tax forms,

the 3rd month after the end of the

collect the right amount of tax.

instructions, publications, and other IRS

fund’s tax year. File Form 1120-SF with

You are not required to provide the

information are available through the

the Internal Revenue Service Center,

information requested on a form that is

Internal Revenue Information Service

Philadelphia, PA 19255.

subject to the Paperwork Reduction Act

(IRIS), on FedWorld, a government

If the due date falls on a Saturday,

unless the form displays a valid OMB

bulletin board. The IRIS menus offer

Sunday, or legal holiday, file on the next

control number. Books or records

information on available file formats and

business day.

relating to a form or its instructions must

software needed to read and print files.

be retained as long as their contents

Extension of time to file.—File Form

You must print the forms to use them;

may become material in the

7004, Application for Automatic

the forms are not designed to be filled

administration of any Internal Revenue

Extension of Time To File Corporation

out on-screen.

law. Generally, tax returns and return

Income Tax Return, to request a

IRIS is directly accessible by modem

information are confidential, as required

6-month extension of time to file.

at 703-321-8020. On the Internet, telnet

by section 6103.

to iris.irs.ustreas.gov or, for file transfer

Who Must Sign

The time needed to complete and file

protocol services, connect to

this form will vary depending on

The return must be signed and dated by

ftp.irs.ustreas.gov. If you are using the

individual circumstances. The estimated

the administrator of the fund.

World Wide Web, connect to

average time is:

FedWorld’s

If the fund administrator completes

Recordkeeping

17 hr., 56 min.

help desk offers technical assistance on

Form 1120-SF, the Paid Preparer spaces

accessing IRIS (not tax help) during

should remain blank. Anyone who

Learning about the

regular business hours at 703-487-4608.

law or the form

3 hr., 5 min.

prepares Form 1120-SF but does not

charge the fund should not sign the

Tax forms, instructions, and

Preparing the form

6 hr., 19 min.

return. Generally, anyone who is paid to

publications are also available on

Copying, assembling, and

prepare the return must sign it and fill in

CD-ROM, including prior-year forms

sending the form to the IRS

48 min.

the Paid Preparer’s Use Only area.

starting with the 1991 tax year. For

If you have comments concerning the

ordering information and software

The paid preparer must complete the

accuracy of these time estimates or

requirements, contact the Government

required preparer information and—

suggestions for making this form

Printing Office’s Superintendent of

Sign the return, by hand, in the space

simpler, we would be happy to hear

Documents (202-512-1800) or Federal

provided for the preparer’s signature

from you. You can write to the Tax

Bulletin Board (202-512-1387).

(signature stamps and labels are not

Forms Committee, Western Area

By phone or in person.—To order

acceptable).

Distribution Center, Rancho Cordova,

forms and publications, call

Give a copy of the return to the

CA 95743-0001.

1-800-TAX-FORM (1-800-829-3676).

administrator.

DO NOT send the tax form to this

You can also get most forms and

office. Instead, see When and Where

publications at your local IRS office.

Tax Year and Accounting

To File on this page.

Method

General Instructions

A qualified settlement fund’s tax year is

A Change To Note

the calendar year and the fund must use

Purpose of Form

the accrual method of accounting.

For certain qualified settlement funds,

the IRS has allowed the use of of the

Form 1120-SF is used by designated

and qualified settlement funds to report

Rounding Off to Whole

cash method of accounting and a fiscal

tax year for tax years beginning before

transfers received, income earned,

Dollars

January 1, 1996. However, beginning

deductions claimed, tax due, and

The fund may show amounts on the

distributions made.

January 1,1996, all qualified settlement

return and accompanying schedules as

funds must use the accrual method of

whole dollars. To do so, drop any

Cat. No. 14988X

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4