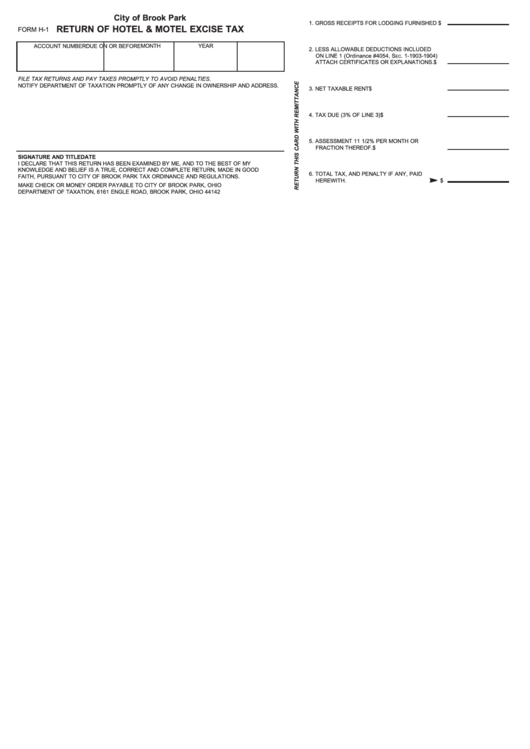

Form H-1 - Return Of Hotel & Motel Excise Tax - City Of Brook Park

ADVERTISEMENT

City of Brook Park

1. GROSS RECEIPTS FOR LODGING FURNISHED $

RETURN OF HOTEL & MOTEL EXCISE TAX

FORM H-1

MONTH

YEAR

ACCOUNT NUMBER

DUE ON OR BEFORE

2. LESS ALLOWABLE DEDUCTIONS INCLUDED

ON LINE 1 (Ordinance #4054, S

. 1-1903-1904)

EC

ATTACH CERTIFICATES OR EXPLANATIONS.

$

FILE TAX RETURNS AND PAY TAXES PROMPTLY TO AVOID PENALTIES.

NOTIFY DEPARTMENT OF TAXATION PROMPTLY OF ANY CHANGE IN OWNERSHIP AND ADDRESS.

3. NET TAXABLE RENT

$

4. TAX DUE (3% OF LINE 3)

$

5. ASSESSMENT 11 1/2% PER MONTH OR

FRACTION THEREOF.

$

SIGNATURE AND TITLE

DATE

I DECLARE THAT THIS RETURN HAS BEEN EXAMINED BY ME, AND TO THE BEST OF MY

KNOWLEDGE AND BELIEF IS A TRUE, CORRECT AND COMPLETE RETURN, MADE IN GOOD

6. TOTAL TAX, AND PENALTY IF ANY, PAID

FAITH, PURSUANT TO CITY OF BROOK PARK TAX ORDINANCE AND REGULATIONS.

HEREWITH.

$

MAKE CHECK OR MONEY ORDER PAYABLE TO CITY OF BROOK PARK, OHIO

DEPARTMENT OF TAXATION, 6161 ENGLE ROAD, BROOK PARK, OHIO 44142

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1