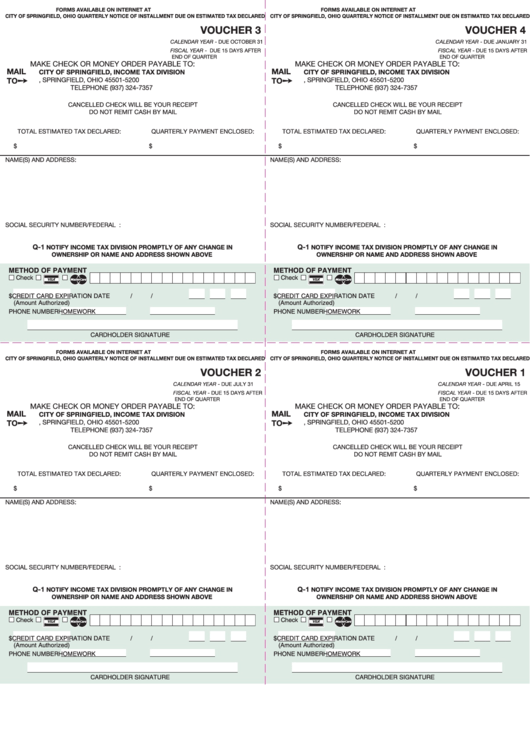

Form Q-1 - Tax Payment Vouchers Form - City Of Springfield

ADVERTISEMENT

FORMS AVAILABLE ON INTERNET AT eld.oh.us

FORMS AVAILABLE ON INTERNET AT eld.oh.us

CITY OF SPRINGFIELD, OHIO QUARTERLY NOTICE OF INSTALLMENT DUE ON ESTIMATED TAX DECLARED

CITY OF SPRINGFIELD, OHIO QUARTERLY NOTICE OF INSTALLMENT DUE ON ESTIMATED TAX DECLARED

VOUCHER 3

VOUCHER 4

CALENDAR YEAR - DUE OCTOBER 31

CALENDAR YEAR - DUE JANUARY 31

FISCAL YEAR - DUE 15 DAYS AFTER

FISCAL YEAR - DUE 15 DAYS AFTER

END OF QUARTER

END OF QUARTER

MAKE CHECK OR MONEY ORDER PAYABLE TO:

MAKE CHECK OR MONEY ORDER PAYABLE TO:

MAIL

MAIL

CITY OF SPRINGFIELD, INCOME TAX DIVISION

CITY OF SPRINGFIELD, INCOME TAX DIVISION

➙

➙

P.O. BOX 5200, SPRINGFIELD, OHIO 45501-5200

P.O. BOX 5200, SPRINGFIELD, OHIO 45501-5200

TO

TO

TELEPHONE (937) 324-7357

TELEPHONE (937) 324-7357

CANCELLED CHECK WILL BE YOUR RECEIPT

CANCELLED CHECK WILL BE YOUR RECEIPT

DO NOT REMIT CASH BY MAIL

DO NOT REMIT CASH BY MAIL

TOTAL ESTIMATED TAX DECLARED:

QUARTERLY PAYMENT ENCLOSED:

TOTAL ESTIMATED TAX DECLARED:

QUARTERLY PAYMENT ENCLOSED:

$ ..........................................

$ .........................................

$ ..........................................

$ .........................................

NAME(S) AND ADDRESS:

NAME(S) AND ADDRESS:

SOCIAL SECURITY NUMBER/FEDERAL I.D. NUMBER:

SOCIAL SECURITY NUMBER/FEDERAL I.D. NUMBER:

Q-1

Q-1

NOTIFY INCOME TAX DIVISION PROMPTLY OF ANY CHANGE IN

NOTIFY INCOME TAX DIVISION PROMPTLY OF ANY CHANGE IN

OWNERSHIP OR NAME AND ADDRESS SHOWN ABOVE

OWNERSHIP OR NAME AND ADDRESS SHOWN ABOVE

METHOD OF PAYMENT

METHOD OF PAYMENT

Check

Check

R

R

$

CREDIT CARD EXPIRATION DATE

/

/

$

CREDIT CARD EXPIRATION DATE

/

/

(Amount Authorized)

(Amount Authorized)

PHONE NUMBER

HOME

WORK

PHONE NUMBER

HOME

WORK

CARDHOLDER SIGNATURE

CARDHOLDER SIGNATURE

FORMS AVAILABLE ON INTERNET AT eld.oh.us

FORMS AVAILABLE ON INTERNET AT eld.oh.us

CITY OF SPRINGFIELD, OHIO QUARTERLY NOTICE OF INSTALLMENT DUE ON ESTIMATED TAX DECLARED

CITY OF SPRINGFIELD, OHIO QUARTERLY NOTICE OF INSTALLMENT DUE ON ESTIMATED TAX DECLARED

VOUCHER 2

VOUCHER 1

CALENDAR YEAR - DUE JULY 31

CALENDAR YEAR - DUE APRIL 15

FISCAL YEAR - DUE 15 DAYS AFTER

FISCAL YEAR - DUE 15 DAYS AFTER

END OF QUARTER

END OF QUARTER

MAKE CHECK OR MONEY ORDER PAYABLE TO:

MAKE CHECK OR MONEY ORDER PAYABLE TO:

MAIL

MAIL

CITY OF SPRINGFIELD, INCOME TAX DIVISION

CITY OF SPRINGFIELD, INCOME TAX DIVISION

➙

➙

P.O. BOX 5200, SPRINGFIELD, OHIO 45501-5200

P.O. BOX 5200, SPRINGFIELD, OHIO 45501-5200

TO

TO

TELEPHONE (937) 324-7357

TELEPHONE (937) 324-7357

CANCELLED CHECK WILL BE YOUR RECEIPT

CANCELLED CHECK WILL BE YOUR RECEIPT

DO NOT REMIT CASH BY MAIL

DO NOT REMIT CASH BY MAIL

TOTAL ESTIMATED TAX DECLARED:

QUARTERLY PAYMENT ENCLOSED:

TOTAL ESTIMATED TAX DECLARED:

QUARTERLY PAYMENT ENCLOSED:

$ ..........................................

$ .........................................

$ ..........................................

$ .........................................

NAME(S) AND ADDRESS:

NAME(S) AND ADDRESS:

SOCIAL SECURITY NUMBER/FEDERAL I.D. NUMBER:

SOCIAL SECURITY NUMBER/FEDERAL I.D. NUMBER:

Q-1

Q-1

NOTIFY INCOME TAX DIVISION PROMPTLY OF ANY CHANGE IN

NOTIFY INCOME TAX DIVISION PROMPTLY OF ANY CHANGE IN

OWNERSHIP OR NAME AND ADDRESS SHOWN ABOVE

OWNERSHIP OR NAME AND ADDRESS SHOWN ABOVE

METHOD OF PAYMENT

METHOD OF PAYMENT

Check

Check

R

R

$

CREDIT CARD EXPIRATION DATE

/

/

$

CREDIT CARD EXPIRATION DATE

/

/

(Amount Authorized)

(Amount Authorized)

PHONE NUMBER

HOME

WORK

PHONE NUMBER

HOME

WORK

CARDHOLDER SIGNATURE

CARDHOLDER SIGNATURE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1