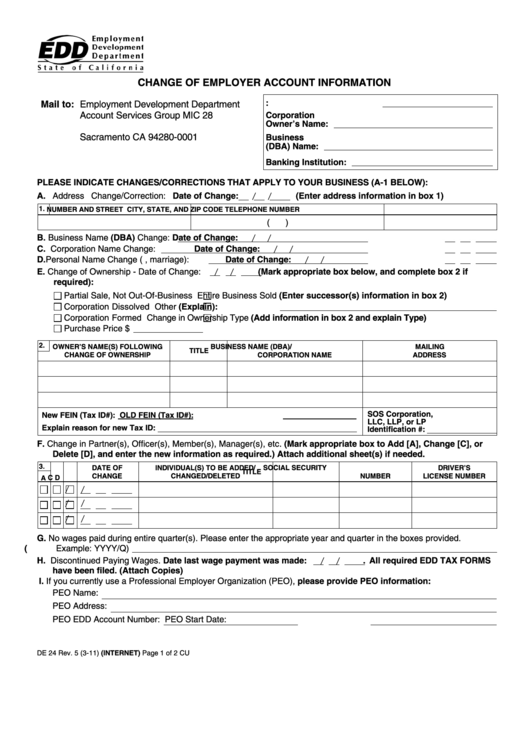

CHANGE OF EMPLOYER ACCOUNT INFORMATION

E.D.D. ACCOUNT NUMBER:

Mail to: Employment Development Department

Account Services Group MIC 28

Corporation

Owner’s Name:

P.O. Box 826880

Sacramento CA 94280-0001

Business

(DBA) Name:

Banking Institution:

PLEASE INDICATE CHANGES/CORRECTIONS THAT APPLY TO YOUR BUSINESS (A-1 BELOW):

A. Address Change/Correction: Date of Change:

(Enter address information in box 1)

/

/

1.

NUMBER AND STREET

CITY, STATE, AND ZIP CODE

TELEPHONE NUMBER

(

)

B. Business Name (DBA) Change:

Date of Change:

/

/

C. Corporation Name Change:

Date of Change:

/

/

D. Personal Name Change (i.e., marriage):

Date of Change:

/

/

E. Change of Ownership - Date of Change:

(Mark appropriate box below, and complete box 2 if

/

/

required):

Partial Sale, Not Out-Of-Business

Entire Business Sold (Enter successor(s) information in box 2)

Corporation Dissolved

Other (Explain):

Corporation Formed

Change in Ownership Type (Add information in box 2 and explain Type)

Purchase Price $

2.

OWNER’S NAME(S) FOLLOWING

BUSINESS NAME (DBA)/

MAILING

TITLE

CHANGE OF OWNERSHIP

CORPORATION NAME

ADDRESS

SOS Corporation,

New FEIN (Tax ID#):

OLD FEIN (Tax ID#):

LLC, LLP, or LP

Explain reason for new Tax ID:

Identification #:

F. Change in Partner(s), Officer(s), Member(s), Manager(s), etc. (Mark appropriate box to Add [A], Change [C], or

Delete [D], and enter the new information as required.) Attach additional sheet(s) if needed.

3.

DATE OF

INDIVIDUAL(S) TO BE ADDED/

SOCIAL SECURITY

DRIVER’S

TITLE

CHANGE

CHANGED/DELETED

NUMBER

LICENSE NUMBER

C

D

A

/

/

/

/

/

/

G. No wages paid during entire quarter(s). Please enter the appropriate year and quarter in the boxes provided.

(Example: YYYY/Q)

H. Discontinued Paying Wages. Date last wage payment was made:

. All required EDD TAX FORMS

/

/

have been filed. (Attach Copies)

I. If you currently use a Professional Employer Organization (PEO), please provide PEO information:

PEO Name:

PEO Address:

PEO EDD Account Number:

PEO Start Date:

DE 24 Rev. 5 (3-11) (INTERNET)

Page 1 of 2

CU

1

1 2

2