Reset

Print

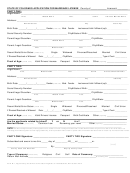

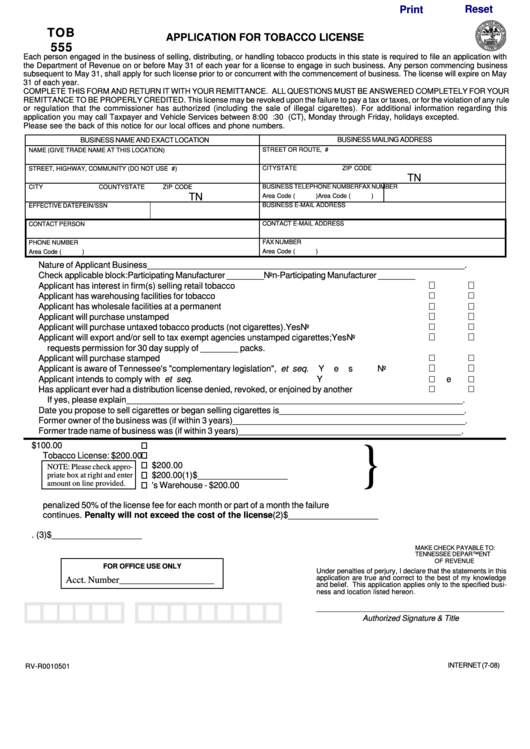

TOB

APPLICATION FOR TOBACCO LICENSE

555

Each person engaged in the business of selling, distributing, or handling tobacco products in this state is required to file an application with

the Department of Revenue on or before May 31 of each year for a license to engage in such business. Any person commencing business

subsequent to May 31, shall apply for such license prior to or concurrent with the commencement of business. The license will expire on May

31 of each year.

COMPLETE THIS FORM AND RETURN IT WITH YOUR REMITTANCE. ALL QUESTIONS MUST BE ANSWERED COMPLETELY FOR YOUR

REMITTANCE TO BE PROPERLY CREDITED. This license may be revoked upon the failure to pay a tax or taxes, or for the violation of any rule

or regulation that the commissioner has authorized (including the sale of illegal cigarettes). For additional information regarding this

application you may call Taxpayer and Vehicle Services between 8:00 a.m. and 4:30 p.m. (CT), Monday through Friday, holidays excepted.

Please see the back of this notice for our local offices and phone numbers.

BUSINESS MAILING ADDRESS

BUSINESS NAME AND EXACT LOCATION

STREET OR ROUTE, P.O. BOX #

NAME (GIVE TRADE NAME AT THIS LOCATION)

CITY

STATE

ZIP CODE

STREET, HIGHWAY, COMMUNITY (DO NOT USE P.O. BOX #)

TN

CITY

COUNTY

STATE

ZIP CODE

BUSINESS TELEPHONE NUMBER

FAX NUMBER

TN

Area Code (

)

Area Code (

)

BUSINESS E-MAIL ADDRESS

EFFECTIVE DATE

FEIN/SSN

CONTACT E-MAIL ADDRESS

CONTACT PERSON

FAX NUMBER

PHONE NUMBER

Area Code (

)

Area Code (

)

Nature of Applicant Business ___________________________________________________________________ .

Check applicable block: Participating Manufacturer ________

Non-Participating Manufacturer ________

Applicant has interest in firm(s) selling retail tobacco products.

Yes

No

Applicant has warehousing facilities for tobacco manufacturers.

Yes

No

Applicant has wholesale facilities at a permanent location.

Yes

No

Applicant will purchase unstamped cigarettes.

Yes

No

Applicant will purchase untaxed tobacco products (not cigarettes).

Yes

No

Applicant will export and/or sell to tax exempt agencies unstamped cigarettes;

Yes

No

requests permission for 30 day supply of ________ packs.

Applicant will purchase stamped cigarettes.

Yes

No

Applicant is aware of Tennessee's "complementary legislation", T.C.A. Section 67-4-2601 et seq.

Yes

No

Applicant intends to comply with T.C.A. Section 67-4-2601 et seq.

Yes

No

Has applicant ever had a distribution license denied, revoked, or enjoined by another state.

Yes

No

If yes, please explain _______________________________________________________________________ .

Date you propose to sell cigarettes or began selling cigarettes is _______________________________________ .

Former owner of the business was (if within 3 years) _________________________________________________ .

Former trade name of business was (if within 3 years) _______________________________________________ .

1. Check Type of

A. Distributors or Representatives - $100.00

}

Tobacco License:

B. Wholesale Dealer - stamped cigarettes only -$200.00

C. Wholesale Dealer - other tobacco products - $200.00

NOTE: Please check appro-

D. Manufacturing/Distributor - $200.00

.... (1) $ ___________________

priate box at right and enter

amount on line provided.

E. Manufactuer's Warehouse - $200.00

2. Penalty - Any person failing to apply for a license upon entering business will be

penalized 50% of the license fee for each month or part of a month the failure

continues. Penalty will not exceed the cost of the license. .............................................. (2) $ ___________________

3. Total Remittance Amount ....................................................................................................... (3) $ ___________________

MAKE CHECK PAYABLE TO:

TENNESSEE DEPARTMENT

OF REVENUE

FOR OFFICE USE ONLY

Under penalties of perjury, I declare that the statements in this

application are true and correct to the best of my knowledge

Acct. Number ____________________

and belief. This application applies only to the specified busi-

ness and location listed hereon.

Authorized Signature & Title

INTERNET (7-08)

RV-R0010501

1

1 2

2