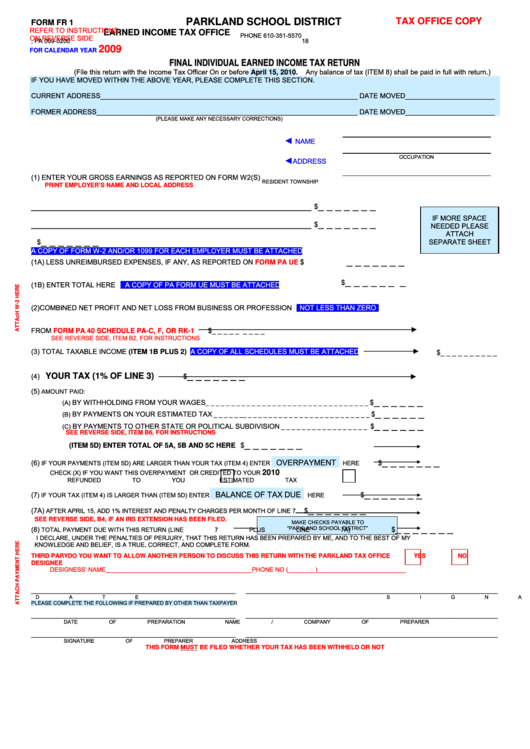

PARKLAND SCHOOL DISTRICT

TAX OFFICE COPY

FORM FR 1

REFER TO INSTRUCTIONS

EARNED INCOME TAX OFFICE

ON REVERSE SIDE

P.O. BOX 200 OREFIELD, PA

18

069-0200

2009

PHONE 610-351-5570

FOR CALENDAR YEAR

FINAL INDIVIDUAL EARNED INCOME TAX RETURN

(File this return with the Income Tax Officer On or before April 15, 2010.

Any balance of tax (ITEM 8) shall be paid in full with return.)

IF YOU HAVE MOVED WITHIN THE ABOVE YEAR, PLEASE COMPLETE THIS SECTION.

CURRENT ADDRESS __________________________________________________________________ DATE MOVED _______________________

FORMER ADDRESS ___________________________________________________________________ DATE MOVED _______________________

(PLEASE MAKE ANY NECESSARY CORRECTIONS)

◄

NAME

OCCUPATION

◄

ADDRESS

(1) ENTER YOUR GROSS EARNINGS AS REPORTED ON FORM W2(S)

RESIDENT TOWNSHIP

PRINT EMPLOYER’S NAME AND LOCAL ADDRESS

_________________________________________________

_ _ _ _ _ _ _

$

IF MORE SPACE

_________________________________________________

_ _ _ _ _ _ _

$

NEEDED PLEASE

ATTACH

_ _ _ _ _ _ _

SEPARATE SHEET

$

A COPY OF FORM W-2 AND/OR 1099 FOR EACH EMPLOYER MUST BE ATTACHED

_ _ _ _ _ _ _

(1A) LESS UNREIMBURSED EXPENSES, IF ANY, AS REPORTED ON

$

FORM PA UE

_ _ _ _ _ _ _

$

(1 B) ENTER TOTAL HERE

A COPY OF PA FORM UE MUST BE ATTACHED

(2) COMBINED NET PROFIT AND NET LOSS FROM BUSINESS OR PROFESSION

NOT LESS THAN ZERO

FROM

$_ _ _ _ _ _ _ _ _

FORM PA 40 SCHEDULE PA-C, F, OR RK-1

SEE REVERSE SIDE, ITEM B2, FOR INSTRUCTIONS

(3) TOTAL TAXABLE INCOME (ITEM 1B PLUS 2)

A COPY OF ALL SCHEDULES MUST BE ATTACHED

$_ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _

(4)

YOUR TAX (1% OF LINE 3)

$

(5)

AMOUNT PAID:

_ _ _ _ _ _

BY WITHHOLDING FROM YOUR WAGES

$

(A)

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _

BY PAYMENTS ON YOUR ESTIMATED TAX

$

(B)

_ _ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _

BY PAYMENTS TO OTHER STATE OR POLITICAL SUBDIVISION

$

(C)

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

SEE REVERSE SIDE, ITEM B6, FOR INSTRUCTIONS

_ _ _ _ _ _ _

$

(ITEM 5D) ENTER TOTAL OF 5A, 5B AND 5C HERE

_ _ _ _ _ _ _

OVERPAYMENT

(6)

$

IF YOUR PAYMENTS (ITEM 5D) ARE LARGER THAN YOUR TAX (ITEM 4) ENTER

HERE

CHECK (X) IF YOU WANT THIS OVERPAYMENT

OR CREDITED TO YOUR

2010

REFUNDED TO YOU

ESTIMATED TAX

_ _ _ _ _ _ _

BALANCE OF TAX DUE

(7

$

) IF YOUR TAX (ITEM 4) IS LARGER THAN (ITEM 5D) ENTER

HERE

_ _ _ _ _ _ _

(7A)

$

AFTER APRIL 15, ADD 1% INTEREST AND PENALTY CHARGES PER MONTH OF LINE 7

SEE REVERSE SIDE, B4, IF AN IRS EXTENSION HAS BEEN FILED.

MAKE CHECKS PAYABLE TO

_ _ _ _ _ _ _

“PARKLAND SCHOOL DISTRICT”

(8)

$

TOTAL PAYMENT DUE WITH THIS RETURN (LINE 7 PLUS LINE 7A)

I DECLARE, UNDER THE PENALTIES OF PERJURY, THAT THIS RETURN HAS BEEN PREPARED BY ME, AND TO THE BEST OF MY

KNOWLEDGE AND BELIEF, IS A TRUE, CORRECT, AND COMPLETE FORM.

THIRD PARY

DO YOU WANT TO ALLOW ANOTHER PERSON TO DISCUSS THIS RETURN WITH THE PARKLAND TAX OFFICE

YES

NO

DESIGNEE

DESIGNESS’ NAME___________________________________________PHONE NO (________)__________________________

____________________________________________________________

__________________________________________________________________________

DATE

SIGNATURE OF TAXPAYER

PLEASE COMPLETE THE FOLLOWING IF PREPARED BY OTHER THAN TAXPAYER

____________________________________________________________

__________________________________________________________________________

DATE OF PREPARATION

NAME / COMPANY OF PREPARER

____________________________________________________________

__________________________________________________________________________

SIGNATURE OF PREPARER

ADDRESS

THIS FORM MUST BE FILED WHETHER YOUR TAX HAS BEEN WITHHELD OR NOT

1

1 2

2