Form Tq-1 - Quarterly Estimate Payment Form - City Of Troy

ADVERTISEMENT

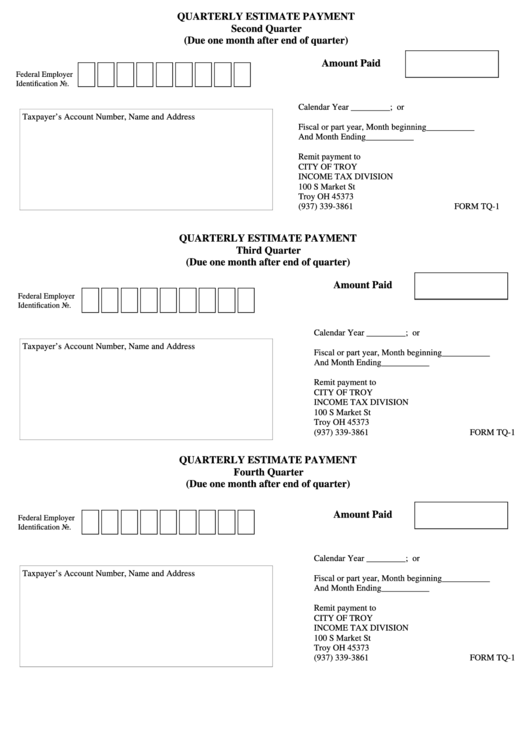

QUARTERLY ESTIMATE PAYMENT

Second Quarter

(Due one month after end of quarter)

Amount Paid

Federal Employer

Identification No.

Calendar Year _________; or

Taxpayer’s Account Number, Name and Address

Fiscal or part year, Month beginning___________

And Month Ending___________

Remit payment to

CITY OF TROY

INCOME TAX DIVISION

100 S Market St

Troy OH 45373

(937) 339-3861

FORM TQ-1

QUARTERLY ESTIMATE PAYMENT

Third Quarter

(Due one month after end of quarter)

Amount Paid

Federal Employer

Identification No.

Calendar Year _________; or

Taxpayer’s Account Number, Name and Address

Fiscal or part year, Month beginning___________

And Month Ending___________

Remit payment to

CITY OF TROY

INCOME TAX DIVISION

100 S Market St

Troy OH 45373

(937) 339-3861

FORM TQ-1

QUARTERLY ESTIMATE PAYMENT

Fourth Quarter

(Due one month after end of quarter)

Amount Paid

Federal Employer

Identification No.

Calendar Year _________; or

Taxpayer’s Account Number, Name and Address

Fiscal or part year, Month beginning___________

And Month Ending___________

Remit payment to

CITY OF TROY

INCOME TAX DIVISION

100 S Market St

Troy OH 45373

(937) 339-3861

FORM TQ-1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1