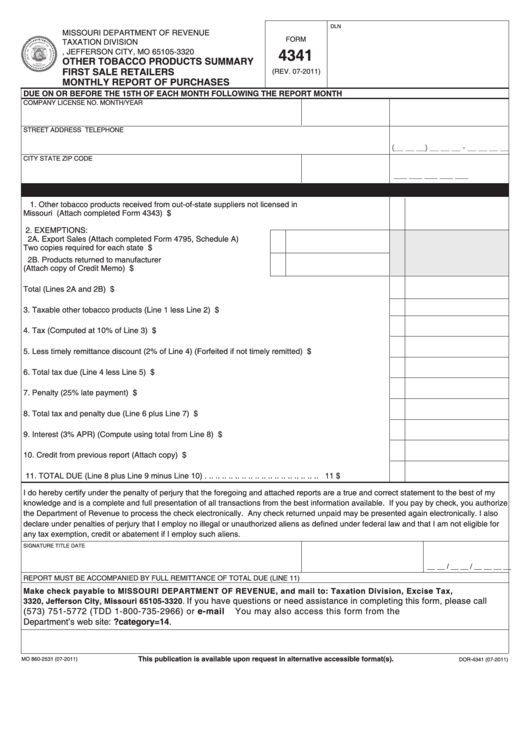

DLN

Print Form

Reset Form

MISSOURI DEPARTMENT OF REVENUE

FORM

TAXATION DIVISION

4341

P.O. BOX 3320, JEFFERSON CITY, MO 65105-3320

OTHER TOBACCO PRODUCTS SUMMARY

FIRST SALE RETAILERS

(REV. 07-2011)

MONTHLY REPORT OF PURCHASES

DUE ON OR BEFORE THE 15TH OF EACH MONTH FOLLOWING THE REPORT MONTH

COMPANY

LICENSE NO.

MONTH/YEAR

STREET ADDRESS

TELEPHONE

(__ __ __) __ __ __ - __ __ __ __

CITY

STATE

ZIP CODE

___ ___ ___ ___ ___

1. Other tobacco products received from out-of-state suppliers not licensed in

Missouri (Attach completed Form 4343) .............................................................................................

1

$

2. EXEMPTIONS:

2A. Export Sales (Attach completed Form 4795, Schedule A)

Two copies required for each state ........................................

2A

$

2B. Products returned to manufacturer

(Attach copy of Credit Memo) ................................................

2B

$

Total (Lines 2A and 2B) .......................................................................................................................

2

$

3. Taxable other tobacco products (Line 1 less Line 2) ...........................................................................

3

$

4. Tax (Computed at 10% of Line 3) ........................................................................................................

4

$

5. Less timely remittance discount (2% of Line 4) (Forfeited if not timely remitted) .................................

5

$

6. Total tax due (Line 4 less Line 5) .........................................................................................................

6

$

7. Penalty (25% late payment) .................................................................................................................

7

$

8. Total tax and penalty due (Line 6 plus Line 7) .....................................................................................

8

$

9. Interest (3% APR) (Compute using total from Line 8) ..........................................................................

9

$

10. Credit from previous report (Attach copy) ............................................................................................

10

$

11. TOTAL DUE (Line 8 plus Line 9 minus Line 10)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

$

I do hereby certify under the penalty of perjury that the foregoing and attached reports are a true and correct statement to the best of my

knowledge and is a complete and full presentation of all transactions from the best information available. If you pay by check, you authorize

the Department of Revenue to process the check electronically. Any check returned unpaid may be presented again electronically. I also

declare under penalties of perjury that I employ no illegal or unauthorized aliens as defined under federal law and that I am not eligible for

any tax exemption, credit or abatement if I employ such aliens.

SIGNATURE

TITLE

DATE

__ __ / __ __ / __ __ __ __

REPORT MUST BE ACCOMPANIED BY FULL REMITTANCE OF TOTAL DUE (LINE 11)

Make check payable to MISSOURI DEPARTMENT OF REVENUE, and mail to: Taxation Division, Excise Tax, P.O. Box

If you have questions or need assistance in completing this form, please call

3320, Jefferson City, Missouri 65105-3320.

(573) 751-5772 (TDD 1-800-735-2966) or e-mail excise@dor.mo.gov. You may also access this form from the

Department’s web site:

This publication is available upon request in alternative accessible format(s).

MO 860-2531 (07-2011)

DOR-4341 (07-2011)

1

1 2

2