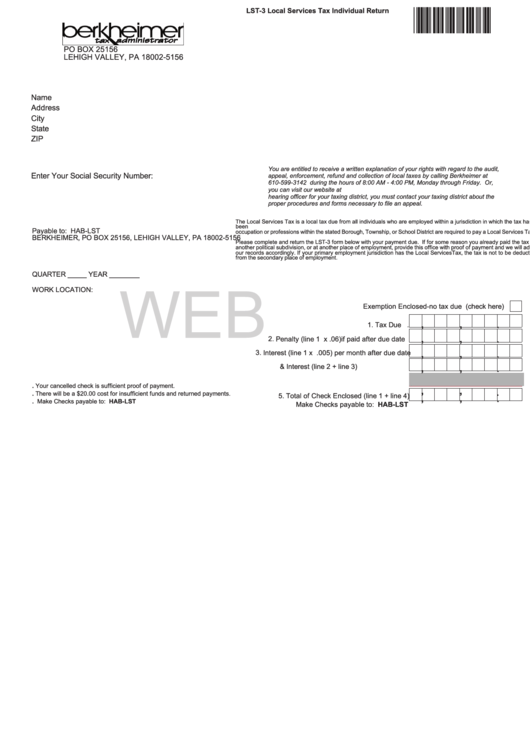

LST-3 Local Services Tax Individual Return

LSTQ3

PO BOX 25156

LEHIGH VALLEY, PA 18002-5156

Name

Address

City

State

ZIP

You are entitled to receive a written explanation of your rights with regard to the audit,

Enter Your Social Security Number:

appeal, enforcement, refund and collection of local taxes by calling Berkheimer at

610-599-3142 during the hours of 8:00 AM - 4:00 PM, Monday through Friday. Or,

you can visit our website at If Berkheimer is not the appointed tax

hearing officer for your taxing district, you must contact your taxing district about the

proper procedures and forms necessary to file an appeal.

WEB

The Local Services Tax is a local tax due from all individuals who are employed within a jurisdiction in which the tax has

been enacted. All Federal Employees and all Self-Reporting Individuals who perform services of any kind or engage in any

Payable to: HAB-LST

occupation or professions within the stated Borough, Township, or School District are required to pay a Local Services Tax.

BERKHEIMER, PO BOX 25156, LEHIGH VALLEY, PA 18002-5156

Please complete and return the LST-3 form below with your payment due. If for some reason you already paid the tax in

another political subdivision, or at another place of employment, provide this office with proof of payment and we will adjust

our records accordingly. If your primary employment jurisdiction has the Local Services Tax, the tax is not to be deducted

J

from the secondary place of employment.

QUARTER _____ YEAR ________

WORK LOCATION:

Exemption Enclosed-no tax due (check here)

.

,

,

1. Tax Due .

.

,

,

2. Penalty (line 1 x .06)if paid after due date

.

,

,

3. Interest (line 1 x .005) per month after due date

.

,

,

4. Total Penalty & Interest (line 2 + line 3)

.

,

,

. Your cancelled check is sufficient proof of payment.

.

,

,

. There will be a $20.00 cost for insufficient funds and returned payments.

5. Total of Check Enclosed (line 1 + line 4)

. Make Checks payable to: HAB-LST

Make Checks payable to: HAB-LST

1

1