Form Va-15 - Employer'S Voucher For Payment Of Virginia Income Tax Withheld (Semi-Weekly) - Virginia Department Of Taxation

ADVERTISEMENT

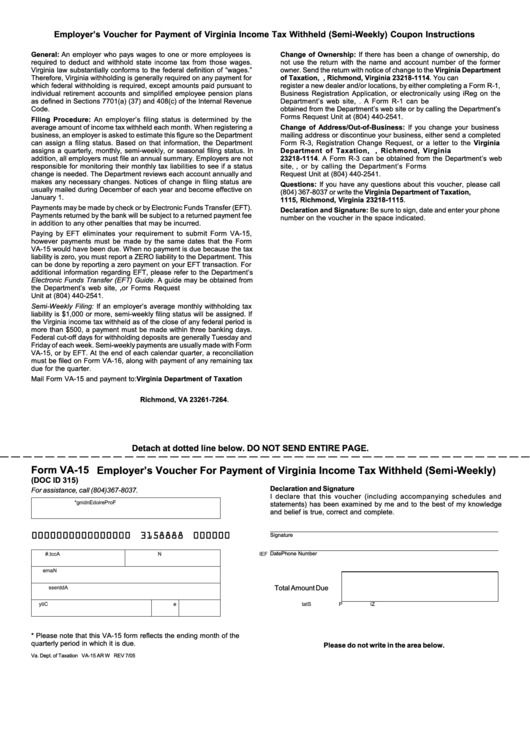

Employer’s Voucher for Payment of Virginia Income Tax Withheld (Semi-Weekly) Coupon Instructions

General: An employer who pays wages to one or more employees is

Change of Ownership: If there has been a change of ownership, do

required to deduct and withhold state income tax from those wages.

not use the return with the name and account number of the former

Virginia law substantially conforms to the federal definition of “wages.”

owner. Send the return with notice of change to the Virginia Department

Therefore, Virginia withholding is generally required on any payment for

of Taxation, P.O. Box 1114, Richmond, Virginia 23218-1114. You can

which federal withholding is required, except amounts paid pursuant to

register a new dealer and/or locations, by either completing a Form R-1,

individual retirement accounts and simplified employee pension plans

Business Registration Application, or electronically using iReg on the

as defined in Sections 7701(a) (37) and 408(c) of the Internal Revenue

Department’s web site, A Form R-1 can be

Code.

obtained from the Department’s web site or by calling the Department’s

Forms Request Unit at (804) 440-2541.

Filing Procedure: An employer’s filing status is determined by the

average amount of income tax withheld each month. When registering a

Change of Address/Out-of-Business: If you change your business

business, an employer is asked to estimate this figure so the Department

mailing address or discontinue your business, either send a completed

can assign a filing status. Based on that information, the Department

Form R-3, Registration Change Request, or a letter to the Virginia

assigns a quarterly, monthly, semi-weekly, or seasonal filing status. In

Department of Taxation, P.O. Box 1114, Richmond, Virginia

addition, all employers must file an annual summary. Employers are not

23218-1114. A Form R-3 can be obtained from the Department’s web

responsible for monitoring their monthly tax liabilities to see if a status

site, , or by calling the Department’s Forms

change is needed. The Department reviews each account annually and

Request Unit at (804) 440-2541.

makes any necessary changes. Notices of change in filing status are

Questions: If you have any questions about this voucher, please call

usually mailed during December of each year and become effective on

(804) 367-8037 or write the Virginia Department of Taxation, P.O. Box

January 1.

1115, Richmond, Virginia 23218-1115.

Payments may be made by check or by Electronic Funds Transfer (EFT).

Declaration and Signature: Be sure to sign, date and enter your phone

Payments returned by the bank will be subject to a returned payment fee

number on the voucher in the space indicated.

in addition to any other penalties that may be incurred.

Paying by EFT eliminates your requirement to submit Form VA-15,

however payments must be made by the same dates that the Form

VA-15 would have been due. When no payment is due because the tax

liability is zero, you must report a ZERO liability to the Department. This

can be done by reporting a zero payment on your EFT transaction. For

additional information regarding EFT, please refer to the Department’s

Electronic Funds Transfer (EFT) Guide. A guide may be obtained from

the Department’s web site, , or Forms Request

Unit at (804) 440-2541.

Semi-Weekly Filing: If an employer’s average monthly withholding tax

liability is $1,000 or more, semi-weekly filing status will be assigned. If

the Virginia income tax withheld as of the close of any federal period is

more than $500, a payment must be made within three banking days.

Federal cut-off days for withholding deposits are generally Tuesday and

Friday of each week. Semi-weekly payments are usually made with Form

VA-15, or by EFT. At the end of each calendar quarter, a reconciliation

must be filed on Form VA-16, along with payment of any remaining tax

due for the quarter.

Mail Form VA-15 and payment to: Virginia Department of Taxation

P.O. Box 27264

Richmond, VA 23261-7264.

Detach at dotted line below. DO NOT SEND ENTIRE PAGE.

Form VA-15

Employer’s Voucher For Payment of Virginia Income Tax Withheld (Semi-Weekly)

(DOC ID 315)

Declaration and Signature

For assistance, call (804)367-8037.

I declare that this voucher (including accompanying schedules and

F

r o

P

r e

o i

d

E

n

d

n i

* g

statements) has been examined by me and to the best of my knowledge

and belief is true, correct and complete.

0000000000000000 3158888 000000

Signature

Date

Phone Number

A

c

. t c

#

F

E

N I

N

a

m

e

A

d

d

e r

s s

Total Amount Due

C

y t i

S

a t

e t

Z

P I

* Please note that this VA-15 form reflects the ending month of the

quarterly period in which it is due.

Please do not write in the area below.

Va. Dept. of Taxation VA-15 AR W REV 7/05

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1