Job Service North Dakota Electronic Tax Report Filing

ADVERTISEMENT

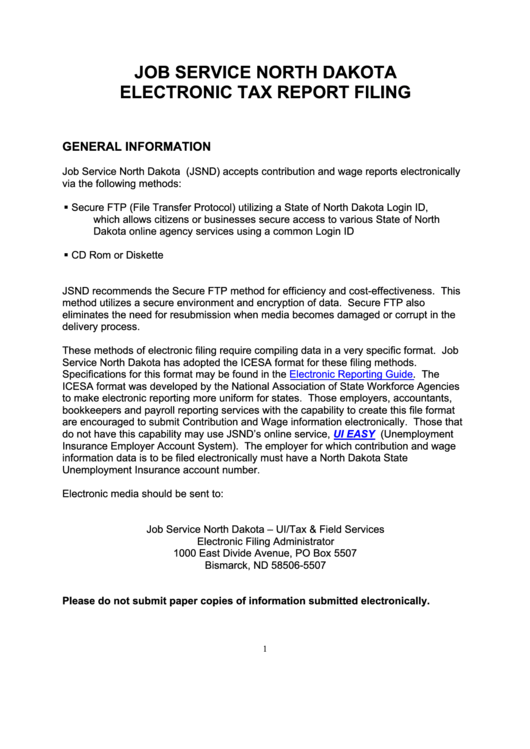

JOB SERVICE NORTH DAKOTA

ELECTRONIC TAX REPORT FILING

GENERAL INFORMATION

Job Service North Dakota (JSND) accepts contribution and wage reports electronically

via the following methods:

Secure FTP (File Transfer Protocol) utilizing a State of North Dakota Login ID,

which allows citizens or businesses secure access to various State of North

Dakota online agency services using a common Login ID

CD Rom or Diskette

JSND recommends the Secure FTP method for efficiency and cost-effectiveness. This

method utilizes a secure environment and encryption of data. Secure FTP also

eliminates the need for resubmission when media becomes damaged or corrupt in the

delivery process.

These methods of electronic filing require compiling data in a very specific format. Job

Service North Dakota has adopted the ICESA format for these filing methods.

Specifications for this format may be found in the

Electronic Reporting

Guide. The

ICESA format was developed by the National Association of State Workforce Agencies

to make electronic reporting more uniform for states. Those employers, accountants,

bookkeepers and payroll reporting services with the capability to create this file format

are encouraged to submit Contribution and Wage information electronically. Those that

do not have this capability may use JSND‟s online service,

UI EASY

(Unemployment

Insurance Employer Account System). The employer for which contribution and wage

information data is to be filed electronically must have a North Dakota State

Unemployment Insurance account number.

Electronic media should be sent to:

Job Service North Dakota – UI/Tax & Field Services

Electronic Filing Administrator

1000 East Divide Avenue, PO Box 5507

Bismarck, ND 58506-5507

Please do not submit paper copies of information submitted electronically.

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6