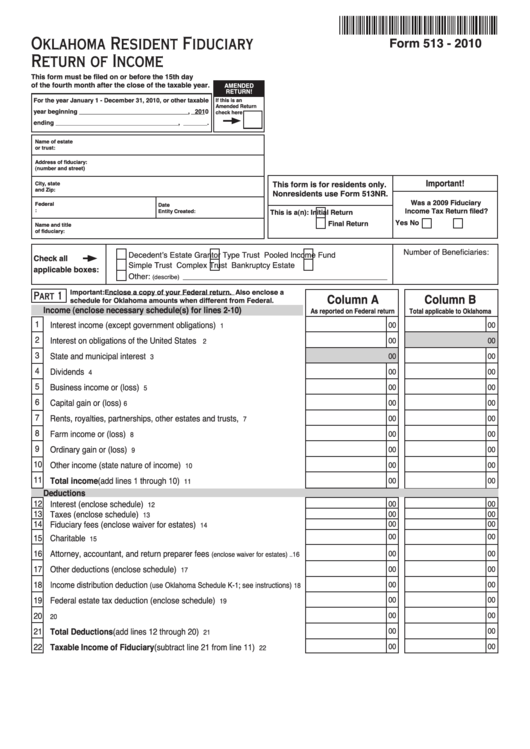

Oklahoma Resident Fiduciary

Form 513 - 2010

Return of Income

This form must be filed on or before the 15th day

of the fourth month after the close of the taxable year.

AMENDED

RETURN!

For the year January 1 - December 31, 2010, or other taxable

If this is an

Amended Return

year beginning ________________________________, 2010

check here

ending ____________________________________, _______.

Name of estate

or trust:

Address of fiduciary:

(number and street)

Important!

This form is for residents only.

City, state

and Zip:

Nonresidents use Form 513NR.

Was a 2009 Fiduciary

Federal

Date

I.D. Number:

Income Tax Return filed?

Entity Created:

This is a(n):

Initial Return

Yes

No

Final Return

Name and title

of fiduciary:

Number of Beneficiaries:

Decedent’s Estate

Grantor Type Trust

Pooled Income Fund

Check all

Simple Trust

Complex Trust

Bankruptcy Estate

applicable boxes:

Other:

(describe) ____________________________________________________________

Important: Enclose a copy of your Federal return. Also enclose a

Part 1

Column A

Column B

schedule for Oklahoma amounts when different from Federal.

Income (enclose necessary schedule(s) for lines 2-10)

As reported on Federal return

Total applicable to Oklahoma

1

Interest income (except government obligations) ....................................

00

00

1

2

Interest on obligations of the United States ............................................

00

00

2

3

State and municipal interest ....................................................................

00

00

3

4

Dividends .................................................................................................

00

00

4

5

Business income or (loss) .......................................................................

00

00

5

6

Capital gain or (loss)................................................................................

00

00

6

7

Rents, royalties, partnerships, other estates and trusts, etc....................

00

00

7

8

Farm income or (loss) ..............................................................................

00

00

8

9

Ordinary gain or (loss) .............................................................................

00

00

9

10

Other income (state nature of income) ...................................................

00

00

10

11

Total income (add lines 1 through 10) ...................................................

00

00

11

Deductions

12

Interest (enclose schedule) ....................................................................

00

00

12

13

Taxes (enclose schedule) .......................................................................

00

00

13

14

Fiduciary fees (enclose waiver for estates) ............................................

00

00

14

00

00

15

Charitable deduction...............................................................................

15

16

Attorney, accountant, and return preparer fees

00

00

(enclose waiver for estates) ..16

17

Other deductions (enclose schedule) .....................................................

00

00

17

18

Income distribution deduction

00

00

(use Oklahoma Schedule K-1; see instructions)

18

19

Federal estate tax deduction (enclose schedule) ...................................

00

00

19

20

Exemption...............................................................................................

00

00

20

21

Total Deductions (add lines 12 through 20) ..........................................

00

00

21

22

Taxable Income of Fiduciary (subtract line 21 from line 11) ................

00

00

22

1

1 2

2 3

3 4

4