Instructions For Tc-65pa - Utah Composite Return For Nonresident Professional Team - Utah State Tax Commission

ADVERTISEMENT

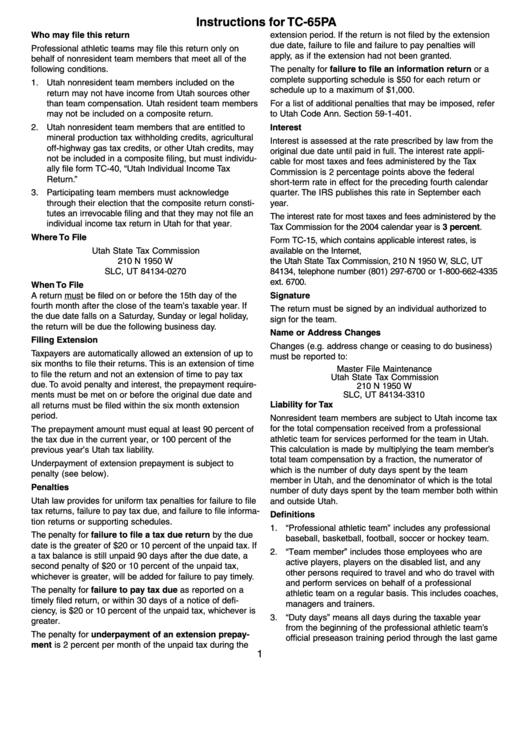

Instructions for TC-65PA

Who may file this return

extension period. If the return is not filed by the extension

due date, failure to file and failure to pay penalties will

Professional athletic teams may file this return only on

apply, as if the extension had not been granted.

behalf of nonresident team members that meet all of the

The penalty for failure to file an information return or a

following conditions.

complete supporting schedule is $50 for each return or

1. Utah nonresident team members included on the

schedule up to a maximum of $1,000.

return may not have income from Utah sources other

than team compensation. Utah resident team members

For a list of additional penalties that may be imposed, refer

may not be included on a composite return.

to Utah Code Ann. Section 59-1-401.

2. Utah nonresident team members that are entitled to

Interest

mineral production tax withholding credits, agricultural

Interest is assessed at the rate prescribed by law from the

off-highway gas tax credits, or other Utah credits, may

original due date until paid in full. The interest rate appli-

not be included in a composite filing, but must individu-

cable for most taxes and fees administered by the Tax

ally file form TC-40, “Utah Individual Income Tax

Commission is 2 percentage points above the federal

Return.”

short-term rate in effect for the preceding fourth calendar

3. Participating team members must acknowledge

quarter. The IRS publishes this rate in September each

through their election that the composite return consti-

year.

tutes an irrevocable filing and that they may not file an

The interest rate for most taxes and fees administered by the

individual income tax return in Utah for that year.

Tax Commission for the 2004 calendar year is 3 percent.

Where To File

Form TC-15, which contains applicable interest rates, is

Utah State Tax Commission

available on the Internet, tax.utah.gov or by calling or writing

210 N 1950 W

the Utah State Tax Commission, 210 N 1950 W, SLC, UT

SLC, UT 84134-0270

84134, telephone number (801) 297-6700 or 1-800-662-4335

ext. 6700.

When To File

Signature

A return must be filed on or before the 15th day of the

fourth month after the close of the team’s taxable year. If

The return must be signed by an individual authorized to

the due date falls on a Saturday, Sunday or legal holiday,

sign for the team.

the return will be due the following business day.

Name or Address Changes

Filing Extension

Changes (e.g. address change or ceasing to do business)

Taxpayers are automatically allowed an extension of up to

must be reported to:

six months to file their returns. This is an extension of time

Master File Maintenance

to file the return and not an extension of time to pay tax

Utah State Tax Commission

due. To avoid penalty and interest, the prepayment require-

210 N 1950 W

SLC, UT 84134-3310

ments must be met on or before the original due date and

Liability for Tax

all returns must be filed within the six month extension

period.

Nonresident team members are subject to Utah income tax

for the total compensation received from a professional

The prepayment amount must equal at least 90 percent of

athletic team for services performed for the team in Utah.

the tax due in the current year, or 100 percent of the

This calculation is made by multiplying the team member’s

previous year’s Utah tax liability.

total team compensation by a fraction, the numerator of

Underpayment of extension prepayment is subject to

which is the number of duty days spent by the team

penalty (see below).

member in Utah, and the denominator of which is the total

Penalties

number of duty days spent by the team member both within

Utah law provides for uniform tax penalties for failure to file

and outside Utah.

tax returns, failure to pay tax due, and failure to file informa-

Definitions

tion returns or supporting schedules.

1. “Professional athletic team” includes any professional

The penalty for failure to file a tax due return by the due

baseball, basketball, football, soccer or hockey team.

date is the greater of $20 or 10 percent of the unpaid tax. If

2. “Team member” includes those employees who are

a tax balance is still unpaid 90 days after the due date, a

active players, players on the disabled list, and any

second penalty of $20 or 10 percent of the unpaid tax,

other persons required to travel and who do travel with

whichever is greater, will be added for failure to pay timely.

and perform services on behalf of a professional

The penalty for failure to pay tax due as reported on a

athletic team on a regular basis. This includes coaches,

timely filed return, or within 30 days of a notice of defi-

managers and trainers.

ciency, is $20 or 10 percent of the unpaid tax, whichever is

3. “Duty days” means all days during the taxable year

greater.

from the beginning of the professional athletic team’s

The penalty for underpayment of an extension prepay-

official preseason training period through the last game

ment is 2 percent per month of the unpaid tax during the

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3