Instructions For Filing Application For Extension Of Time To File City Income Tax Return

ADVERTISEMENT

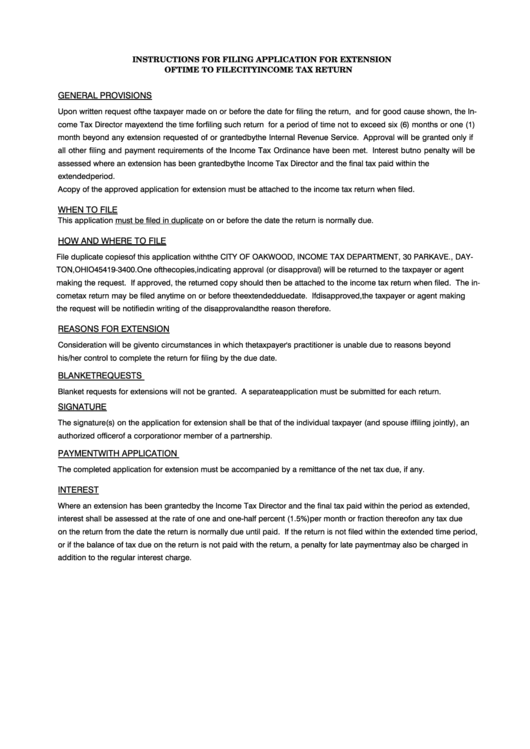

INSTRUCTIONS FOR FILING APPLICATION FOR EXTENSION

OF TIME TO FILE CITY INCOME TAX RETURN

GENERAL PROVISIONS

Upon written request of the taxpayer made on or before the date for filing the return, and for good cause shown, the In-

come Tax Director may extend the time for filing such return for a period of time not to exceed six (6) months or one (1)

month beyond any extension requested of or granted by the Internal Revenue Service. Approval will be granted only if

all other filing and payment requirements of the Income Tax Ordinance have been met. Interest but no penalty will be

assessed where an extension has been granted by the Income Tax Director and the final tax paid within the

extended period.

A copy of the approved application for extension must be attached to the income tax return when filed.

WHEN TO FILE

This application must be filed in duplicate on or before the date the return is normally due.

HOW AND WHERE TO FILE

File duplicate copies of this application with the CITY OF OAKWOOD, INCOME TAX DEPARTMENT, 30 PARK AVE., DAY-

TON, OHIO 45419-3400. One of the copies, indicating approval (or disapproval) will be returned to the taxpayer or agent

making the request. If approved, the returned copy should then be attached to the income tax return when filed. The in-

come tax return may be filed anytime on or before the extended due date. If disapproved, the taxpayer or agent making

the request will be notified in writing of the disapproval and the reason therefore.

REASONS FOR EXTENSION

Consideration will be given to circumstances in which the taxpayer's practitioner is unable due to reasons beyond

his/her control to complete the return for filing by the due date.

BLANKET REQUESTS

Blanket requests for extensions will not be granted. A separate application must be submitted for each return.

SIGNATURE

The signature(s) on the application for extension shall be that of the individual taxpayer (and spouse if filing jointly), an

authorized officer of a corporation or member of a partnership.

PAYMENT WITH APPLICATION

The completed application for extension must be accompanied by a remittance of the net tax due, if any.

INTEREST

Where an extension has been granted by the Income Tax Director and the final tax paid within the period as extended,

interest shall be assessed at the rate of one and one-half percent (1.5%) per month or fraction thereof on any tax due

on the return from the date the return is normally due until paid. If the return is not filed within the extended time period,

or if the balance of tax due on the return is not paid with the return, a penalty for late payment may also be charged in

addition to the regular interest charge.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1