State Form 1882 - Tax Return - Fixed Personal Property Of Public Utilities - 2008

ADVERTISEMENT

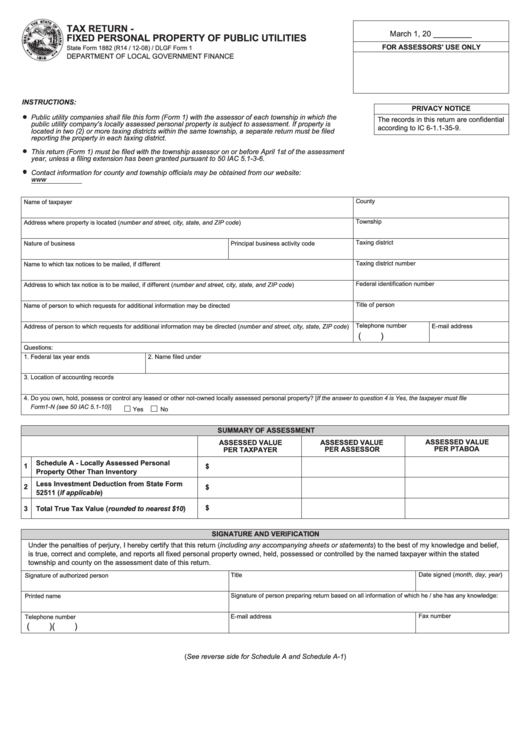

TAX RETURN -

March 1, 20 _________

FIXED PERSONAL PROPERTY OF PUBLIC UTILITIES

FOR ASSESSORS' USE ONLY

State Form 1882 (R14 / 12-08) / DLGF Form 1

DEPARTMENT OF LOCAL GOVERNMENT FINANCE

INSTRUCTIONS:

PRIVACY NOTICE

Public utility companies shall file this form (Form 1) with the assessor of each township in which the

The records in this return are confidential

public utility company's locally assessed personal property is subject to assessment. If property is

according to IC 6-1.1-35-9.

located in two (2) or more taxing districts within the same township, a separate return must be filed

reporting the property in each taxing district.

This return (Form 1) must be filed with the township assessor on or before April 1st of the assessment

year, unless a filing extension has been granted pursuant to 50 IAC 5.1-3-6.

Contact information for county and township officials may be obtained from our website:

County

Name of taxpayer

Township

Address where property is located (number and street, city, state, and ZIP code)

Taxing district

Nature of business

Principal business activity code

Taxing district number

Name to which tax notices to be mailed, if different

Federal identification number

Address to which tax notice is to be mailed, if different (number and street, city, state, and ZIP code)

Title of person

Name of person to which requests for additional information may be directed

Telephone number

Address of person to which requests for additional information may be directed (number and street, city, state, ZIP code)

E-mail address

(

)

Questions:

1. Federal tax year ends

2. Name filed under

3. Location of accounting records

4. Do you own, hold, possess or control any leased or other not-owned locally assessed personal property? [If the answer to question 4 is Yes, the taxpayer must file

Form1-N (see 50 IAC 5.1-10)]

Yes

No

SUMMARY OF ASSESSMENT

ASSESSED VALUE

ASSESSED VALUE

ASSESSED VALUE

PER PTABOA

PER ASSESSOR

PER TAXPAYER

Schedule A - Locally Assessed Personal

1

$

Property Other Than Inventory

Less Investment Deduction from State Form

2

$

52511 (if applicable)

$

3

Total True Tax Value (rounded to nearest $10)

SIGNATURE AND VERIFICATION

Under the penalties of perjury, I hereby certify that this return (including any accompanying sheets or statements) to the best of my knowledge and belief,

is true, correct and complete, and reports all fixed personal property owned, held, possessed or controlled by the named taxpayer within the stated

township and county on the assessment date of this return.

Date signed (month, day, year)

Title

Signature of authorized person

Signature of person preparing return based on all information of which he / she has any knowledge:

Printed name

Fax number

E-mail address

Telephone number

(

)

(

)

(See reverse side for Schedule A and Schedule A-1)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2