Form Dp-10 - Interest And Dividends Tax Instructions - New Hampshire Department Of Revenue Administration - 1999

ADVERTISEMENT

1999

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION

FORM

INTEREST AND DIVIDENDS TAX

DP-10

INSTRUCTIONS

Instructions

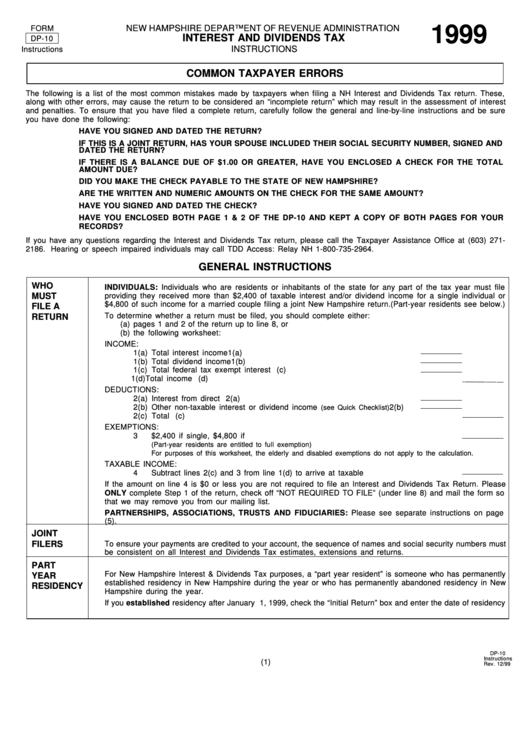

COMMON TAXPAYER ERRORS

The following is a list of the most common mistakes made by taxpayers when filing a NH Interest and Dividends Tax return. These,

along with other errors, may cause the return to be considered an “incomplete return” which may result in the assessment of interest

and penalties. To ensure that you have filed a complete return, carefully follow the general and line-by-line instructions and be sure

you have done the following:

HAVE YOU SIGNED AND DATED THE RETURN?

IF THIS IS A JOINT RETURN, HAS YOUR SPOUSE INCLUDED THEIR SOCIAL SECURITY NUMBER, SIGNED AND

DATED THE RETURN?

IF THERE IS A BALANCE DUE OF $1.00 OR GREATER, HAVE YOU ENCLOSED A CHECK FOR THE TOTAL

AMOUNT DUE?

DID YOU MAKE THE CHECK PAYABLE TO THE STATE OF NEW HAMPSHIRE?

ARE THE WRITTEN AND NUMERIC AMOUNTS ON THE CHECK FOR THE SAME AMOUNT?

HAVE YOU SIGNED AND DATED THE CHECK?

HAVE YOU ENCLOSED BOTH PAGE 1 & 2 OF THE DP-10 AND KEPT A COPY OF BOTH PAGES FOR YOUR

RECORDS?

If you have any questions regarding the Interest and Dividends Tax return, please call the Taxpayer Assistance Office at (603) 271-

2186. Hearing or speech impaired individuals may call TDD Access: Relay NH 1-800-735-2964.

GENERAL INSTRUCTIONS

WHO

INDIVIDUALS: Individuals who are residents or inhabitants of the state for any part of the tax year must file

MUST

providing they received more than $2,400 of taxable interest and/or dividend income for a single individual or

$4,800 of such income for a married couple filing a joint New Hampshire return.(Part-year residents see below.)

FILE A

To determine whether a return must be filed, you should complete either:

RETURN

(a) pages 1 and 2 of the return up to line 8, or

(b) the following worksheet:

INCOME:

1(a) Total interest income .................................................................................... 1(a)

1(b) Total dividend income .................................................................................. 1(b)

1(c) Total federal tax exempt interest income.............................................. 1(c)

1(d) Total income received............................................................................................. 1(d)

DEDUCTIONS:

2(a) Interest from direct U.S. Obligations .......................................................... 2(a)

2(b) Other non-taxable interest or dividend income

2(b)

(see Quick Checklist) .......

2(c) Total deductions.......................................................................................................2(c)

EXEMPTIONS:

3

$2,400 if single, $4,800 if married........................................................................... 3

(Part-year residents are entitled to full exemption)

For purposes of this worksheet, the elderly and disabled exemptions do not apply to the calculation.

TAXABLE INCOME:

4

Subtract lines 2(c) and 3 from line 1(d) to arrive at taxable income....................... 4

If the amount on line 4 is $0 or less you are not required to file an Interest and Dividends Tax Return. Please

ONLY complete Step 1 of the return, check off “NOT REQUIRED TO FILE” (under line 8) and mail the form so

that we may remove you from our mailing list.

PARTNERSHIPS, ASSOCIATIONS, TRUSTS AND FIDUCIARIES: Please see separate instructions on page

(5).

JOINT

FILERS

To ensure your payments are credited to your account, the sequence of names and social security numbers must

be consistent on all Interest and Dividends Tax estimates, extensions and returns.

PART

For New Hampshire Interest & Dividends Tax purposes, a “part year resident” is someone who has permanently

YEAR

established residency in New Hampshire during the year or who has permanently abandoned residency in New

RESIDENCY

Hampshire during the year.

If you established residency after January 1, 1999, check the “Initial Return” box and enter the date of residency

DP-10

Instructions

(1)

Rev. 12/99

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6