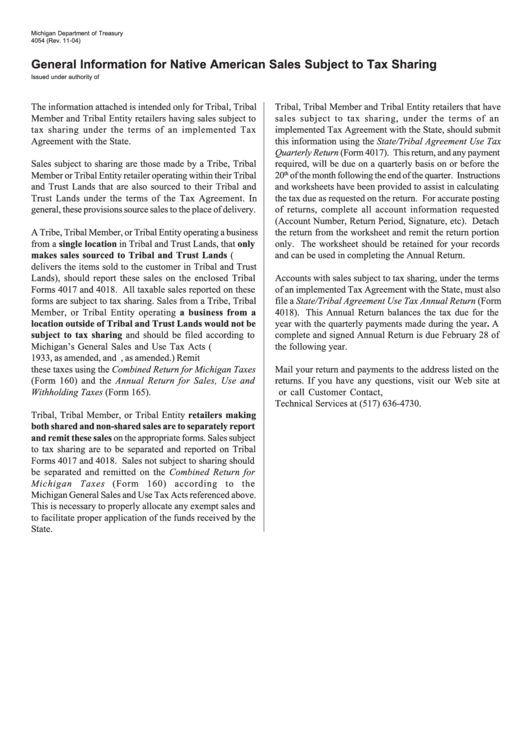

Form 4054 - General Information For Native American Sales Subject To Tax Sharing

ADVERTISEMENT

Michigan Department of Treasury

4054 (Rev. 11-04)

General Information for Native American Sales Subject to Tax Sharing

Issued under authority of P.A. 616 of 2002.

The information attached is intended only for Tribal, Tribal

Tribal, Tribal Member and Tribal Entity retailers that have

Member and Tribal Entity retailers having sales subject to

sales subject to tax sharing, under the terms of an

tax sharing under the terms of an implemented Tax

implemented Tax Agreement with the State, should submit

Agreement with the State.

this information using the State/Tribal Agreement Use Tax

Quarterly Return (Form 4017). This return, and any payment

Sales subject to sharing are those made by a Tribe, Tribal

required, will be due on a quarterly basis on or before the

Member or Tribal Entity retailer operating within their Tribal

20

th

of the month following the end of the quarter. Instructions

and Trust Lands that are also sourced to their Tribal and

and worksheets have been provided to assist in calculating

Trust Lands under the terms of the Tax Agreement. In

the tax due as requested on the return. For accurate posting

general, these provisions source sales to the place of delivery.

of returns, complete all account information requested

(Account Number, Return Period, Signature, etc). Detach

A Tribe, Tribal Member, or Tribal Entity operating a business

the return from the worksheet and remit the return portion

from a single location in Tribal and Trust Lands, that only

only. The worksheet should be retained for your records

makes sales sourced to Tribal and Trust Lands (e.g. it

and can be used in completing the Annual Return.

delivers the items sold to the customer in Tribal and Trust

Lands), should report these sales on the enclosed Tribal

Accounts with sales subject to tax sharing, under the terms

Forms 4017 and 4018. All taxable sales reported on these

of an implemented Tax Agreement with the State, must also

forms are subject to tax sharing. Sales from a Tribe, Tribal

file a State/Tribal Agreement Use Tax Annual Return (Form

Member, or Tribal Entity operating a business from a

4018). This Annual Return balances the tax due for the

location outside of Tribal and Trust Lands would not be

year with the quarterly payments made during the year. A

subject to tax sharing and should be filed according to

complete and signed Annual Return is due February 28 of

Michigan’s General Sales and Use Tax Acts (P.A. 167 of

the following year.

1933, as amended, and P.A. 94 of 1937, as amended.) Remit

these taxes using the Combined Return for Michigan Taxes

Mail your return and payments to the address listed on the

(Form 160) and the Annual Return for Sales, Use and

returns. If you have any questions, visit our Web site at

Withholding Taxes (Form 165).

or call Customer Contact,

Technical Services at (517) 636-4730.

Tribal, Tribal Member, or Tribal Entity retailers making

both shared and non-shared sales are to separately report

and remit these sales on the appropriate forms. Sales subject

to tax sharing are to be separated and reported on Tribal

Forms 4017 and 4018. Sales not subject to sharing should

be separated and remitted on the Combined Return for

Michigan Taxes (Form 160) according to the

Michigan General Sales and Use Tax Acts referenced above.

This is necessary to properly allocate any exempt sales and

to facilitate proper application of the funds received by the

State.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1