2010 Business License Renewal Form - City Of Alexandria

ADVERTISEMENT

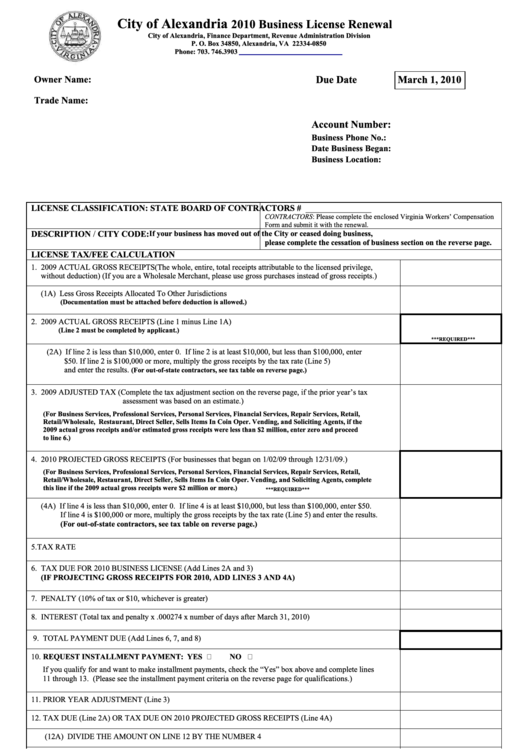

City of Alexandria

2010 Business License Renewal

City of Alexandria, Finance Department, Revenue Administration Division

P. O. Box 34850, Alexandria, VA 22334-0850

Phone: 703. 746.3903

March 1, 2010

Due Date

Owner Name:

Trade Name:

Account Number:

Business Phone No.:

Date Business Began:

Business Location:

LICENSE CLASSIFICATION:

STATE BOARD OF CONTRACTORS # _______________

CONTRACTORS: Please complete the enclosed Virginia Workers’ Compensation

Form and submit it with the renewal.

DESCRIPTION / CITY CODE:

If your business has moved out of the City or ceased doing business,

please complete the cessation of business section on the reverse page.

LICENSE TAX/FEE CALCULATION

1. 2009 ACTUAL GROSS RECEIPTS (The whole, entire, total receipts attributable to the licensed privilege,

without deduction) (If you are a Wholesale Merchant, please use gross purchases instead of gross receipts.)

(1A) Less Gross Receipts Allocated To Other Jurisdictions

(Documentation must be attached before deduction is allowed.)

2. 2009 ACTUAL GROSS RECEIPTS (Line 1 minus Line 1A)

(Line 2 must be completed by applicant.)

***REQUIRED***

(2A) If line 2 is less than $10,000, enter 0. If line 2 is at least $10,000, but less than $100,000, enter

$50. If line 2 is $100,000 or more, multiply the gross receipts by the tax rate (Line 5)

and enter the results.

(For out-of-state contractors, see tax table on reverse page.)

3. 2009 ADJUSTED TAX (Complete the tax adjustment section on the reverse page, if the prior year’s tax

assessment was based on an estimate.)

(For Business Services, Professional Services, Personal Services, Financial Services, Repair Services, Retail,

Retail/Wholesale, Restaurant, Direct Seller, Sells Items In Coin Oper. Vending, and Soliciting Agents, if the

2009 actual gross receipts and/or estimated gross receipts were less than $2 million, enter zero and proceed

to line 6.)

4. 2010 PROJECTED GROSS RECEIPTS (For businesses that began on 1/02/09 through 12/31/09.)

(For Business Services, Professional Services, Personal Services, Financial Services, Repair Services, Retail,

Retail/Wholesale, Restaurant, Direct Seller, Sells Items In Coin Oper. Vending, and Soliciting Agents, complete

this line if the 2009 actual gross receipts were $2 million or more.)

***REQUIRED***

(4A) If line 4 is less than $10,000, enter 0. If line 4 is at least $10,000, but less than $100,000, enter $50.

If line 4 is $100,000 or more, multiply the gross receipts by the tax rate (Line 5) and enter the results.

(For out-of-state contractors, see tax table on reverse page.)

5. TAX RATE

6. TAX DUE FOR 2010 BUSINESS LICENSE (Add Lines 2A and 3)

(IF PROJECTING GROSS RECEIPTS FOR 2010, ADD LINES 3 AND 4A)

7. PENALTY (10% of tax or $10, whichever is greater)

8. INTEREST (Total tax and penalty x .000274 x number of days after March 31, 2010)

9. TOTAL PAYMENT DUE (Add Lines 6, 7, and 8)

10. REQUEST INSTALLMENT PAYMENT: YES

NO

If you qualify for and want to make installment payments, check the “Yes” box above and complete lines

11 through 13. (Please see the installment payment criteria on the reverse page for qualifications.)

11. PRIOR YEAR ADJUSTMENT (Line 3)

12. TAX DUE (Line 2A) OR TAX DUE ON 2010 PROJECTED GROSS RECEIPTS (Line 4A)

(12A) DIVIDE THE AMOUNT ON LINE 12 BY THE NUMBER 4

13. FIRST INSTALLMENT PAYMENT DUE (Add Lines 11 and 12A)

Notice: It is a misdemeanor for any person to willfully complete an application, which he/she does not believe to be true and correct as to every material matter (Code

of Virginia §58.1-11). Operating a business without a license is a criminal offense punishable up to a five hundred dollar ($500) fine for each separate offense. A

license shall not be issued or have any legal effect unless all delinquent business license, business personal property, meal sales and transient lodging taxes are paid in

full. The Business license is valid only for the person named herein and is not transferable.

___________________________________________

____________________

___________________________________

______________

APPLICANT’S SIGNATURE

DATE

PREPARER’S SIGNATURE

DATE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2