Instructions For Form 945 - Annual Return Of Withheld Federal Income Tax - 2004

ADVERTISEMENT

04

2 0

Department of the Treasury

Internal Revenue Service

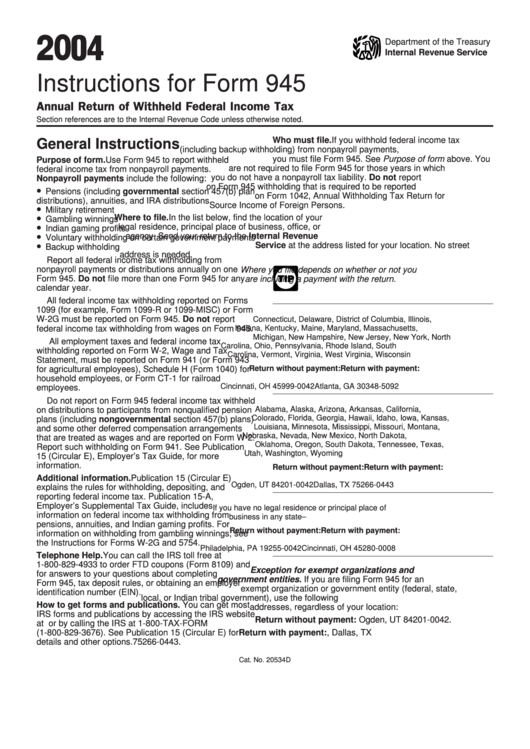

Instructions for Form 945

Annual Return of Withheld Federal Income Tax

Section references are to the Internal Revenue Code unless otherwise noted.

Who must file. If you withhold federal income tax

General Instructions

(including backup withholding) from nonpayroll payments,

you must file Form 945. See Purpose of form above. You

Purpose of form. Use Form 945 to report withheld

are not required to file Form 945 for those years in which

federal income tax from nonpayroll payments.

you do not have a nonpayroll tax liability. Do not report

Nonpayroll payments include the following:

on Form 945 withholding that is required to be reported

•

Pensions (including governmental section 457(b) plan

on Form 1042, Annual Withholding Tax Return for U.S.

distributions), annuities, and IRA distributions

Source Income of Foreign Persons.

•

Military retirement

•

Where to file. In the list below, find the location of your

Gambling winnings

•

legal residence, principal place of business, office, or

Indian gaming profits

•

agency. Send your return to the Internal Revenue

Voluntary withholding on certain government payments

•

Service at the address listed for your location. No street

Backup withholding

address is needed.

Report all federal income tax withholding from

nonpayroll payments or distributions annually on one

Where you file depends on whether or not you

Form 945. Do not file more than one Form 945 for any

TIP

are including a payment with the return.

calendar year.

All federal income tax withholding reported on Forms

1099 (for example, Form 1099-R or 1099-MISC) or Form

W-2G must be reported on Form 945. Do not report

Connecticut, Delaware, District of Columbia, Illinois,

federal income tax withholding from wages on Form 945.

Indiana, Kentucky, Maine, Maryland, Massachusetts,

Michigan, New Hampshire, New Jersey, New York, North

All employment taxes and federal income tax

Carolina, Ohio, Pennsylvania, Rhode Island, South

withholding reported on Form W-2, Wage and Tax

Carolina, Vermont, Virginia, West Virginia, Wisconsin

Statement, must be reported on Form 941 (or Form 943

Return without payment:

Return with payment:

for agricultural employees), Schedule H (Form 1040) for

P.O. Box 105092

household employees, or Form CT-1 for railroad

Cincinnati, OH 45999-0042

Atlanta, GA 30348-5092

employees.

Do not report on Form 945 federal income tax withheld

Alabama, Alaska, Arizona, Arkansas, California,

on distributions to participants from nonqualified pension

Colorado, Florida, Georgia, Hawaii, Idaho, Iowa, Kansas,

plans (including nongovernmental section 457(b) plans)

Louisiana, Minnesota, Mississippi, Missouri, Montana,

and some other deferred compensation arrangements

Nebraska, Nevada, New Mexico, North Dakota,

that are treated as wages and are reported on Form W-2.

Oklahoma, Oregon, South Dakota, Tennessee, Texas,

Report such withholding on Form 941. See Publication

Utah, Washington, Wyoming

15 (Circular E), Employer’s Tax Guide, for more

information.

Return without payment:

Return with payment:

P.O. Box 660443

Additional information. Publication 15 (Circular E)

Ogden, UT 84201-0042

Dallas, TX 75266-0443

explains the rules for withholding, depositing, and

reporting federal income tax. Publication 15-A,

Employer’s Supplemental Tax Guide, includes

If you have no legal residence or principal place of

information on federal income tax withholding from

business in any state –

pensions, annuities, and Indian gaming profits. For

Return without payment:

Return with payment:

information on withholding from gambling winnings, see

P.O. Box 80108

the Instructions for Forms W-2G and 5754.

Philadelphia, PA 19255-0042

Cincinnati, OH 45280-0008

Telephone Help. You can call the IRS toll free at

1-800-829-4933 to order FTD coupons (Form 8109) and

Exception for exempt organizations and

for answers to your questions about completing

government entities. If you are filing Form 945 for an

Form 945, tax deposit rules, or obtaining an employer

exempt organization or government entity (federal, state,

identification number (EIN).

local, or Indian tribal government), use the following

How to get forms and publications. You can get most

addresses, regardless of your location:

IRS forms and publications by accessing the IRS website

Return without payment: Ogden, UT 84201-0042.

at or by calling the IRS at 1-800-TAX-FORM

(1-800-829-3676). See Publication 15 (Circular E) for

Return with payment: P.O. Box 660443, Dallas, TX

details and other options.

75266-0443.

Cat. No. 20534D

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4