Instructions For Form 945 - Annual Return Of Withheld Federal Income Tax - 2001

ADVERTISEMENT

01

2 0

Department of the Treasury

Internal Revenue Service

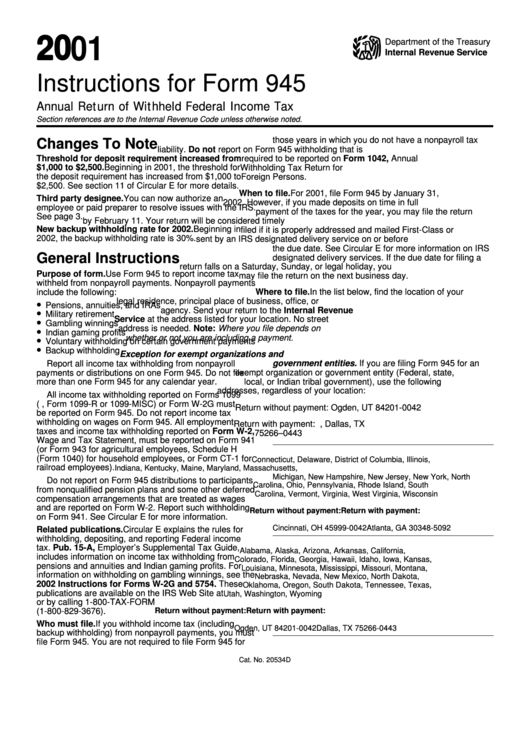

Instructions for Form 945

Annual Return of Withheld Federal Income Tax

Section references are to the Internal Revenue Code unless otherwise noted.

those years in which you do not have a nonpayroll tax

Changes To Note

liability. Do not report on Form 945 withholding that is

Threshold for deposit requirement increased from

required to be reported on Form 1042, Annual

$1,000 to $2,500. Beginning in 2001, the threshold for

Withholding Tax Return for U.S. Source Income of

the deposit requirement has increased from $1,000 to

Foreign Persons.

$2,500. See section 11 of Circular E for more details.

When to file. For 2001, file Form 945 by January 31,

Third party designee. You can now authorize an

2002. However, if you made deposits on time in full

employee or paid preparer to resolve issues with the IRS.

payment of the taxes for the year, you may file the return

See page 3.

by February 11. Your return will be considered timely

New backup withholding rate for 2002. Beginning in

filed if it is properly addressed and mailed First-Class or

2002, the backup withholding rate is 30%.

sent by an IRS designated delivery service on or before

the due date. See Circular E for more information on IRS

General Instructions

designated delivery services. If the due date for filing a

return falls on a Saturday, Sunday, or legal holiday, you

Purpose of form. Use Form 945 to report income tax

may file the return on the next business day.

withheld from nonpayroll payments. Nonpayroll payments

include the following:

Where to file. In the list below, find the location of your

•

legal residence, principal place of business, office, or

Pensions, annuities, and IRAs

•

agency. Send your return to the Internal Revenue

Military retirement

•

Service at the address listed for your location. No street

Gambling winnings

•

address is needed. Note: Where you file depends on

Indian gaming profits

•

whether or not you are including a payment.

Voluntary withholding on certain government payments

•

Backup withholding

Exception for exempt organizations and

government entities. If you are filing Form 945 for an

Report all income tax withholding from nonpayroll

payments or distributions on one Form 945. Do not file

exempt organization or government entity (Federal, state,

local, or Indian tribal government), use the following

more than one Form 945 for any calendar year.

addresses, regardless of your location:

All income tax withholding reported on Forms 1099

(e.g., Form 1099-R or 1099-MISC) or Form W-2G must

Return without payment: Ogden, UT 84201-0042

be reported on Form 945. Do not report income tax

withholding on wages on Form 945. All employment

Return with payment: P.O. Box 660443, Dallas, TX

taxes and income tax withholding reported on Form W-2,

75266 –0443

Wage and Tax Statement, must be reported on Form 941

(or Form 943 for agricultural employees, Schedule H

(Form 1040) for household employees, or Form CT-1 for

Connecticut, Delaware, District of Columbia, Illinois,

railroad employees).

Indiana, Kentucky, Maine, Maryland, Massachusetts,

Michigan, New Hampshire, New Jersey, New York, North

Do not report on Form 945 distributions to participants

Carolina, Ohio, Pennsylvania, Rhode Island, South

from nonqualified pension plans and some other deferred

Carolina, Vermont, Virginia, West Virginia, Wisconsin

compensation arrangements that are treated as wages

and are reported on Form W-2. Report such withholding

Return without payment:

Return with payment:

on Form 941. See Circular E for more information.

P.O. Box 105092

Cincinnati, OH 45999-0042

Atlanta, GA 30348-5092

Related publications. Circular E explains the rules for

withholding, depositing, and reporting Federal income

tax. Pub. 15-A, Employer’s Supplemental Tax Guide,

Alabama, Alaska, Arizona, Arkansas, California,

includes information on income tax withholding from

Colorado, Florida, Georgia, Hawaii, Idaho, Iowa, Kansas,

pensions and annuities and Indian gaming profits. For

Louisiana, Minnesota, Mississippi, Missouri, Montana,

information on withholding on gambling winnings, see the

Nebraska, Nevada, New Mexico, North Dakota,

2002 Instructions for Forms W-2G and 5754. These

Oklahoma, Oregon, South Dakota, Tennessee, Texas,

publications are available on the IRS Web Site at

Utah, Washington, Wyoming

or by calling 1-800-TAX-FORM

Return without payment:

Return with payment:

(1-800-829-3676).

P.O. Box 660443

Who must file. If you withhold income tax (including

Ogden, UT 84201-0042

Dallas, TX 75266-0443

backup withholding) from nonpayroll payments, you must

file Form 945. You are not required to file Form 945 for

Cat. No. 20534D

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4