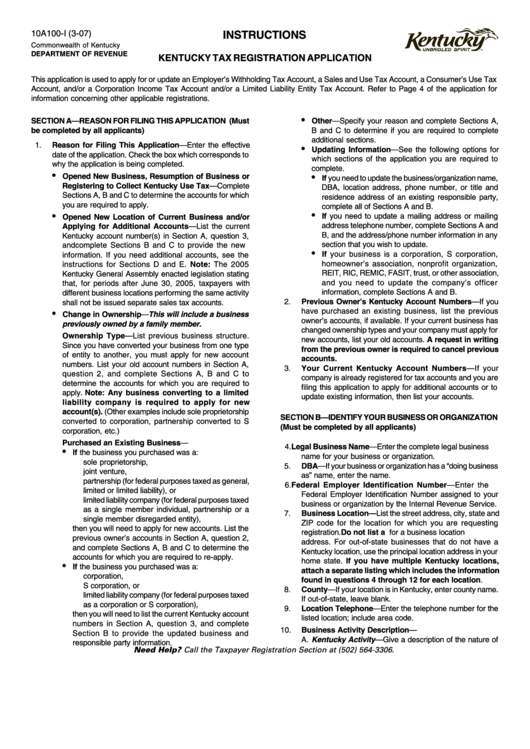

Form 10a100-I - Instructions For Kentucky Tax Registration Application - Commonwealth Of Kentucky Department Of Revenue

ADVERTISEMENT

10A100-I (3-07)

INSTRUCTIONS

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

KENTUCKY TAX REGISTRATION APPLICATION

This application is used to apply for or update an Employer’s Withholding Tax Account, a Sales and Use Tax Account, a Consumer’s Use Tax

Account, and/or a Corporation Income Tax Account and/or a Limited Liability Entity Tax Account. Refer to Page 4 of the application for

information concerning other applicable registrations.

•

SECTION A—REASON FOR FILING THIS APPLICATION (Must

Other—Specify your reason and complete Sections A,

be completed by all applicants)

B and C to determine if you are required to complete

additional sections.

1.

Reason for Filing This Application—Enter the effective

•

Updating Information—See the following options for

date of the application. Check the box which corresponds to

which sections of the application you are required to

why the application is being completed.

complete.

•

Opened New Business, Resumption of Business or

•

If you need to update the business/organization name,

Registering to Collect Kentucky Use Tax—Complete

DBA, location address, phone number, or title and

Sections A, B and C to determine the accounts for which

residence address of an existing responsible party,

you are required to apply.

complete all of Sections A and B.

•

•

If you need to update a mailing address or mailing

Opened New Location of Current Business and/or

address telephone number, complete Sections A and

Applying for Additional Accounts—List the current

B, and the address/phone number information in any

Kentucky account number(s) in Section A, question 3,

section that you wish to update.

and complete Sections B and C to provide the new

•

If your business is a corporation, S corporation,

information. If you need additional accounts, see the

homeowner’s association, nonprofit organization,

instructions for Sections D and E. Note: The 2005

REIT, RIC, REMIC, FASIT, trust, or other association,

Kentucky General Assembly enacted legislation stating

and you need to update the company’s officer

that, for periods after June 30, 2005, taxpayers with

information, complete Sections A and B.

different business locations performing the same activity

2.

Previous Owner’s Kentucky Account Numbers—If you

shall not be issued separate sales tax accounts.

have purchased an existing business, list the previous

•

Change in Ownership— This will include a business

owner’s accounts, if available. If your current business has

previously owned by a family member.

changed ownership types and your company must apply for

Ownership Type—List previous business structure.

new accounts, list your old accounts. A request in writing

Since you have converted your business from one type

from the previous owner is required to cancel previous

of entity to another, you must apply for new account

accounts.

numbers. List your old account numbers in Section A,

3.

Your Current Kentucky Account Numbers—If your

question 2, and complete Sections A, B and C to

company is already registered for tax accounts and you are

determine the accounts for which you are required to

filing this application to apply for additional accounts or to

apply. Note: Any business converting to a limited

update existing information, then list your accounts.

liability company is required to apply for new

account(s). (Other examples include sole proprietorship

SECTION B—IDENTIFY YOUR BUSINESS OR ORGANIZATION

converted to corporation, partnership converted to S

(Must be completed by all applicants)

corporation, etc.)

Purchased an Existing Business—

4.

Legal Business Name—Enter the complete legal business

•

If the business you purchased was a:

name for your business or organization.

sole proprietorship,

5.

DBA—If your business or organization has a “doing business

joint venture,

as” name, enter the name.

partnership (for federal purposes taxed as general,

6.

Federal Employer Identification Number—Enter the

limited or limited liability), or

Federal Employer Identification Number assigned to your

limited liability company (for federal purposes taxed

business or organization by the Internal Revenue Service.

as a single member individual, partnership or a

7.

Business Location—List the street address, city, state and

single member disregarded entity),

ZIP code for the location for which you are requesting

then you will need to apply for new accounts. List the

registration. Do not list a P.O. Box for a business location

previous owner’s accounts in Section A, question 2,

address. For out-of-state businesses that do not have a

and complete Sections A, B and C to determine the

Kentucky location, use the principal location address in your

accounts for which you are required to re-apply.

home state. If you have multiple Kentucky locations,

•

If the business you purchased was a:

attach a separate listing which includes the information

corporation,

found in questions 4 through 12 for each location.

S corporation, or

8.

County—If your location is in Kentucky, enter county name.

limited liability company (for federal purposes taxed

If out-of-state, leave blank.

as a corporation or S corporation),

9.

Location Telephone—Enter the telephone number for the

then you will need to list the current Kentucky account

listed location; include area code.

numbers in Section A, question 3, and complete

10.

Business Activity Description—

Section B to provide the updated business and

A. Kentucky Activity —Give a description of the nature of

responsible party information.

Need Help? Call the Taxpayer Registration Section at (502) 564-3306.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4