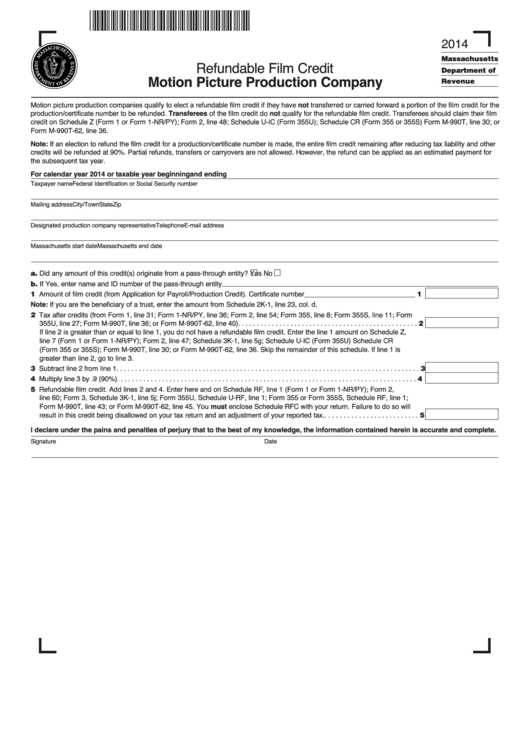

Refundable Film Credit Form Motion Picture Production Company - 2014

ADVERTISEMENT

2014

Massachusetts

Refundable Film Credit

Department of

Motion Picture Production Company

Revenue

Motion picture production companies qualify to elect a refundable film credit if they have not transferred or carried forward a portion of the film credit for the

production/certificate number to be refunded. Transferees of the film credit do not qualify for the refundable film credit. Transferees should claim their film

credit on Schedule Z (Form 1 or Form 1-NR/PY); Form 2, line 48; Schedule U-IC (Form 355U); Schedule CR (Form 355 or 355S) Form M-990T, line 30; or

Form M-990T-62, line 36.

Note: If an election to refund the film credit for a production/certificate number is made, the entire film credit remaining after reducing tax liability and other

credits will be refunded at 90%. Partial refunds, transfers or carryovers are not allowed. However, the refund can be applied as an estimated payment for

the subsequent tax year.

For calendar year 2014 or taxable year beginning

and ending

Taxpayer name

Federal Identification or Social Security number

Mailing address

City/Town

State

Zip

Designated production company representative

Telephone

E-mail address

Massachusetts start date

Massachusetts end date

a. Did any amount of this credit(s) originate from a pass-through entity?

Yes

No

b. If Yes, enter name and ID number of the pass-through entity

1 Amount of film credit (from Application for Payroll/Production Credit). Certificate number _____________________________ 1

Note: If you are the beneficiary of a trust, enter the amount from Schedule 2K-1, line 23, col. d.

2 Tax after credits (from Form 1, line 31; Form 1-NR/PY, line 36; Form 2, line 54; Form 355, line 8; Form 355S, line 11; Form

355U, line 27; Form M-990T, line 36; or Form M-990T-62, line 40) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

If line 2 is greater than or equal to line 1, you do not have a refundable film credit. Enter the line 1 amount on Schedule Z,

line 7 (Form 1 or Form 1-NR/PY); Form 2, line 47; Schedule 3K-1, line 5g; Schedule U-IC (Form 355U) Schedule CR

(Form 355 or 355S); Form M-990T, line 30; or Form M-990T-62, line 36. Skip the remainder of this schedule. If line 1 is

greater than line 2, go to line 3.

3 Subtract line 2 from line 1. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Multiply line 3 by .9 (90%) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

5 Refundable film credit. Add lines 2 and 4. Enter here and on Schedule RF, line 1 (Form 1 or Form 1-NR/PY); Form 2,

line 60; Form 3, Schedule 3K-1, line 5j; Form 355U, Schedule U-RF, line 1; Form 355 or Form 355S, Schedule RF, line 1;

Form M-990T, line 43; or Form M-990T-62, line 45. You must enclose Schedule RFC with your return. Failure to do so will

result in this credit being disallowed on your tax return and an adjustment of your reported tax. . . . . . . . . . . . . . . . . . . . . . . . . . 5

I declare under the pains and penalties of perjury that to the best of my knowledge, the information contained herein is accurate and complete.

Signature

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1