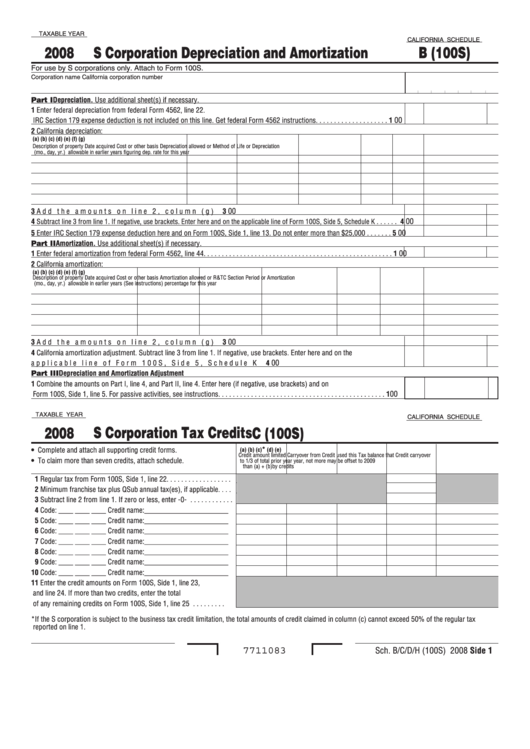

TAXABLE YEAR

CALIFORNIA SCHEDULE

S Corporation Depreciation and Amortization

B (100S)

2008

For use by S corporations only. Attach to Form 100S.

Corporation name

California corporation number

Part I Depreciation. Use additional sheet(s) if necessary.

� Enter federal depreciation from federal Form 4562, line 22.

00

IRC Section 179 expense deduction is not included on this line. Get federal Form 4562 instructions . . . . . . . . . . . . . . . . . . . .

�

2 California depreciation:

(a)

(b)

(c)

(d)

(e)

(f)

(g)

Description of property

Date acquired

Cost or other basis

Depreciation allowed or

Method of

Life or

Depreciation

(mo., day, yr.)

allowable in earlier years

figuring dep.

rate

for this year

00

3 Add the amounts on line 2, column (g) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

00

4

. . . . . .

4

Subtract line 3 from line 1. If negative, use brackets. Enter here and on the applicable line of Form 100S, Side 5, Schedule K

00

5 Enter IRC Section 179 expense deduction here and on Form 100S, Side 1, line 13. Do not enter more than $25,000 . . . . . . .

5

Part II Amortization. Use additional sheet(s) if necessary.

� Enter federal amortization from federal Form 4562, line 44 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

�

00

2 California amortization:

(a)

(b)

(c)

(d)

(e)

(f)

(g)

Description of property

Date acquired

Cost or other basis

Amortization allowed or

R&TC Section

Period or

Amortization

(mo., day, yr.)

allowable in earlier years

(See instructions)

percentage

for this year

00

3 Add the amounts on line 2, column (g) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

4 California amortization adjustment. Subtract line 3 from line 1. If negative, use brackets. Enter here and on the

00

applicable line of Form 100S, Side 5, Schedule K . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

Part III Depreciation and Amortization Adjustment

�

Combine the amounts on Part I, line 4, and Part II, line 4. Enter here (if negative, use brackets) and on

00

Form 100S, Side 1, line 5. For passive activities, see instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

�

TAXABLE YEAR

CALIFORNIA SCHEDULE

S Corporation Tax Credits

2008

C (100S)

*

• Complete and attach all supporting credit forms.

(a)

(b)

(c)

(d)

(e)

Credit amount limited

Carryover from

Credit used this

Tax balance that

Credit carryover

• To claim more than seven credits, attach schedule.

to 1/3 of total

prior year

year, not more

may be offset

to 2009

than (a) + (b)

by credits

� Regular tax from Form 100S, Side 1, line 22 . . . . . . . . . . . . . . . . . .

2 Minimum franchise tax plus QSub annual tax(es), if applicable. . . .

3 Subtract line 2 from line 1. If zero or less, enter -0- . . . . . . . . . . . .

4 Code: ____ ____ ____ Credit name:_______________________

5 Code: ____ ____ ____ Credit name:_______________________

6 Code: ____ ____ ____ Credit name:_______________________

7 Code: ____ ____ ____ Credit name:_______________________

8 Code: ____ ____ ____ Credit name:_______________________

9 Code: ____ ____ ____ Credit name:_______________________

�0 Code: ____ ____ ____ Credit name:_______________________

�� Enter the credit amounts on Form 100S, Side 1, line 23,

and line 24. If more than two credits, enter the total

of any remaining credits on Form 100S, Side 1, line 25 . . . . . . . . .

*If the S corporation is subject to the business tax credit limitation, the total amounts of credit claimed in column (c) cannot exceed 50% of the regular tax

reported on line 1.

Sch. B/C/D/H (100S) 2008 Side �

7711083

1

1