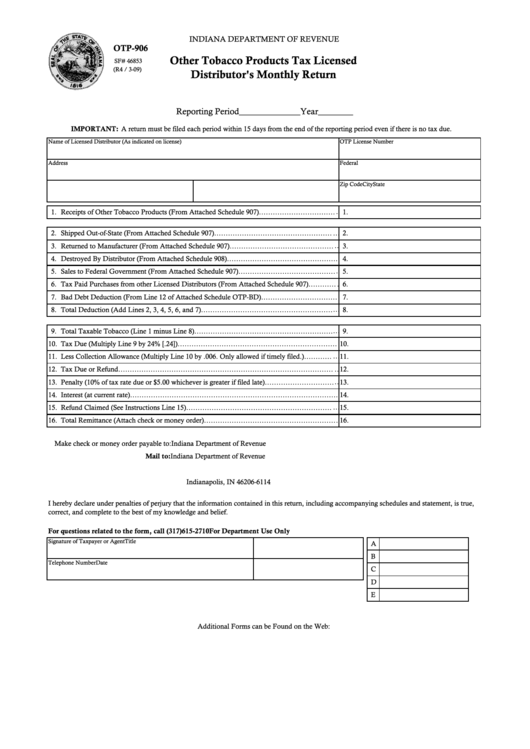

INDIANA DEPARTMENT OF REVENUE

OTP-906

Other Tobacco Products Tax Licensed

SF# 46853

(R4 / 3-09)

Distributor's Monthly Return

Reporting Period______________Year________

IMPORTANT: A return must be filed each period within 15 days from the end of the reporting period even if there is no tax due.

Name of Licensed Distributor (As indicated on license)

OTP License Number

Address

Federal I.D. Number or SSN

City

State

Zip Code

1.

Receipts of Other Tobacco Products (From Attached Schedule 907)………………………………

1.

2.

Shipped Out-of-State (From Attached Schedule 907)………………………………………………

2.

3.

Returned to Manufacturer (From Attached Schedule 907)…………………………………………

3.

4.

Destroyed By Distributor (From Attached Schedule 908)…………………………………………

4.

5.

Sales to Federal Government (From Attached Schedule 907)………………………………………

5.

6.

Tax Paid Purchases from other Licensed Distributors (From Attached Schedule 907)……………

6.

7.

Bad Debt Deduction (From Line 12 of Attached Schedule OTP-BD)……………………………

7.

8.

Total Deduction (Add Lines 2, 3, 4, 5, 6, and 7)……………………………………………………

8.

9.

Total Taxable Tobacco (Line 1 minus Line 8)………………………………………………………

9.

10.

Tax Due (Multiply Line 9 by 24% [.24])……………………………………………………………

10.

11.

Less Collection Allowance (Multiply Line 10 by .006. Only allowed if timely filed.)……………

11.

12.

Tax Due or Refund……………………………………………………………………………………

12.

13.

Penalty (10% of tax rate due or $5.00 whichever is greater if filed late)……………………………

13.

14.

Interest (at current rate)………………………………………………………………………………

14.

15.

Refund Claimed (See Instructions Line 15)…………………………………………………………

15.

16.

Total Remittance (Attach check or money order)…………………………………………………… 16.

Make check or money order payable to:

Indiana Department of Revenue

Indiana Department of Revenue

Mail to:

P.O. Box 6114

Indianapolis, IN 46206-6114

I hereby declare under penalties of perjury that the information contained in this return, including accompanying schedules and statement, is true,

correct, and complete to the best of my knowledge and belief.

For questions related to the form, call (317)615-2710

For Department Use Only

Signature of Taxpayer or Agent

Title

A

B

Telephone Number

Date

C

D

E

Additional Forms can be Found on the Web:

1

1 2

2