3

Form 3520-A (2006)

Page

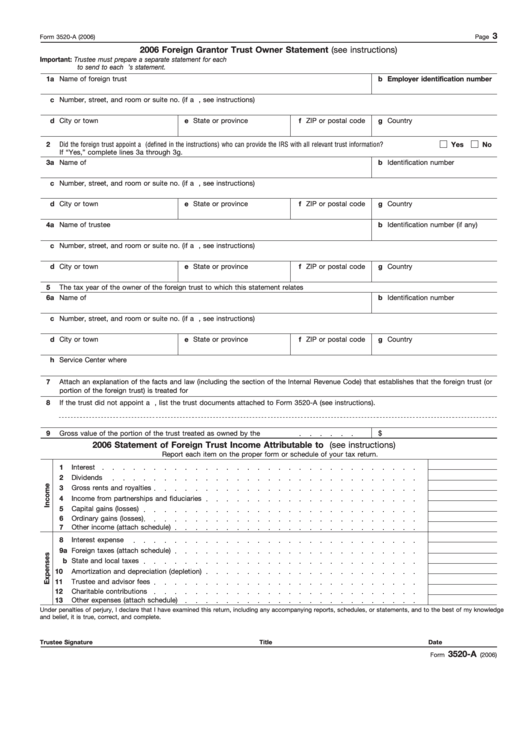

2006 Foreign Grantor Trust Owner Statement (see instructions)

Important: Trustee must prepare a separate statement for each U.S. owner and include a copy of each statement with Form 3520-A. Trustee is also required

to send to each U.S. owner a copy of the owner’s statement. U.S. owner must attach a copy of its statement to Form 3520.

1a Name of foreign trust

b Employer identification number

c Number, street, and room or suite no. (if a P.O. box, see instructions)

d City or town

e State or province

f ZIP or postal code

g Country

2

Did the foreign trust appoint a U.S. agent (defined in the instructions) who can provide the IRS with all relevant trust information?

Yes

No

If “Yes,” complete lines 3a through 3g.

3a Name of U.S. agent

b Identification number

c Number, street, and room or suite no. (if a P.O. box, see instructions)

d City or town

e State or province

f ZIP or postal code

g Country

4a Name of trustee

b Identification number (if any)

c Number, street, and room or suite no. (if a P.O. box, see instructions)

d City or town

e State or province

f ZIP or postal code

g Country

5

The tax year of the owner of the foreign trust to which this statement relates

6a Name of U.S. owner

b Identification number

c Number, street, and room or suite no. (if a P.O. box, see instructions)

d City or town

e State or province

f ZIP or postal code

g Country

h Service Center where U.S. owner files its income tax returns

7

Attach an explanation of the facts and law (including the section of the Internal Revenue Code) that establishes that the foreign trust (or

portion of the foreign trust) is treated for U.S. tax principles as owned by the U.S. person.

8

If the trust did not appoint a U.S. agent, list the trust documents attached to Form 3520-A (see instructions).

9

Gross value of the portion of the trust treated as owned by the U.S. owner

$

2006 Statement of Foreign Trust Income Attributable to U.S. Owner (see instructions)

Report each item on the proper form or schedule of your tax return.

1

Interest

2

Dividends

3

Gross rents and royalties

4

Income from partnerships and fiduciaries

5

Capital gains (losses)

6

Ordinary gains (losses)

7

Other income (attach schedule)

8

Interest expense

9a Foreign taxes (attach schedule)

b State and local taxes

10

Amortization and depreciation (depletion)

11

Trustee and advisor fees

12

Charitable contributions

13

Other expenses (attach schedule)

Under penalties of perjury, I declare that I have examined this return, including any accompanying reports, schedules, or statements, and to the best of my knowledge

and belief, it is true, correct, and complete.

Trustee Signature

Title

Date

3520-A

Form

(2006)

1

1