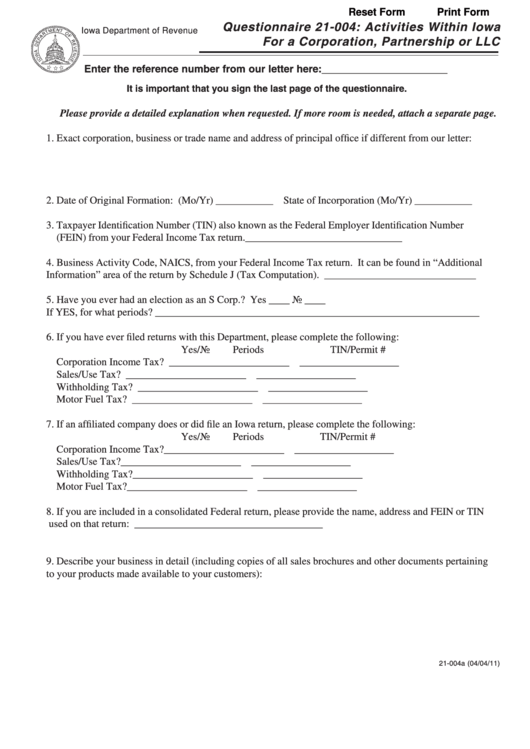

Reset Form

Print Form

Questionnaire 21-004: Activities Within Iowa

Iowa Department of Revenue

For a Corporation, Partnership or LLC

Enter the reference number from our letter here:______________________

It is important that you sign the last page of the questionnaire.

Please provide a detailed explanation when requested. If more room is needed, attach a separate page.

1. Exact corporation, business or trade name and address of principal office if different from our letter:

2. Date of Original Formation: (Mo/Yr) ___________ State of Incorporation (Mo/Yr) ___________

3. Taxpayer Identification Number (TIN) also known as the Federal Employer Identification Number

(FEIN) from your Federal Income Tax return.______________________________

4. Business Activity Code, NAICS, from your Federal Income Tax return. It can be found in “Additional

Information” area of the return by Schedule J (Tax Computation). _____________________________

5. Have you ever had an election as an S Corp.? Yes ____ No ____

If YES, for what periods? ______________________________________________________________

6. If you have ever filed returns with this Department, please complete the following:

Yes/No

Periods

TIN/Permit #

Corporation Income Tax?

_____

__________________

___________________

Sales/Use Tax?

_____

__________________

___________________

Withholding Tax?

_____

__________________

___________________

Motor Fuel Tax?

_____

__________________

___________________

7. If an affiliated company does or did file an Iowa return, please complete the following:

Yes/No

Periods

TIN/Permit #

Corporation Income Tax?

_____

__________________

___________________

Sales/Use Tax?

_____

__________________

___________________

Withholding Tax?

_____

__________________

___________________

Motor Fuel Tax?

_____

__________________

___________________

8. If you are included in a consolidated Federal return, please provide the name, address and FEIN or TIN

used on that return: ____________________________________

9. Describe your business in detail (including copies of all sales brochures and other documents pertaining

to your products made available to your customers):

21-004a (04/04/11)

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9