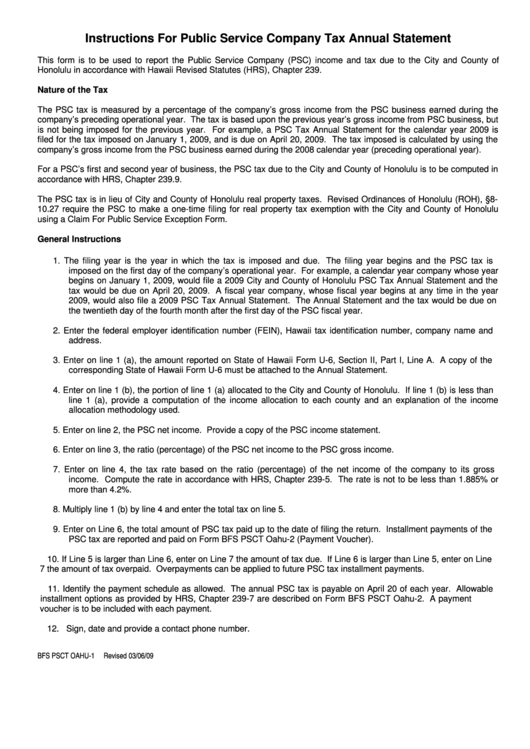

Instructions For Public Service Company Tax Annual Statement

ADVERTISEMENT

Instructions For Public Service Company Tax Annual Statement

This form is to be used to report the Public Service Company (PSC) income and tax due to the City and County of

Honolulu in accordance with Hawaii Revised Statutes (HRS), Chapter 239.

Nature of the Tax

The PSC tax is measured by a percentage of the company’s gross income from the PSC business earned during the

company’s preceding operational year. The tax is based upon the previous year’s gross income from PSC business, but

is not being imposed for the previous year. For example, a PSC Tax Annual Statement for the calendar year 2009 is

filed for the tax imposed on January 1, 2009, and is due on April 20, 2009. The tax imposed is calculated by using the

company’s gross income from the PSC business earned during the 2008 calendar year (preceding operational year).

For a PSC’s first and second year of business, the PSC tax due to the City and County of Honolulu is to be computed in

accordance with HRS, Chapter 239.9.

The PSC tax is in lieu of City and County of Honolulu real property taxes. Revised Ordinances of Honolulu (ROH), §8-

10.27 require the PSC to make a one-time filing for real property tax exemption with the City and County of Honolulu

using a Claim For Public Service Exception Form.

General Instructions

1. The filing year is the year in which the tax is imposed and due. The filing year begins and the PSC tax is

imposed on the first day of the company’s operational year. For example, a calendar year company whose year

begins on January 1, 2009, would file a 2009 City and County of Honolulu PSC Tax Annual Statement and the

tax would be due on April 20, 2009. A fiscal year company, whose fiscal year begins at any time in the year

2009, would also file a 2009 PSC Tax Annual Statement. The Annual Statement and the tax would be due on

the twentieth day of the fourth month after the first day of the PSC fiscal year.

2. Enter the federal employer identification number (FEIN), Hawaii tax identification number, company name and

address.

3. Enter on line 1 (a), the amount reported on State of Hawaii Form U-6, Section II, Part I, Line A. A copy of the

corresponding State of Hawaii Form U-6 must be attached to the Annual Statement.

4. Enter on line 1 (b), the portion of line 1 (a) allocated to the City and County of Honolulu. If line 1 (b) is less than

line 1 (a), provide a computation of the income allocation to each county and an explanation of the income

allocation methodology used.

5. Enter on line 2, the PSC net income. Provide a copy of the PSC income statement.

6. Enter on line 3, the ratio (percentage) of the PSC net income to the PSC gross income.

7. Enter on line 4, the tax rate based on the ratio (percentage) of the net income of the company to its gross

income. Compute the rate in accordance with HRS, Chapter 239-5. The rate is not to be less than 1.885% or

more than 4.2%.

8. Multiply line 1 (b) by line 4 and enter the total tax on line 5.

9. Enter on Line 6, the total amount of PSC tax paid up to the date of filing the return. Installment payments of the

PSC tax are reported and paid on Form BFS PSCT Oahu-2 (Payment Voucher).

10. If Line 5 is larger than Line 6, enter on Line 7 the amount of tax due. If Line 6 is larger than Line 5, enter on Line

7 the amount of tax overpaid. Overpayments can be applied to future PSC tax installment payments.

11. Identify the payment schedule as allowed. The annual PSC tax is payable on April 20 of each year. Allowable

installment options as provided by HRS, Chapter 239-7 are described on Form BFS PSCT Oahu-2. A payment

voucher is to be included with each payment.

12. Sign, date and provide a contact phone number.

BFS PSCT OAHU-1

Revised 03/06/09

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2