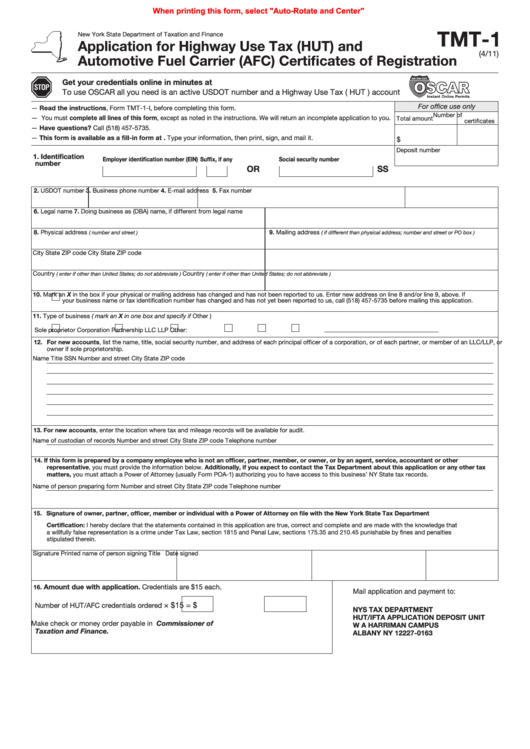

When printing this form, select "Auto-Rotate and Center"

TMT-1

New York State Department of Taxation and Finance

Application for Highway Use Tax (HUT) and

(4/11)

Automotive Fuel Carrier (AFC) Certificates of Registration

Get your credentials online in minutes at

To use OSCAR all you need is an active USDOT number and a Highway Use Tax ( HUT ) account

For office use only

— Read the instructions, Form TMT-1-I, before completing this form.

Number of

— You must complete all lines of this form, except as noted in the instructions. We will return an incomplete application to you.

Total amount

certificates

— Have questions? Call (518) 457-5735.

— This form is available as a fill-in form at Type your information, then print, sign, and mail it.

$

Deposit number

1. Identification

Employer identification number (EIN) Suffix, if any

Social security number

number

OR

SS

2. USDOT number 3. Business phone number

4. E-mail address

5. Fax number

6. Legal name

7. Doing business as (DBA) name, if different from legal name

8. Physical address

9. Mailing address

( number and street )

( if different than physical address; number and street or PO box )

City

State

ZIP code

City

State

ZIP code

Country

Country

( enter if other than United States; do not abbreviate )

( enter if other than United States; do not abbreviate )

10.

Mark an X in the box if your physical or mailing address has changed and has not been reported to us. Enter new address on line 8 and/or line 9, above. If

your business name or tax identification number has changed and has not yet been reported to us, call (518) 457-5735 before mailing this application.

11. Type of business ( mark an X in one box and specify if Other )

Sole proprietor

Corporation

Partnership

LLC

LLP

Other:

12. For new accounts, list the name, title, social security number, and address of each principal officer of a corporation, or of each partner, or member of an LLC/LLP, or

owner if sole proprietorship.

Name

Title

SSN

Number and street

City

State

ZIP code

13. For new accounts, enter the location where tax and mileage records will be available for audit.

Name of custodian of records

Number and street

City

State

ZIP code

Telephone number

14. If this form is prepared by a company employee who is not an officer, partner, member, or owner, or by an agent, service, accountant or other

representative, you must provide the information below. Additionally, if you expect to contact the Tax Department about this application or any other tax

matters, you must attach a Power of Attorney (usually Form POA-1) authorizing you to have access to this business’ NY State tax records.

Name of person preparing form

Number and street

City

State

ZIP code

Telephone number

15. Signature of owner, partner, officer, member or individual with a Power of Attorney on file with the New York State Tax Department

Certification: I hereby declare that the statements contained in this application are true, correct and complete and are made with the knowledge that

a willfully false representation is a crime under Tax Law, section 1815 and Penal Law, sections 175.35 and 210.45 punishable by fines and penalties

stipulated therein.

Signature

Printed name of person signing

Title

Date signed

Amount due with application. Credentials are $15 each.

16.

Mail application and payment to:

× $15 = $

Number of HUT/AFC credentials ordered

NYS TAX DEPARTMENT

HUT/IFTA APPLICATION DEPOSIT UNIT

Make check or money order payable in U.S. funds to Commissioner of

W A HARRIMAN CAMPUS

Taxation and Finance.

ALBANY NY 12227-0163

1

1 2

2