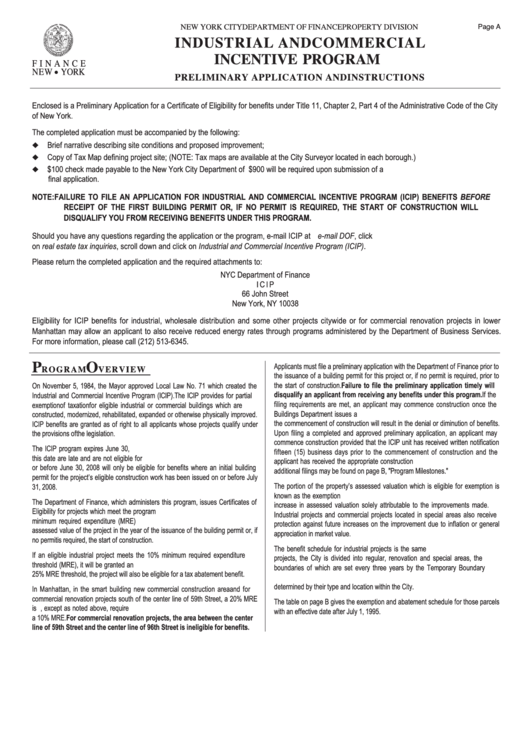

Industrial And Commercial Incentive Program Preliminary Application And Instructions

ADVERTISEMENT

INDUSTRIAL AND COMMERCIAL

NEW YORK CITY DEPARTMENT OF FINANCE PROPERTY DIVISION

Page A

INCENTIVE PROGRAM

F I N A N C E

NEW

YORK

PRELIMINARY APPLICATION AND INSTRUCTIONS

G

Enclosed is a Preliminary Application for a Certificate of Eligibility for benefits under Title 11, Chapter 2, Part 4 of the Administrative Code of the City

of New York.

The completed application must be accompanied by the following:

Brief narrative describing site conditions and proposed improvement;

N

Copy of Tax Map defining project site; (NOTE: Tax maps are available at the City Surveyor located in each borough.)

N

$100 check made payable to the New York City Department of Finance. An additional fee of up to $900 will be required upon submission of a

N

final application.

NOTE:

FAILURE TO FILE AN APPLICATION FOR INDUSTRIAL AND COMMERCIAL INCENTIVE PROGRAM (ICIP) BENEFITS BEFORE

RECEIPT OF THE FIRST BUILDING PERMIT OR, IF NO PERMIT IS REQUIRED, THE START OF CONSTRUCTION WILL

DISQUALIFY YOU FROM RECEIVING BENEFITS UNDER THIS PROGRAM.

Should you have any questions regarding the application or the program, e-mail ICIP at Click on e-mail DOF, click

on real estate tax inquiries, scroll down and click on Industrial and Commercial Incentive Program (ICIP).

Please return the completed application and the required attachments to:

NYC Department of Finance

I C I P

66 John Street

New York, NY 10038

Eligibility for ICIP benefits for industrial, wholesale distribution and some other projects citywide or for commercial renovation projects in lower

Manhattan may allow an applicant to also receive reduced energy rates through programs administered by the Department of Business Services.

For more information, please call (212) 513-6345.

P

O

ROGRAM

VERVIEW

Applicants must file a preliminary application with the Department of Finance prior to

the issuance of a building permit for this project or, if no permit is required, prior to

the start of construction. Failure to file the preliminary application timely will

On November 5, 1984, the Mayor approved Local Law No. 71 which created the

disqualify an applicant from receiving any benefits under this program. If the

Industrial and Commercial Incentive Program (ICIP). The ICIP provides for partial

filing requirements are met, an applicant may commence construction once the

exemption of taxation for eligible industrial or commercial buildings which are

Buildings Department issues a permit. Failure to receive a building permit prior to

constructed, modernized, rehabilitated, expanded or otherwise physically improved.

the commencement of construction will result in the denial or diminution of benefits.

ICIP benefits are granted as of right to all applicants whose projects qualify under

Upon filing a completed and approved preliminary application, an applicant may

the provisions of the legislation.

commence construction provided that the ICIP unit has received written notification

The ICIP program expires June 30, 2008. Preliminary applications received after

fifteen (15) business days prior to the commencement of construction and the

this date are late and are not eligible for benefits. Preliminary applications filed on

applicant has received the appropriate construction permits. Information regarding

or before June 30, 2008 will only be eligible for benefits where an initial building

additional filings may be found on page B, "Program Milestones."

permit for the project’s eligible construction work has been issued on or before July

The portion of the property’s assessed valuation which is eligible for exemption is

31, 2008.

known as the exemption base. The exemption base for each year is limited to the

The Department of Finance, which administers this program, issues Certificates of

increase in assessed valuation solely attributable to the improvements made.

Eligibility for projects which meet the program requirements. Applicants must meet

Industrial projects and commercial projects located in special areas also receive

minimum required expenditure (MRE) targets. The MRE is a percentage of

protection against future increases on the improvement due to inflation or general

assessed value of the project in the year of the issuance of the building permit or, if

appreciation in market value.

no permit is required, the start of construction.

The benefit schedule for industrial projects is the same citywide. For commercial

If an eligible industrial project meets the 10% minimum required expenditure

projects, the City is divided into regular, renovation and special areas, the

threshold (MRE), it will be granted an exemption. If the industrial project meets the

boundaries of which are set every three years by the Temporary Boundary

25% MRE threshold, the project will also be eligible for a tax abatement benefit.

Commission. The amount of benefits granted to commercial projects will be

determined by their type and location within the City.

In Manhattan, in the smart building new commercial construction area and for

commercial renovation projects south of the center line of 59th Street, a 20% MRE

The table on page B gives the exemption and abatement schedule for those parcels

is required. All other commercial projects citywide, except as noted above, require

with an effective date after July 1, 1995.

a 10% MRE. For commercial renovation projects, the area between the center

line of 59th Street and the center line of 96th Street is ineligible for benefits.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4