Form St-101.5 - Annual Schedule N Instructions

ADVERTISEMENT

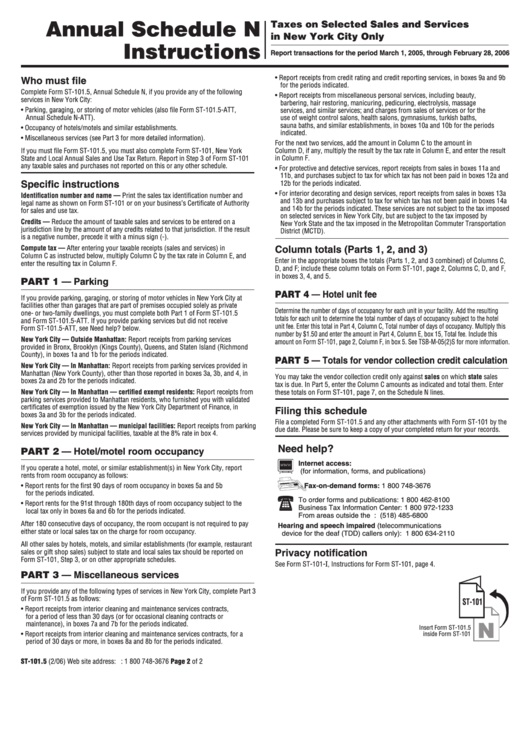

Annual Schedule N

Taxes on Selected Sales and Services

in New York City Only

Instructions

Report transactions for the period March 1, 2005, through February 28, 2006

• Report receipts from credit rating and credit reporting services, in boxes 9a and 9b

Who must file

for the periods indicated.

Complete Form ST-101.5, Annual Schedule N, if you provide any of the following

• Report receipts from miscellaneous personal services, including beauty,

services in New York City:

barbering, hair restoring, manicuring, pedicuring, electrolysis, massage

• Parking, garaging, or storing of motor vehicles (also file Form ST-101.5-ATT,

services, and similar services; and charges from sales of services or for the

Annual Schedule N-ATT).

use of weight control salons, health salons, gymnasiums, turkish baths,

sauna baths, and similar establishments, in boxes 10a and 10b for the periods

• Occupancy of hotels/motels and similar establishments.

indicated.

• Miscellaneous services (see Part 3 for more detailed information).

For the next two services, add the amount in Column C to the amount in

If you must file Form ST-101.5, you must also complete Form ST-101, New York

Column D, if any, multiply the result by the tax rate in Column E, and enter the result

State and Local Annual Sales and Use Tax Return. Report in Step 3 of Form ST-101

in Column F.

any taxable sales and purchases not reported on this or any other schedule.

• For protective and detective services, report receipts from sales in boxes 11a and

11b, and purchases subject to tax for which tax has not been paid in boxes 12a and

Specific instructions

12b for the periods indicated.

• For interior decorating and design services, report receipts from sales in boxes 13a

Identification number and name — Print the sales tax identification number and

and 13b and purchases subject to tax for which tax has not been paid in boxes 14a

legal name as shown on Form ST-101 or on your business’s Certificate of Authority

and 14b for the periods indicated. These services are not subject to the tax imposed

for sales and use tax.

on selected services in New York City, but are subject to the tax imposed by

Credits — Reduce the amount of taxable sales and services to be entered on a

New York State and the tax imposed in the Metropolitan Commuter Transportation

jurisdiction line by the amount of any credits related to that jurisdiction. If the result

District (MCTD).

is a negative number, precede it with a minus sign (-).

Column totals (Parts 1, 2, and 3)

Compute tax — After entering your taxable receipts (sales and services) in

Column C as instructed below, multiply Column C by the tax rate in Column E, and

Enter in the appropriate boxes the totals (Parts 1, 2, and 3 combined) of Columns C,

enter the resulting tax in Column F.

D, and F; include these column totals on Form ST-101, page 2, Columns C, D, and F,

in boxes 3, 4, and 5.

PART 1 — Parking

PART 4 — Hotel unit fee

If you provide parking, garaging, or storing of motor vehicles in New York City at

facilities other than garages that are part of premises occupied solely as private

Determine the number of days of occupancy for each unit in your facility. Add the resulting

one- or two-family dwellings, you must complete both Part 1 of Form ST-101.5

totals for each unit to determine the total number of days of occupancy subject to the hotel

and Form ST-101.5-ATT. If you provide parking services but did not receive

unit fee. Enter this total in Part 4, Column C, Total number of days of occupancy. Multiply this

Form ST-101.5-ATT, see Need help? below.

number by $1.50 and enter the amount in Part 4, Column E, box 15, Total fee. Include this

New York City — Outside Manhattan: Report receipts from parking services

amount on Form ST-101, page 2, Column F, in box 5. See TSB-M-05(2)S for more information.

provided in Bronx, Brooklyn (Kings County), Queens, and Staten Island (Richmond

County), in boxes 1a and 1b for the periods indicated.

PART 5 — Totals for vendor collection credit calculation

New York City — In Manhattan: Report receipts from parking services provided in

Manhattan (New York County), other than those reported in boxes 3a, 3b, and 4, in

You may take the vendor collection credit only against sales on which state sales

boxes 2a and 2b for the periods indicated.

tax is due. In Part 5, enter the Column C amounts as indicated and total them. Enter

New York City — In Manhattan — certified exempt residents: Report receipts from

these totals on Form ST-101, page 7, on the Schedule N lines.

parking services provided to Manhattan residents, who furnished you with validated

certificates of exemption issued by the New York City Department of Finance, in

Filing this schedule

boxes 3a and 3b for the periods indicated.

File a completed Form ST-101.5 and any other attachments with Form ST-101 by the

New York City — In Manhattan — municipal facilities: Report receipts from parking

due date. Please be sure to keep a copy of your completed return for your records.

services provided by municipal facilities, taxable at the 8% rate in box 4.

Need help?

PART 2 — Hotel/motel room occupancy

Internet access:

If you operate a hotel, motel, or similar establishment(s) in New York City, report

(for information, forms, and publications)

rents from room occupancy as follows:

• Report rents for the first 90 days of room occupancy in boxes 5a and 5b

Fax-on-demand forms: 1 800 748-3676

for the periods indicated.

To order forms and publications:

1 800 462-8100

• Report rents for the 91st through 180th days of room occupancy subject to the

Business Tax Information Center:

1 800 972-1233

local tax only in boxes 6a and 6b for the periods indicated.

From areas outside the U.S. and outside Canada:

(518) 485-6800

After 180 consecutive days of occupancy, the room occupant is not required to pay

Hearing and speech impaired (telecommunications

either state or local sales tax on the charge for room occupancy.

device for the deaf (TDD) callers only):

1 800 634-2110

All other sales by hotels, motels, and similar establishments (for example, restaurant

Privacy notification

sales or gift shop sales) subject to state and local sales tax should be reported on

Form ST-101, Step 3, or on other appropriate schedules.

See Form ST-101-

I

, Instructions for Form ST-101, page 4.

PART 3 — Miscellaneous services

If you provide any of the following types of services in New York City, complete Part 3

of Form ST-101.5 as follows:

ST-101

• Report receipts from interior cleaning and maintenance services contracts,

for a period of less than 30 days (or for occasional cleaning contracts or

N

maintenance), in boxes 7a and 7b for the periods indicated.

Insert Form ST-101.5

• Report receipts from interior cleaning and maintenance services contracts, for a

inside Form ST-101

period of 30 days or more, in boxes 8a and 8b for the periods indicated.

ST-101.5 (2/06)

Web site address:

Fax-on-demand forms ordering system: 1 800 748-3676

Page 2 of 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1