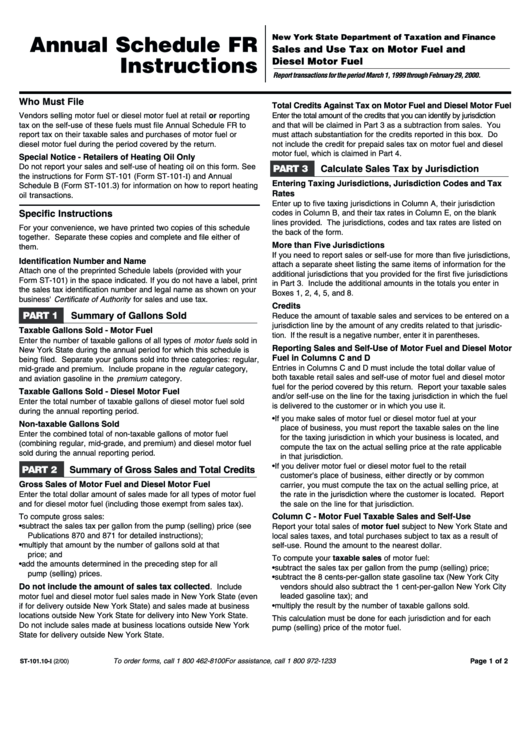

Form St-101.10-I - Annual Schedule Fr Instructions - New York State Department Of Taxation And Finance

ADVERTISEMENT

New York State Department of Taxation and Finance

Annual Schedule FR

Sales and Use Tax on Motor Fuel and

Instructions

Diesel Motor Fuel

Report transactions for the period March 1, 1999 through February 29, 2000.

Who Must File

Total Credits Against Tax on Motor Fuel and Diesel Motor Fuel

Vendors selling motor fuel or diesel motor fuel at retail or reporting

Enter the total amount of the credits that you can identify by jurisdiction

tax on the self-use of these fuels must file Annual Schedule FR to

and that will be claimed in Part 3 as a subtraction from sales. You

report tax on their taxable sales and purchases of motor fuel or

must attach substantiation for the credits reported in this box. Do

diesel motor fuel during the period covered by the return.

not include the credit for prepaid sales tax on motor fuel and diesel

motor fuel, which is claimed in Part 4.

Special Notice - Retailers of Heating Oil Only

Do not report your sales and self-use of heating oil on this form. See

PART 3

Calculate Sales Tax by Jurisdiction

the instructions for Form ST-101 (Form ST-101-I) and Annual

Entering Taxing Jurisdictions, Jurisdiction Codes and Tax

Schedule B (Form ST-101.3) for information on how to report heating

Rates

oil transactions.

Enter up to five taxing jurisdictions in Column A, their jurisdiction

Specific Instructions

codes in Column B, and their tax rates in Column E, on the blank

lines provided. The jurisdictions, codes and tax rates are listed on

For your convenience, we have printed two copies of this schedule

the back of the form.

together. Separate these copies and complete and file either of

More than Five Jurisdictions

them.

If you need to report sales or self-use for more than five jurisdictions,

Identification Number and Name

attach a separate sheet listing the same items of information for the

Attach one of the preprinted Schedule labels (provided with your

additional jurisdictions that you provided for the first five jurisdictions

Form ST-101) in the space indicated. If you do not have a label, print

in Part 3. Include the additional amounts in the totals you enter in

the sales tax identification number and legal name as shown on your

Boxes 1, 2, 4, 5, and 8.

business' Certificate of Authority for sales and use tax.

Credits

PART 1

Summary of Gallons Sold

Reduce the amount of taxable sales and services to be entered on a

jurisdiction line by the amount of any credits related to that jurisdic-

Taxable Gallons Sold - Motor Fuel

tion. If the result is a negative number, enter it in parentheses.

Enter the number of taxable gallons of all types of motor fuels sold in

Reporting Sales and Self-Use of Motor Fuel and Diesel Motor

New York State during the annual period for which this schedule is

Fuel in Columns C and D

being filed. Separate your gallons sold into three categories: regular,

Entries in Columns C and D must include the total dollar value of

mid-grade and premium. Include propane in the regular category,

both taxable retail sales and self-use of motor fuel and diesel motor

and aviation gasoline in the premium category.

fuel for the period covered by this return. Report your taxable sales

Taxable Gallons Sold - Diesel Motor Fuel

and/or self-use on the line for the taxing jurisdiction in which the fuel

Enter the total number of taxable gallons of diesel motor fuel sold

is delivered to the customer or in which you use it.

during the annual reporting period.

• If you make sales of motor fuel or diesel motor fuel at your

Non-taxable Gallons Sold

place of business, you must report the taxable sales on the line

Enter the combined total of non-taxable gallons of motor fuel

for the taxing jurisdiction in which your business is located, and

(combining regular, mid-grade, and premium) and diesel motor fuel

compute the tax on the actual selling price at the rate applicable

sold during the annual reporting period.

in that jurisdiction.

• If you deliver motor fuel or diesel motor fuel to the retail

PART 2

Summary of Gross Sales and Total Credits

customer's place of business, either directly or by common

Gross Sales of Motor Fuel and Diesel Motor Fuel

carrier, you must compute the tax on the actual selling price, at

Enter the total dollar amount of sales made for all types of motor fuel

the rate in the jurisdiction where the customer is located. Report

and for diesel motor fuel (including those exempt from sales tax).

the sale on the line for that jurisdiction.

To compute gross sales:

Column C - Motor Fuel Taxable Sales and Self-Use

• subtract the sales tax per gallon from the pump (selling) price (see

Report your total sales of motor fuel subject to New York State and

Publications 870 and 871 for detailed instructions);

local sales taxes, and total purchases subject to tax as a result of

• multiply that amount by the number of gallons sold at that

self-use. Round the amount to the nearest dollar.

price; and

To compute your taxable sales of motor fuel:

• add the amounts determined in the preceding step for all

• subtract the sales tax per gallon from the pump (selling) price;

pump (selling) prices.

• subtract the 8 cents-per-gallon state gasoline tax (New York City

Do not include the amount of sales tax collected.

vendors should also subtract the 1 cent-per-gallon New York City

Include

motor fuel and diesel motor fuel sales made in New York State (even

leaded gasoline tax); and

if for delivery outside New York State) and sales made at business

• multiply the result by the number of taxable gallons sold.

locations outside New York State for delivery into New York State.

This calculation must be done for each jurisdiction and for each

Do not include sales made at business locations outside New York

pump (selling) price of the motor fuel.

State for delivery outside New York State.

To order forms, call 1 800 462-8100

For assistance, call 1 800 972-1233

Page 1 of 2

ST-101.10-I (2/00)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2