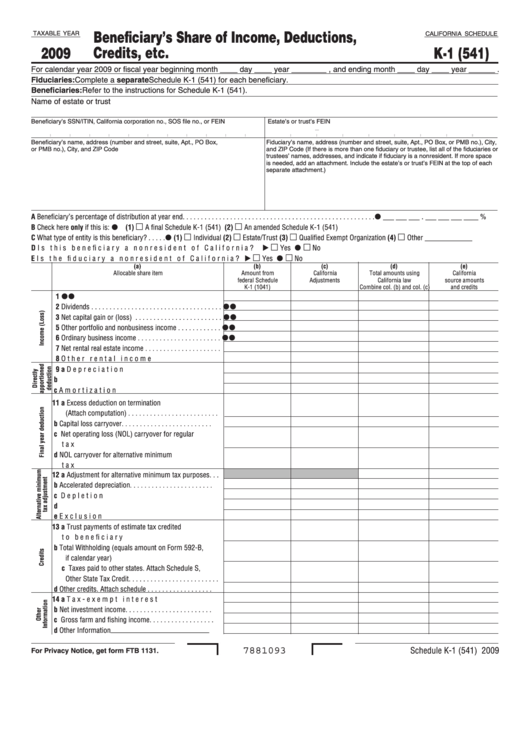

Beneficiary’s Share of Income, Deductions,

TAXABLE YEAR

CALIFORNIA SCHEDULE

Credits, etc.

2009

K-1 (541)

For calendar year 2009 or fiscal year beginning month ____ day ____ year ________ , and ending month ____ day ____ year ______ .

Fiduciaries: Complete a separate Schedule K-1 (541) for each beneficiary.

Beneficiaries: Refer to the instructions for Schedule K-1 (541).

Name of estate or trust

Beneficiary’s SSN/ITIN, California corporation no., SOS file no., or FEIN

Estate’s or trust’s FEIN

-

Beneficiary’s name, address (number and street, suite, Apt., PO Box,

Fiduciary’s name, address (number and street, suite, Apt., PO Box, or PMB no.), City,

or PMB no.), City, and ZIP Code

and ZIP Code (If there is more than one fiduciary or trustee, list all of the fiduciaries or

trustees’ names, addresses, and indicate if fiduciary is a nonresident. If more space

is needed, add an attachment. Include the estate’s or trust’s FEIN at the top of each

separate attachment.)

.

A Beneficiary’s percentage of distribution at year end . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

___ ___ ___

___ ___ ___ ____ %

B Check here only if this is:

(1)

A final Schedule K-1 (541)

(2)

An amended Schedule K-1 (541)

C What type of entity is this beneficiary? . . . . .

(1)

Individual (2)

Estate/Trust (3)

Qualified Exempt Organization (4)

Other _____________

D Is this beneficiary a nonresident of California? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

E Is the fiduciary a nonresident of California? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

(a)

(b)

(c)

(d)

(e)

Allocable share item

Amount from

California

Total amounts using

California

federal Schedule

Adjustments

California law

source amounts

K-1 (1041)

Combine col . (b) and col . (c)

and credits

1 Interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2 Dividends . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3 Net capital gain or (loss) . . . . . . . . . . . . . . . . . . . . . . . .

5 Other portfolio and nonbusiness income . . . . . . . . . . . .

6 Ordinary business income . . . . . . . . . . . . . . . . . . . . . . .

7 Net rental real estate income . . . . . . . . . . . . . . . . . . . . .

8 Other rental income . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9 a Depreciation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

b Depletion . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

c Amortization . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11 a Excess deduction on termination

(Attach computation) . . . . . . . . . . . . . . . . . . . . . . . . .

b Capital loss carryover . . . . . . . . . . . . . . . . . . . . . . . . .

c Net operating loss (NOL) carryover for regular

tax purposes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

d NOL carryover for alternative minimum

tax purposes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12 a Adjustment for alternative minimum tax purposes . . .

b Accelerated depreciation . . . . . . . . . . . . . . . . . . . . . . .

c Depletion . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

d Amortization . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

e Exclusion items . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13 a Trust payments of estimate tax credited

to beneficiary . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

b Total Withholding (equals amount on Form 592-B,

if calendar year)

c Taxes paid to other states . Attach Schedule S,

Other State Tax Credit . . . . . . . . . . . . . . . . . . . . . . . . .

d Other credits . Attach schedule . . . . . . . . . . . . . . . . . .

14 a Tax-exempt interest . . . . . . . . . . . . . . . . . . . . . . . . . .

b Net investment income . . . . . . . . . . . . . . . . . . . . . . . .

c Gross farm and fishing income . . . . . . . . . . . . . . . . . .

d Other Information ___________________________

Schedule K-1 (541) 2009

7881093

For Privacy Notice, get form FTB 1131.

1

1