Form Ptax-340 General Information/instructions - 2005

ADVERTISEMENT

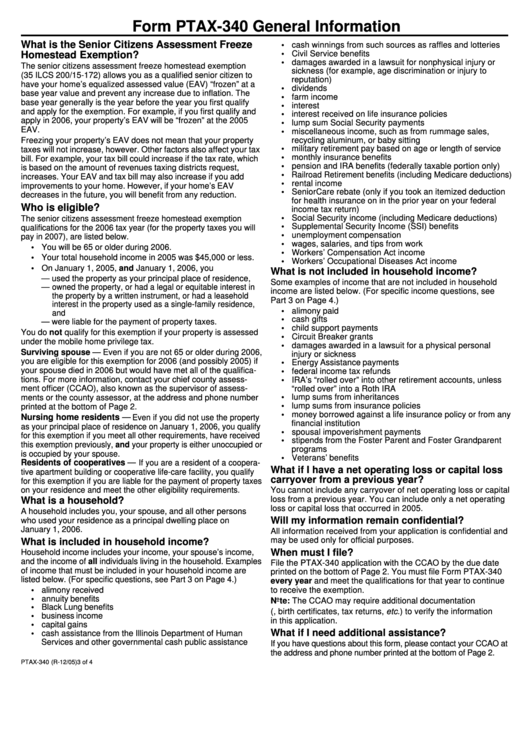

Form PTAX-340 General Information

What is the Senior Citizens Assessment Freeze

• cash winnings from such sources as raffles and lotteries

• Civil Service benefits

Homestead Exemption?

• damages awarded in a lawsuit for nonphysical injury or

The senior citizens assessment freeze homestead exemption

sickness (for example, age discrimination or injury to

(35 ILCS 200/15-172) allows you as a qualified senior citizen to

reputation)

have your home’s equalized assessed value (EAV) “frozen” at a

• dividends

base year value and prevent any increase due to inflation. The

• farm income

base year generally is the year before the year you first qualify

• interest

and apply for the exemption. For example, if you first qualify and

• interest received on life insurance policies

apply in 2006, your property’s EAV will be “frozen” at the 2005

• lump sum Social Security payments

EAV.

• miscellaneous income, such as from rummage sales,

recycling aluminum, or baby sitting

Freezing your property’s EAV does not mean that your property

• military retirement pay based on age or length of service

taxes will not increase, however. Other factors also affect your tax

• monthly insurance benefits

bill. For example, your tax bill could increase if the tax rate, which

• pension and IRA benefits (federally taxable portion only)

is based on the amount of revenues taxing districts request,

• Railroad Retirement benefits (including Medicare deductions)

increases. Your EAV and tax bill may also increase if you add

• rental income

improvements to your home. However, if your home’s EAV

• SeniorCare rebate (only if you took an itemized deduction

decreases in the future, you will benefit from any reduction.

for health insurance on in the prior year on your federal

Who is eligible?

income tax return)

• Social Security income (including Medicare deductions)

The senior citizens assessment freeze homestead exemption

• Supplemental Security Income (SSI) benefits

qualifications for the 2006 tax year (for the property taxes you will

• unemployment compensation

pay in 2007), are listed below.

• wages, salaries, and tips from work

• You will be 65 or older during 2006.

• Workers’ Compensation Act income

• Your total household income in 2005 was $45,000 or less.

• Workers’ Occupational Diseases Act income

• On January 1, 2005, and January 1, 2006, you

What is not included in household income?

— used the property as your principal place of residence,

Some examples of income that are not included in household

— owned the property, or had a legal or equitable interest in

income are listed below. (For specific income questions, see

the property by a written instrument, or had a leasehold

Part 3 on Page 4.)

interest in the property used as a single-family residence,

• alimony paid

and

• cash gifts

— were liable for the payment of property taxes.

• child support payments

You do not qualify for this exemption if your property is assessed

• Circuit Breaker grants

under the mobile home privilege tax.

• damages awarded in a lawsuit for a physical personal

Surviving spouse — Even if you are not 65 or older during 2006,

injury or sickness

you are eligible for this exemption for 2006 (and possibly 2005) if

• Energy Assistance payments

your spouse died in 2006 but would have met all of the qualifica-

• federal income tax refunds

tions. For more information, contact your chief county assess-

• IRA’s “rolled over” into other retirement accounts, unless

ment officer (CCAO), also known as the supervisor of assess-

“rolled over” into a Roth IRA

• lump sums from inheritances

ments or the county assessor, at the address and phone number

• lump sums from insurance policies

printed at the bottom of Page 2.

• money borrowed against a life insurance policy or from any

Nursing home residents —

Even if you did not use the property

financial institution

as your principal place of residence on January 1, 2006, you qualify

• spousal impoverishment payments

for this exemption if you meet all other requirements, have received

• stipends from the Foster Parent and Foster Grandparent

this exemption previously, and your property is either unoccupied or

programs

is occupied by your spouse.

• Veterans’ benefits

Residents of cooperatives —

If you are a resident of a coopera-

What if I have a net operating loss or capital loss

tive apartment building or cooperative life-care facility, you qualify

carryover from a previous year?

for this exemption if you are liable for the payment of property taxes

on your residence and meet the other eligibility requirements.

You cannot include any carryover of net operating loss or capital

loss from a previous year. You can include only a net operating

What is a household?

loss or capital loss that occurred in 2005.

A household includes you, your spouse, and all other persons

Will my information remain confidential?

who used your residence as a principal dwelling place on

January 1, 2006.

All information received from your application is confidential and

may be used only for official purposes.

What is included in household income?

When must I file?

Household income includes your income, your spouse’s income,

and the income of all individuals living in the household. Examples

File the PTAX-340 application with the CCAO by the due date

of income that must be included in your household income are

printed on the bottom of Page 2. You must file Form PTAX-340

listed below. (For specific questions, see Part 3 on Page 4.)

every year and meet the qualifications for that year to continue

to receive the exemption.

• alimony received

• annuity benefits

Note: The CCAO may require additional documentation

• Black Lung benefits

(i.e., birth certificates, tax returns, etc.) to verify the information

• business income

in this application.

• capital gains

What if I need additional assistance?

• cash assistance from the Illinois Department of Human

Services and other governmental cash public assistance

If you have questions about this form, please contact your CCAO at

the address and phone number printed at the bottom of Page 2.

PTAX-340 (R-12/05)

3 of 4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2