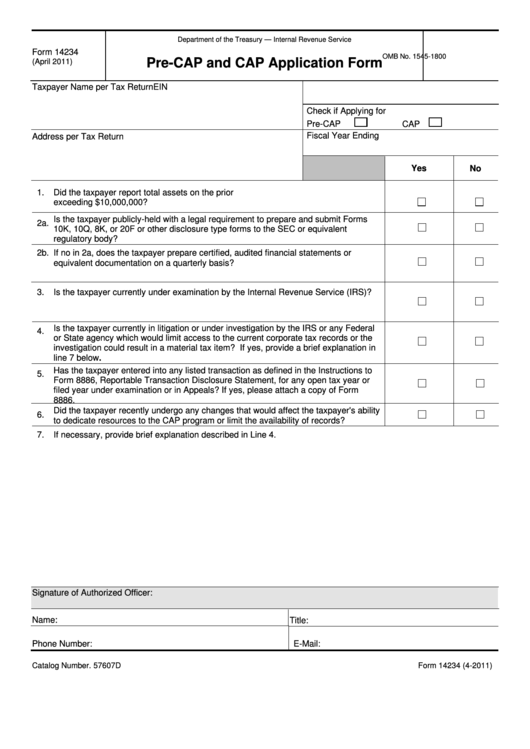

Department of the Treasury — Internal Revenue Service

Form 14234

OMB No. 1545-1800

Pre-CAP and CAP Application Form

(April 2011)

Taxpayer Name per Tax Return

EIN

Check if Applying for

Pre-CAP

CAP

Fiscal Year Ending

Address per Tax Return

Yes

No

1.

Did the taxpayer report total assets on the prior U.S. income tax return equal to or

exceeding $10,000,000?

Is the taxpayer publicly-held with a legal requirement to prepare and submit Forms

2a.

10K, 10Q, 8K, or 20F or other disclosure type forms to the SEC or equivalent

regulatory body?

2b.

If no in 2a, does the taxpayer prepare certified, audited financial statements or

equivalent documentation on a quarterly basis?

3.

Is the taxpayer currently under examination by the Internal Revenue Service (IRS)?

Is the taxpayer currently in litigation or under investigation by the IRS or any Federal

4.

or State agency which would limit access to the current corporate tax records or the

investigation could result in a material tax item? If yes, provide a brief explanation in

line 7 below.

Has the taxpayer entered into any listed transaction as defined in the Instructions to

5.

Form 8886, Reportable Transaction Disclosure Statement, for any open tax year or

filed year under examination or in Appeals? If yes, please attach a copy of Form

8886.

Did the taxpayer recently undergo any changes that would affect the taxpayer's ability

6.

to dedicate resources to the CAP program or limit the availability of records?

7.

If necessary, provide brief explanation described in Line 4.

Signature of Authorized Officer:

Name:

Title:

E-Mail:

Phone Number:

Catalog Number. 57607D

Form 14234 (4-2011)

1

1 2

2