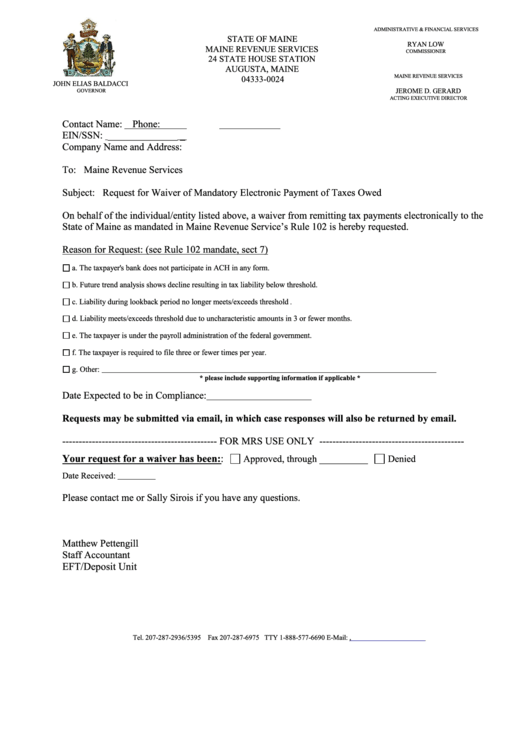

Request For Waiver Of Mandatory Electronic Payment Of Taxes Owed Form

ADVERTISEMENT

ADMINISTRATIVE & FINANCIAL SERVICES

STATE OF MAINE

RYAN LOW

MAINE REVENUE SERVICES

COMMISSIONER

24 STATE HOUSE STATION

AUGUSTA, MAINE

MAINE REVENUE SERVICES

04333-0024

JOHN ELIAS BALDACCI

JEROME D. GERARD

GOVERNOR

ACTING EXECUTIVE DIRECTOR

Contact Name:

Phone:

EIN/SSN: ______________ _

Company Name and Address:

To:

Maine Revenue Services

Subject:

Request for Waiver of Mandatory Electronic Payment of Taxes Owed

On behalf of the individual/entity listed above, a waiver from remitting tax payments electronically to the

State of Maine as mandated in Maine Revenue Service’s Rule 102 is hereby requested.

Reason for Request: (see Rule 102 mandate, sect 7)

a. The taxpayer's bank does not participate in ACH in any form.

b. Future trend analysis shows decline resulting in tax liability below threshold.

c. Liability during lookback period no longer meets/exceeds threshold

.

d. Liability meets/exceeds threshold due to uncharacteristic amounts in 3 or fewer months.

e. The taxpayer is under the payroll administration of the federal government.

f. The taxpayer is required to file three or fewer times per year.

g. Other:

* please include supporting information if applicable *

Date Expected to be in Compliance:

Requests may be submitted via email, in which case responses will also be returned by email.

----------------------------------------------- FOR MRS USE ONLY --------------------------------------------

Your request for a waiver has been::

Approved, through __________

Denied

Date Received:

Please contact me or Sally Sirois if you have any questions.

Matthew Pettengill

Staff Accountant

EFT/Deposit Unit

Tel. 207-287-2936/5395 Fax 207-287-6975 TTY 1-888-577-6690 E-Mail: efunds.transfer@maine.gov,

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1