Print and Reset Form

Reset Form

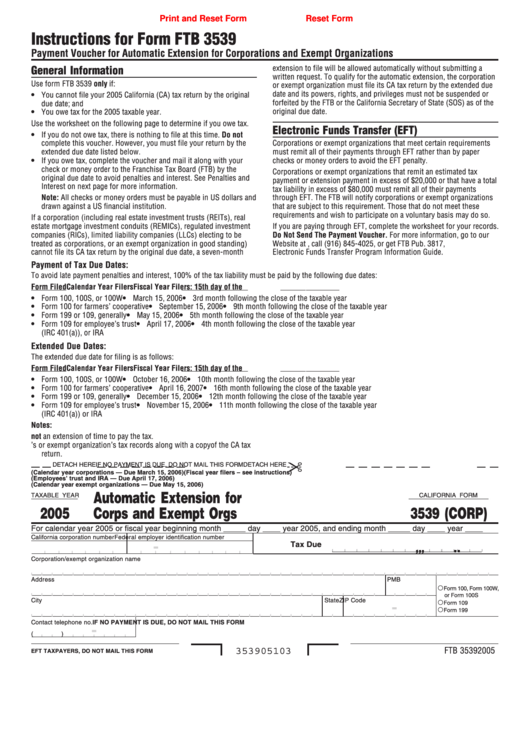

Instructions for Form FTB 3539

Payment Voucher for Automatic Extension for Corporations and Exempt Organizations

extension to file will be allowed automatically without submitting a

General Information

written request. To qualify for the automatic extension, the corporation

Use form FTB 3539 only if:

or exempt organization must file its CA tax return by the extended due

date and its powers, rights, and privileges must not be suspended or

• You cannot file your 2005 California (CA) tax return by the original

forfeited by the FTB or the California Secretary of State (SOS) as of the

due date; and

original due date.

• You owe tax for the 2005 taxable year.

Use the worksheet on the following page to determine if you owe tax.

Electronic Funds Transfer (EFT)

• If you do not owe tax, there is nothing to file at this time. Do not

complete this voucher. However, you must file your return by the

Corporations or exempt organizations that meet certain requirements

extended due date listed below.

must remit all of their payments through EFT rather than by paper

• If you owe tax, complete the voucher and mail it along with your

checks or money orders to avoid the EFT penalty.

check or money order to the Franchise Tax Board (FTB) by the

Corporations or exempt organizations that remit an estimated tax

original due date to avoid penalties and interest. See Penalties and

payment or extension payment in excess of $20,000 or that have a total

Interest on next page for more information.

tax liability in excess of $80,000 must remit all of their payments

Note: All checks or money orders must be payable in US dollars and

through EFT. The FTB will notify corporations or exempt organizations

drawn against a US financial institution.

that are subject to this requirement. Those that do not meet these

requirements and wish to participate on a voluntary basis may do so.

If a corporation (including real estate investment trusts (REITs), real

estate mortgage investment conduits (REMICs), regulated investment

If you are paying through EFT, complete the worksheet for your records.

companies (RICs), limited liability companies (LLCs) electing to be

Do Not Send The Payment Voucher. For more information, go to our

treated as corporations, or an exempt organization in good standing)

Website at , call (916) 845-4025, or get FTB Pub. 3817,

cannot file its CA tax return by the original due date, a seven-month

Electronic Funds Transfer Program Information Guide.

Payment of Tax Due Dates:

To avoid late payment penalties and interest, 100% of the tax liability must be paid by the following due dates:

Form Filed

Calendar Year Filers

Fiscal Year Filers: 15th day of the

• Form 100, 100S, or 100W

• March 15, 2006

• 3rd month following the close of the taxable year

• Form 100 for farmers’ cooperative

• September 15, 2006

• 9th month following the close of the taxable year

• Form 199 or 109, generally

• May 15, 2006

• 5th month following the close of the taxable year

• Form 109 for employee’s trust

• April 17, 2006

• 4th month following the close of the taxable year

(IRC 401(a)), or IRA

Extended Due Dates:

The extended due date for filing is as follows:

Form Filed

Calendar Year Filers

Fiscal Year Filers: 15th day of the

• Form 100, 100S, or 100W

• October 16, 2006

• 10th month following the close of the taxable year

• Form 100 for farmers’ cooperative

• April 16, 2007

• 16th month following the close of the taxable year

• Form 199 or 109, generally

• December 15, 2006

• 12th month following the close of the taxable year

• Form 109 for employee’s trust

• November 15, 2006

• 11th month following the close of the taxable year

(IRC 401(a)) or IRA

Notes:

1. An extension of time to file the CA tax return is not an extension of time to pay the tax.

2. Save the completed worksheet as a permanent part of the corporation’s or exempt organization’s tax records along with a copy of the CA tax

return.

§

DETACH HERE

IF NO PAYMENT IS DUE, DO NOT MAIL THIS FORM

DETACH HERE

(Calendar year corporations — Due March 15, 2006) (Fiscal year filers – see instructions)

(Employees’ trust and IRA — Due April 17, 2006)

(Calendar year exempt organizations — Due May 15, 2006)

Automatic Extension for

TAXABLE YEAR

CALIFORNIA FORM

2005

Corps and Exempt Orgs

3539 (CORP)

For calendar year 2005 or fiscal year beginning month _____ day ____ year 2005, and ending month _____ day ____ year ____

California corporation number

Federal employer identification number

-

Tax Due

. . . . .

,

,

,

Corporation/exempt organization name

Address

PMB no.

Entity will file.

Form 100, Form 100W,

or Form 100S

City

State ZIP Code

Form 109

-

Form 199

Contact telephone no.

IF NO PAYMENT IS DUE, DO NOT MAIL THIS FORM

-

(

)

FTB 3539 2005

353905103

EFT TAXPAYERS, DO NOT MAIL THIS FORM

1

1