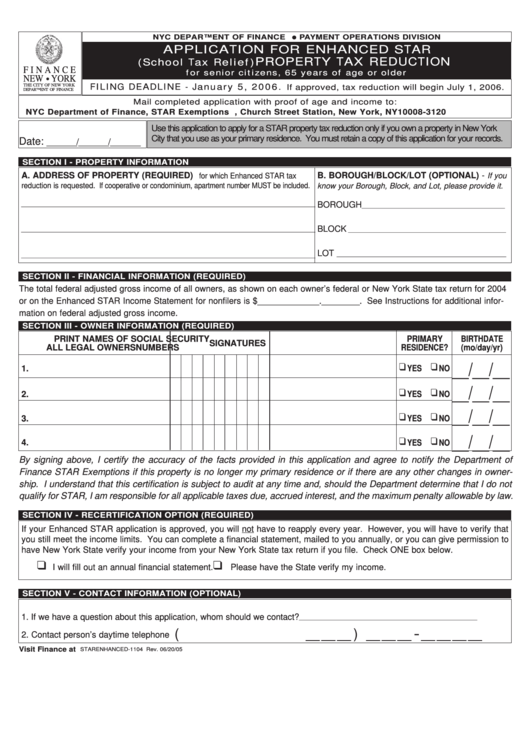

NYC DEPARTMENT OF FINANCE

PAYMENT OPERATIONS DIVISION

APPLICATION FOR ENHANCED STAR

PROPERTY TAX REDUCTION

(School Tax Relief)

F I N A N C E

for senior citizens, 65 years of age or older

NEW YORK

THE CITY OF NEW YORK

FILING DEADLINE - Januar y 5, 2006.

If approved, tax reduction will begin July 1, 2006.

DEPARTMENT OF FINANCE

Mail completed application with proof of age and income to:

NYC Department of Finance, STAR Exemptions P.O. Box 3120, Church Street Station, New York, NY 10008-3120

Use this application to apply for a STAR property tax reduction only if you own a property in New York

City that you use as your primary residence. You must retain a copy of this application for your records.

Date:

_______/_______/_______

SECTION I - PROPERTY INFORMATION

A. ADDRESS OF PROPERTY (REQUIRED)

B. BOROUGH/BLOCK/LOT (OPTIONAL) -

If you

for which Enhanced STAR tax

reduction is requested. If cooperative or condominium, apartment number MUST be included.

know your Borough, Block, and Lot, please provide it.

BOROUGH

___________________________________________________________________________________________________________

_________________________________________________

BLOCK

___________________________________________________________________________________________________________

______________________________________________________

LOT

__________________________________________________________

___________________________________________________________________________________________________________

SECTION II - FINANCIAL INFORMATION (REQUIRED)

The total federal adjusted gross income of all owners, as shown on each owner’s federal or New York State tax return for 2004

or on the Enhanced STAR Income Statement for nonfilers is $_____________.________. See Instructions for additional infor-

mation on federal adjusted gross income.

SECTION III - OWNER INFORMATION (REQUIRED)

PRINT NAMES OF

SOCIAL SECURITY

PRIMARY

BIRTHDATE

SIGNATURES

ALL LEGAL OWNERS

NUMBERS

RESIDENCE?

(mo/day/yr)

__/__/__

1.

YES

NO

__/__/__

2.

YES

NO

__/__/__

3.

YES

NO

__/__/__

4.

YES

NO

By signing above, I certify the accuracy of the facts provided in this application and agree to notify the Department of

Finance STAR Exemptions if this property is no longer my primary residence or if there are any other changes in owner-

ship. I understand that this certification is subject to audit at any time and, should the Department determine that I do not

qualify for STAR, I am responsible for all applicable taxes due, accrued interest, and the maximum penalty allowable by law.

SECTION IV - RECERTIFICATION OPTION (REQUIRED)

If your Enhanced STAR application is approved, you will not have to reapply every year. However, you will have to verify that

you still meet the income limits. You can complete a financial statement, mailed to you annually, or you can give permission to

have New York State verify your income from your New York State tax return if you file. Check ONE box below.

I will fill out an annual financial statement.

Please have the State verify my income.

SECTION V - CONTACT INFORMATION (OPTIONAL)

1. If we have a question about this application, whom should we contact?

_____________________________________________________________

(_ _ _ ) _ _ _ - _ _ _ _

2. Contact person’s daytime telephone number ........................................

Visit Finance at nyc.gov/finance

STARENHANCED-1104 Rev. 06/20/05

1

1 2

2