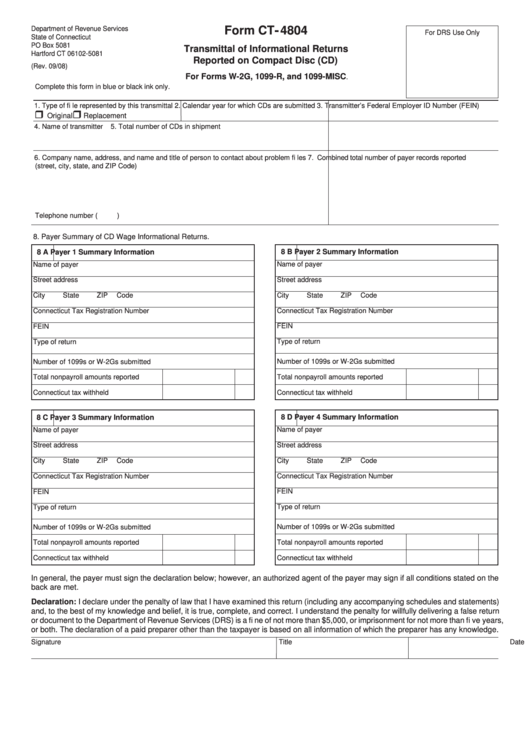

Form Ct-4804 - Transmittal Of Informational Returns Reported On Compact Disc (Cd)

ADVERTISEMENT

Department of Revenue Services

Form CT- 4804

For DRS Use Only

State of Connecticut

PO Box 5081

Transmittal of Informational Returns

Hartford CT 06102-5081

Reported on Compact Disc (CD)

(Rev. 09/08)

For Forms W-2G, 1099-R, and 1099-MISC

.

Complete this form in blue or black ink only.

1. Type of fi le represented by this transmittal

2. Calendar year for which CDs are submitted

3. Transmitter’s Federal Employer ID Number (FEIN)

Original

Replacement

4. Name of transmitter

5. Total number of CDs in shipment

6. Company name, address, and name and title of person to contact about problem fi les

7. Combined total number of payer records reported

(street, city, state, and ZIP Code)

Telephone number (

)

8. Payer Summary of CD Wage Informational Returns.

8 A

Payer 1 Summary Information

8 B

Payer 2 Summary Information

Name of payer

Name of payer

Street address

Street address

City

State

ZIP Code

City

State

ZIP Code

Connecticut Tax Registration Number

Connecticut Tax Registration Number

FEIN

FEIN

Type of return

Type of return

Number of 1099s or W-2Gs submitted

Number of 1099s or W-2Gs submitted

Total nonpayroll amounts reported

Total nonpayroll amounts reported

Connecticut tax withheld

Connecticut tax withheld

8 D

Payer 4 Summary Information

8 C

Payer 3 Summary Information

Name of payer

Name of payer

Street address

Street address

City

State

ZIP Code

City

State

ZIP Code

Connecticut Tax Registration Number

Connecticut Tax Registration Number

FEIN

FEIN

Type of return

Type of return

Number of 1099s or W-2Gs submitted

Number of 1099s or W-2Gs submitted

Total nonpayroll amounts reported

Total nonpayroll amounts reported

Connecticut tax withheld

Connecticut tax withheld

In general, the payer must sign the declaration below; however, an authorized agent of the payer may sign if all conditions stated on the

back are met.

Declaration: I declare under the penalty of law that I have examined this return (including any accompanying schedules and statements)

and, to the best of my knowledge and belief, it is true, complete, and correct. I understand the penalty for willfully delivering a false return

or document to the Department of Revenue Services (DRS) is a fi ne of not more than $5,000, or imprisonment for not more than fi ve years,

or both. The declaration of a paid preparer other than the taxpayer is based on all information of which the preparer has any knowledge.

Signature

Title

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1