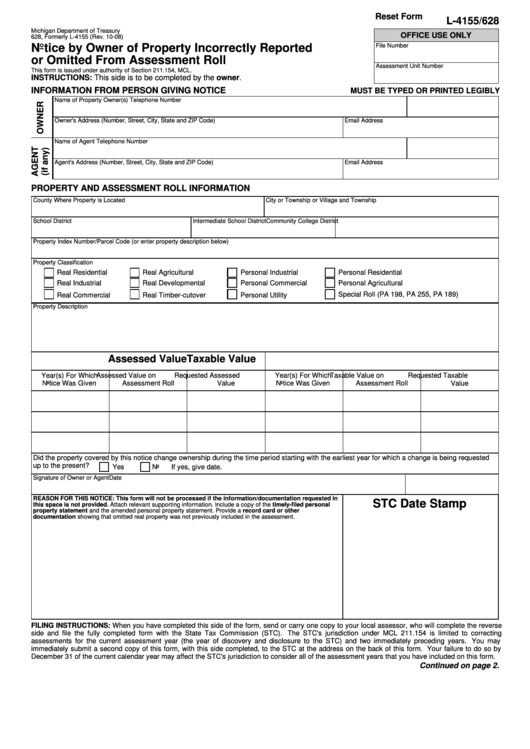

Reset Form

L-4155/628

Michigan Department of Treasury

OFFICE USE ONLY

628, Formerly L-4155 (Rev. 10-08)

Notice by Owner of Property Incorrectly Reported

File Number

or Omitted From Assessment Roll

Assessment Unit Number

This form is issued under authority of Section 211.154, MCL.

INSTRUCTIONS: This side is to be completed by the owner.

INFORMATION FROM PERSON GIVING NOTICE

MUST BE TYPED OR PRINTED LEGIBLY

Name of Property Owner(s)

Telephone Number

Owner's Address (Number, Street, City, State and ZIP Code)

Email Address

Name of Agent

Telephone Number

Agent's Address (Number, Street, City, State and ZIP Code)

Email Address

PROPERTY AND ASSESSMENT ROLL INFORMATION

County Where Property is Located

City or Township or Village and Township

School District

Intermediate School District

Community College District

Property Index Number/Parcel Code (or enter property description below)

Property Classification

Real Residential

Real Agricultural

Personal Industrial

Personal Residential

Real Industrial

Real Developmental

Personal Commercial

Personal Agricultural

Special Roll (PA 198, PA 255, PA 189)

Real Commercial

Real Timber-cutover

Personal Utility

Property Description

Assessed Value

Taxable Value

Year(s) For Which

Assessed Value on

Requested Assessed

Year(s) For Which

Taxable Value on

Requested Taxable

Notice Was Given

Assessment Roll

Value

Notice Was Given

Assessment Roll

Value

Did the property covered by this notice change ownership during the time period starting with the earliest year for which a change is being requested

up to the present?

Yes

No

If yes, give date.

Signature of Owner or Agent

Date

REASON FOR THIS NOTICE: This form will not be processed if the information/documentation requested in

STC Date Stamp

this space is not provided. Attach relevant supporting information. Include a copy of the timely-filed personal

property statement and the amended personal property statement. Provide a record card or other

documentation showing that omitted real property was not previously included in the assessment.

FILING INSTRUCTIONS: When you have completed this side of the form, send or carry one copy to your local assessor, who will complete the reverse

side and file the fully completed form with the State Tax Commission (STC). The STC's jurisdiction under MCL 211.154 is limited to correcting

assessments for the current assessment year (the year of discovery and disclosure to the STC) and two immediately preceding years. You may

immediately submit a second copy of this form, with this side completed, to the STC at the address on the back of this form. Your failure to do so by

December 31 of the current calendar year may affect the STC's jurisdiction to consider all of the assessment years that you have included on this form.

Continued on page 2.

1

1 2

2