Instructions For Filing Certificate Of Withdrawal

ADVERTISEMENT

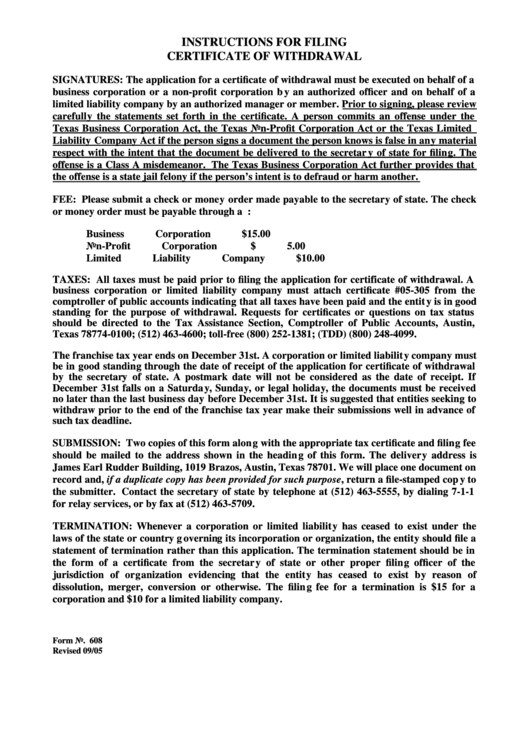

INSTRUCTIONS FOR FILING

CERTIFICATE OF WITHDRAWAL

SIGNATURES: The application for a certificate of withdrawal must be executed on behalf of a

business corporation or a non-profit corporation by an authorized officer and on behalf of a

limited liability company by an authorized manager or member. Prior to signing, please review

carefully the statements set forth in the certificate. A person commits an offense under the

Texas Business Corporation Act, the Texas Non-Profit Corporation Act or the Texas Limited

Liability Company Act if the person signs a document the person knows is false in any material

respect with the intent that the document be delivered to the secretary of state for filing. The

offense is a Class A misdemeanor. The Texas Business Corporation Act further provides that

the offense is a state jail felony if the person’s intent is to defraud or harm another.

FEE: Please submit a check or money order made payable to the secretary of state. The check

or money order must be payable through a U.S. bank or other financial institution. The fee is:

Business Corporation

$15.00

Non-Profit Corporation

$ 5.00

Limited Liability Company

$10.00

TAXES: All taxes must be paid prior to filing the application for certificate of withdrawal. A

business corporation or limited liability company must attach certificate #05-305 from the

comptroller of public accounts indicating that all taxes have been paid and the entity is in good

standing for the purpose of withdrawal. Requests for certificates or questions on tax status

should be directed to the Tax Assistance Section, Comptroller of Public Accounts, Austin,

Texas 78774-0100; (512) 463-4600; toll-free (800) 252-1381; (TDD) (800) 248-4099.

The franchise tax year ends on December 31st. A corporation or limited liability company must

be in good standing through the date of receipt of the application for certificate of withdrawal

by the secretary of state. A postmark date will not be considered as the date of receipt. If

December 31st falls on a Saturday, Sunday, or legal holiday, the documents must be received

no later than the last business day before December 31st. It is suggested that entities seeking to

withdraw prior to the end of the franchise tax year make their submissions well in advance of

such tax deadline.

SUBMISSION: Two copies of this form along with the appropriate tax certificate and filing fee

should be mailed to the address shown in the heading of this form. The delivery address is

James Earl Rudder Building, 1019 Brazos, Austin, Texas 78701. We will place one document on

record and, if a duplicate copy has been provided for such purpose, return a file-stamped copy to

the submitter. Contact the secretary of state by telephone at (512) 463-5555, by dialing 7-1-1

for relay services, or by fax at (512) 463-5709.

TERMINATION: Whenever a corporation or limited liability has ceased to exist under the

laws of the state or country governing its incorporation or organization, the entity should file a

statement of termination rather than this application. The termination statement should be in

the form of a certificate from the secretary of state or other proper filing officer of the

jurisdiction of organization evidencing that the entity has ceased to exist by reason of

dissolution, merger, conversion or otherwise. The filing fee for a termination is $15 for a

corporation and $10 for a limited liability company.

Form No. 608

Revised 09/05

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1