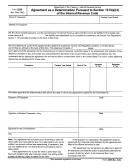

2

Form 8928 (12-2009)

Page

Name of filer:

Filer’s EIN:

Part II

Tax on Failure To Meet Portability, Access, and Renewability Requirements Under Section 4980D

Complete a separate Part II, lines 17 through 23, for failures due to reasonable cause and not to willful neglect, and a

separate Part II, lines 29-32, for other failures to meet certain group health plan requirements that occurred during the

reporting period (see instructions).

Section A – Failures Due to Reasonable Cause and Not to Willful Neglect

17

17

Enter the total number of days of noncompliance in the reporting period

18

Enter the number of individuals to whom the failure applies

18

19

19

Multiply line 17 by line 18

20

20

Multiply line 19 by $100

21

If the failure was not discovered despite exercising reasonable diligence or was corrected within

the correction period and was due to reasonable cause, enter -0- here, and then go to line 22.

21

Otherwise, enter the amount from line 20 on line 23 and go to line 24

22

If the failure was not corrected before the date a notice of examination of income tax liability was

sent to the employer and the failure continued during the examination period, multiply $2,500 by

the number of qualified beneficiaries for whom one or more failures occurred (multiply by $15,000

to the extent the violations were more than de minimis for a qualified beneficiary). If the failures

were corrected before the day a notice of examination was sent, enter -0-

22

23

23

Enter the smaller of line 20 or line 22

24

If there was more than one failure, add the amounts shown on line 23 of all forms, and enter the

24

total on a single “summary” form. Otherwise, enter the amount from line 23 above

25

Enter the aggregate amount paid or incurred during the preceding tax year for

a single employer group health plan or the amount paid or incurred during the

current tax year for a multiemployer health plan to provide medical care

25

26

26

Multiply line 25 by 10% (.10)

500,000

27

27

Amount from section 4980D(c)(3)

28

28

Enter the smallest of lines 24, 26, or 27.

Section B – Failures Due to Willful Neglect or Otherwise Not Due to Reasonable Cause

29

29

Enter the total number of days of noncompliance in the reporting period

30

Enter the number of individuals to whom the failure applies

30

31

31

Multiply line 29 by line 30

32

32

Multiply line 31 by $100

33

If there was more than one failure, add the amounts shown on line 32 of all forms, and enter the

total on a single “summary” form. Otherwise, enter the amount from line 32 above

33

Section C – Total Tax Due Under Section 4980D

34

Add lines 28 and 33

34

Part III

Tax on Failure To Make Comparable Archer MSA Contributions Under Section 4980E

35

35

Aggregate amount contributed to Archer MSAs of employees within calendar year

Total tax due under section 4980E. Multiply line 35 by 35% (.35)

36

36

Part IV

Tax on Failure To Make Comparable HSA Contributions Under Section 4980G

37

37

Aggregate amount contributed to HSAs of employees within calendar year

Total tax due under section 4980G. Multiply line 37 by 35% (.35)

38

38

Part V

Tax Due or Overpayment

39

39

Add lines 16, 34, 36, and 38

40

40

Enter amount of tax paid with Form 7004

41

Tax due. Subtract line 40 from line 39. If less than zero, enter -0-, and go to line 42. If the result

is greater than zero, enter here and attach a check or money order payable to “United States

Treasury.” Write your name, identifying number, plan number, and “Form 8928” on your payment

41

42

Overpayment. Subtract line 39 from line 40

42

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my

knowledge and belief, it is true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer

Sign

has any knowledge.

Here

Your signature

Telephone number

Date

Check

Date

Preparer’s SSN or PTIN

Paid

Preparer’s

if self-

signature

employed

Preparer’s

Firm’s name (or

EIN

Use Only

yours, if self-employed),

address, and ZIP code

Phone no. (

)

8928

Form

(12-2009)

1

1 2

2