Form R-5197 - Instructions And Rates

ADVERTISEMENT

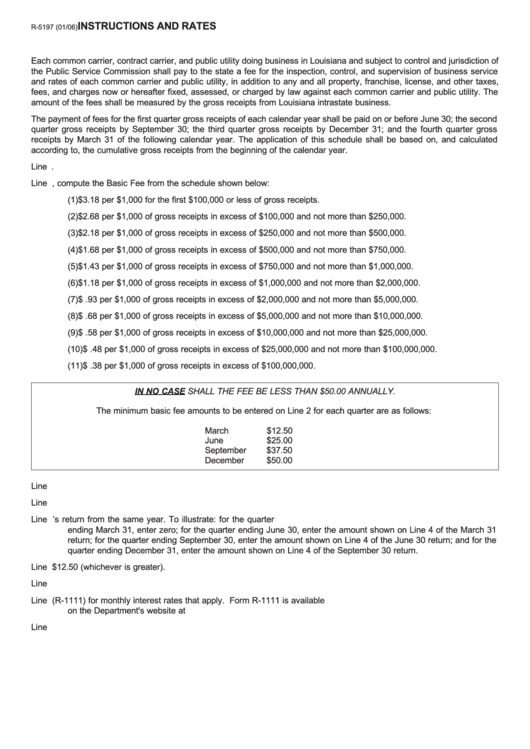

INSTRUCTIONS AND RATES

R-5197 (01/06)

Each common carrier, contract carrier, and public utility doing business in Louisiana and subject to control and jurisdiction of

the Public Service Commission shall pay to the state a fee for the inspection, control, and supervision of business service

and rates of each common carrier and public utility, in addition to any and all property, franchise, license, and other taxes,

fees, and charges now or hereafter fixed, assessed, or charged by law against each common carrier and public utility. The

amount of the fees shall be measured by the gross receipts from Louisiana intrastate business.

The payment of fees for the first quarter gross receipts of each calendar year shall be paid on or before June 30; the second

quarter gross receipts by September 30; the third quarter gross receipts by December 31; and the fourth quarter gross

receipts by March 31 of the following calendar year. The application of this schedule shall be based on, and calculated

according to, the cumulative gross receipts from the beginning of the calendar year.

Line 1.

Enter the amount of the total intrastate gross receipts from January 1 to the end of the quarter reported on this return.

Line 2.

Using the amount from Line 1, compute the Basic Fee from the schedule shown below:

(1)

$3.18 per $1,000 for the first $100,000 or less of gross receipts.

(2)

$2.68 per $1,000 of gross receipts in excess of $100,000 and not more than $250,000.

(3)

$2.18 per $1,000 of gross receipts in excess of $250,000 and not more than $500,000.

(4)

$1.68 per $1,000 of gross receipts in excess of $500,000 and not more than $750,000.

(5)

$1.43 per $1,000 of gross receipts in excess of $750,000 and not more than $1,000,000.

(6)

$1.18 per $1,000 of gross receipts in excess of $1,000,000 and not more than $2,000,000.

(7)

$ .93 per $1,000 of gross receipts in excess of $2,000,000 and not more than $5,000,000.

(8)

$ .68 per $1,000 of gross receipts in excess of $5,000,000 and not more than $10,000,000.

(9)

$ .58 per $1,000 of gross receipts in excess of $10,000,000 and not more than $25,000,000.

(10) $ .48 per $1,000 of gross receipts in excess of $25,000,000 and not more than $100,000,000.

(11) $ .38 per $1,000 of gross receipts in excess of $100,000,000.

IN NO CASE SHALL THE FEE BE LESS THAN $50.00 ANNUALLY.

The minimum basic fee amounts to be entered on Line 2 for each quarter are as follows:

March

$12.50

June

$25.00

September

$37.50

December

$50.00

Line 3.

Self-explanatory.

Line 4.

Add Line 2 and Line 3E.

Line 5.

Enter the amount from Line 4 of the preceding quarter’s return from the same year. To illustrate: for the quarter

ending March 31, enter zero; for the quarter ending June 30, enter the amount shown on Line 4 of the March 31

return; for the quarter ending September 30, enter the amount shown on Line 4 of the June 30 return; and for the

quarter ending December 31, enter the amount shown on Line 4 of the September 30 return.

Line 6.

Subtract Line 5 from Line 4. Enter results or $12.50 (whichever is greater).

Line 7.

Self-explanatory.

Line 8.

Refer to the Tax Interest Rate Schedule (R-1111) for monthly interest rates that apply. Form R-1111 is available

on the Department's website at

Line 9.

Self-explanatory.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1