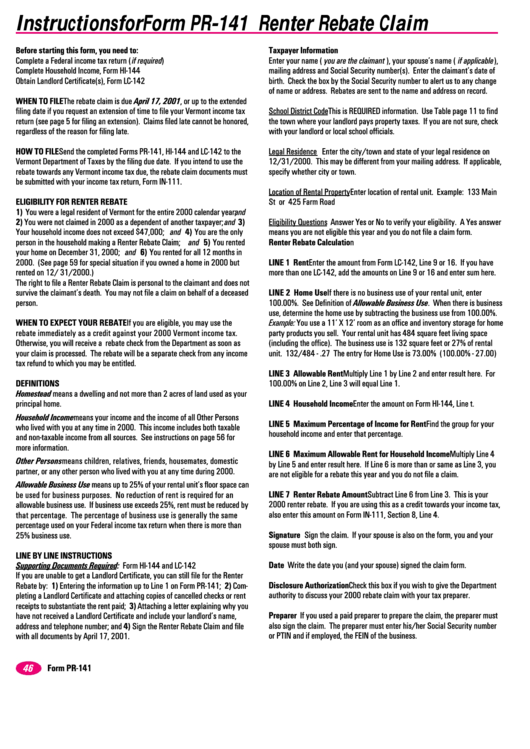

Instructions For Form Pr-141 Renter Rebate Claim

ADVERTISEMENT

Instructions for Form PR-141 Renter Rebate Claim

B efore starting this form, you need to:

Taxpayer Information

Complete a Federal income tax return ( if required )

Enter your name ( you are the claimant ), your spouse’s name ( if applicable ),

Complete Household Income, Form HI-144

mailing address and Social Security number(s). Enter the claimant’s date of

Obtain Landlord Certificate(s), Form LC-142

birth. Check the box by the Social Security number to alert us to any change

of name or address. Rebates are sent to the name and address on record.

WHEN TO FILE The rebate claim is due April 17, 2001, or up to the extended

filing date if you request an extension of time to file your Vermont income tax

School District Code This is REQUIRED information. Use Table page 11 to find

return (see page 5 for filing an extension). Claims filed late cannot be honored,

the town where your landlord pays property taxes. If you are not sure, check

regardless of the reason for filing late.

with your landlord or local school officials.

HOW TO FILE Send the completed Forms PR-141, HI-144 and LC-142 to the

Legal Residence Enter the city/town and state of your legal residence on

Vermont Department of Taxes by the filing due date. If you intend to use the

12/31/2000. This may be different from your mailing address. If applicable,

rebate towards any Vermont income tax due, the rebate claim documents must

specify whether city or town.

be submitted with your income tax return, Form IN-111.

Location of Rental Property Enter location of rental unit. Example: 133 Main

ELIGIBILITY FOR RENTER REBATE

St or 425 Farm Road

1) You were a legal resident of Vermont for the entire 2000 calendar year; and

2) You were not claimed in 2000 as a dependent of another taxpayer; and 3)

Eligibility Questions Answer Yes or No to verify your eligibility. A Yes answer

Your household income does not exceed $47,000; and 4) You are the only

means you are not eligible this year and you do not file a claim form.

person in the household making a Renter Rebate Claim; and 5) You rented

Renter Rebate Calculation

your home on December 31, 2000; and 6) You rented for all 12 months in

2000. (See page 59 for special situation if you owned a home in 2000 but

LINE 1 Rent Enter the amount from Form LC-142, Line 9 or 16. If you have

rented on 12/ 31/2000.)

more than one LC-142, add the amounts on Line 9 or 16 and enter sum here.

The right to file a Renter Rebate Claim is personal to the claimant and does not

survive the claimant’s death. You may not file a claim on behalf of a deceased

LINE 2 Home Use If there is no business use of your rental unit, enter

person.

100.00%. See Definition of Allowable Business Use. When there is business

use, determine the home use by subtracting the business use from 100.00%.

WHEN TO EXPECT YOUR REBATE If you are eligible, you may use the

Example: You use a 11’ X 12’ room as an office and inventory storage for home

rebate immediately as a credit against your 2000 Vermont income tax.

party products you sell. Your rental unit has 484 square feet living space

Otherwise, you will receive a rebate check from the Department as soon as

(including the office). The business use is 132 square feet or 27% of rental

your claim is processed. The rebate will be a separate check from any income

unit. 132/484 - .27 The entry for Home Use is 73.00% (100.00% - 27.00)

tax refund to which you may be entitled.

LINE 3 Allowable Rent Multiply Line 1 by Line 2 and enter result here. For

DEFINITIONS

100.00% on Line 2, Line 3 will equal Line 1.

Homestead means a dwelling and not more than 2 acres of land used as your

principal home.

LINE 4 Household Income Enter the amount on Form HI-144, Line t.

Household Income means your income and the income of all Other Persons

LINE 5 Maximum Percentage of Income for Rent Find the group for your

who lived with you at any time in 2000. This income includes both taxable

household income and enter that percentage.

and non-taxable income from all sources. See instructions on page 56 for

more information.

LINE 6 Maximum Allowable Rent for Household Income Multiply Line 4

Other Persons means children, relatives, friends, housemates, domestic

by Line 5 and enter result here. If Line 6 is more than or same as Line 3, you

partner, or any other person who lived with you at any time during 2000.

are not eligible for a rebate this year and you do not file a claim.

Allowable Business Use means up to 25% of your rental unit’s floor space can

LINE 7 Renter Rebate Amount Subtract Line 6 from Line 3. This is your

be used for business purposes. No reduction of rent is required for an

allowable business use. If business use exceeds 25%, rent must be reduced by

2000 renter rebate. If you are using this as a credit towards your income tax,

also enter this amount on Form IN-111, Section 8, Line 4.

that percentage. The percentage of business use is generally the same

percentage used on your Federal income tax return when there is more than

Signature Sign the claim. If your spouse is also on the form, you and your

25% business use.

spouse must both sign.

LINE BY LINE INSTRUCTIONS

Date Write the date you (and your spouse) signed the claim form.

Supporting Documents Required: Form HI-144 and LC-142

If you are unable to get a Landlord Certificate, you can still file for the Renter

Rebate by: 1) Entering the information up to Line 1 on Form PR-141; 2) Com-

Disclosure Authorization Check this box if you wish to give the Department

authority to discuss your 2000 rebate claim with your tax preparer.

pleting a Landlord Certificate and attaching copies of cancelled checks or rent

receipts to substantiate the rent paid; 3) Attaching a letter explaining why you

Preparer If you used a paid preparer to prepare the claim, the preparer must

have not received a Landlord Certificate and include your landlord’s name,

also sign the claim. The preparer must enter his/her Social Security number

address and telephone number; and 4) Sign the Renter Rebate Claim and file

or PTIN and if employed, the FEIN of the business.

with all documents by April 17, 2001.

46

Form PR-141

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1